Costs of Big Batteries Are Tumbling and Can Boost Clean Power

(Bloomberg) -- Battery storage costs fell more than a quarter to a record low last year, improving the economics of projects to pair the equipment with renewables and which can help tackle curtailment of solar and wind.

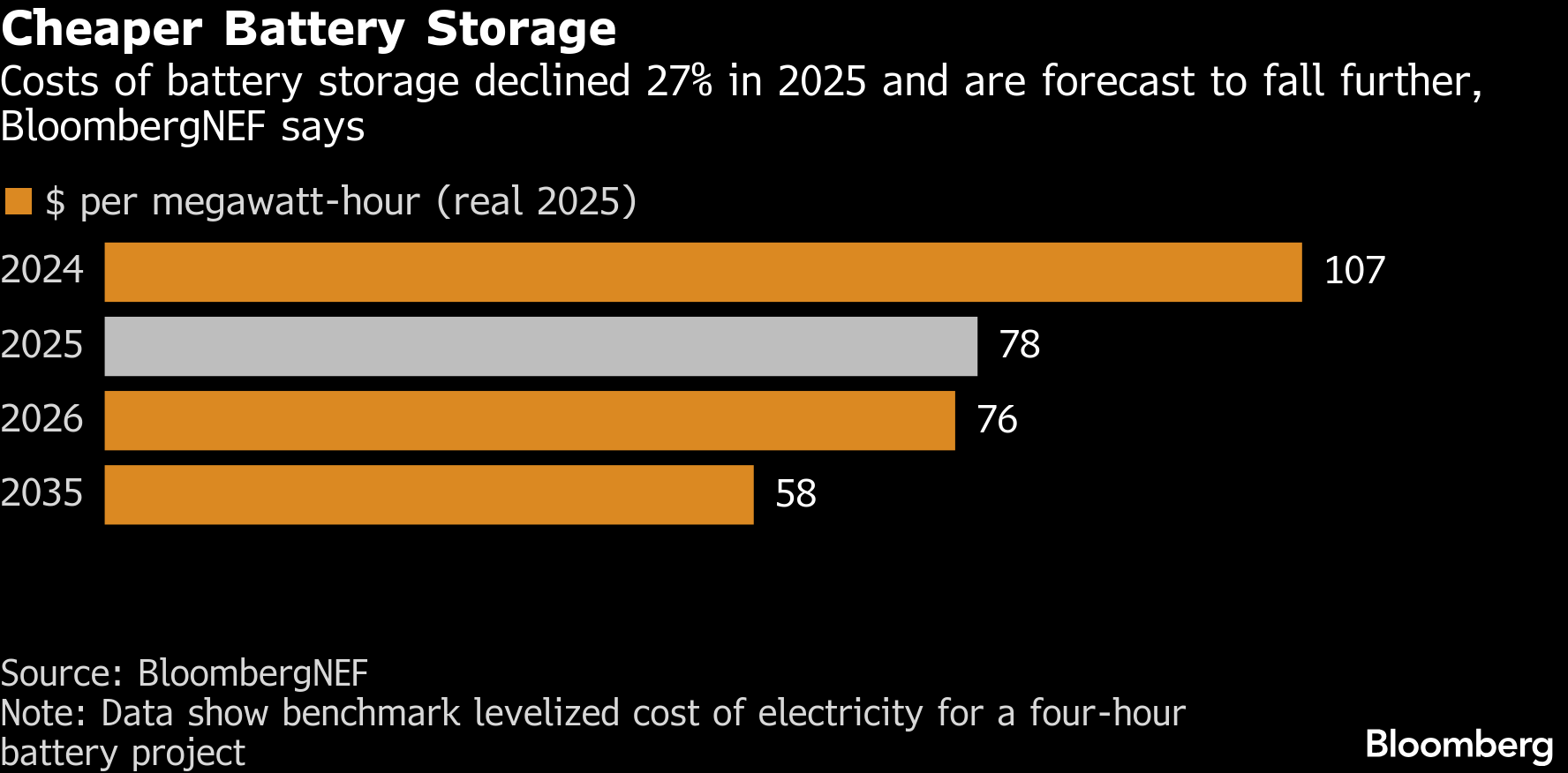

The benchmark levelized cost of electricity for a standalone four-hour battery project declined 27% in 2025 from a year earlier to $78 per megawatt-hour and is expected to fall to $58 per megawatt-hour by 2035, BloombergNEF said in a report published Wednesday.

“As costs continue to drop, we expect battery storage to strengthen solar project revenues, support broader renewable deployment and accelerate the shift toward storage‑led system balancing over fossil-fuel‑based peaking capacity,” said Amar Vasdev, a BNEF senior energy economics associate and lead author of the report.

Lowering the cost of battery storage — which can soak up surplus electricity generated through the day and release it in the evening, when demand is highest — is seen as crucial, particularly as an influx of solar and wind generation in some countries begins to strain grids, forcing the curtailment of renewables projects.

Wider adoption of storage technology is also improving the resilience of energy infrastructure as electricity demand rises sharply, and helped to cushion the impact of last month’s severe US winter storms. For developing economies, providing cheaper and reliable clean alternatives to the cost competitiveness of fossil fuels is regarded as key to promote decarbonization.

Battery storage was an exception in 2025 among most energy technologies, with supply chain constraints or other factors driving costs higher for wind farms, fixed-axis solar projects and combined-cycle gas turbines, the BNEF report said. Lower battery cell prices, improved designs and more competition helped propel the savings, and outpaced BNEF’s projection for an 11% cost reduction last year.

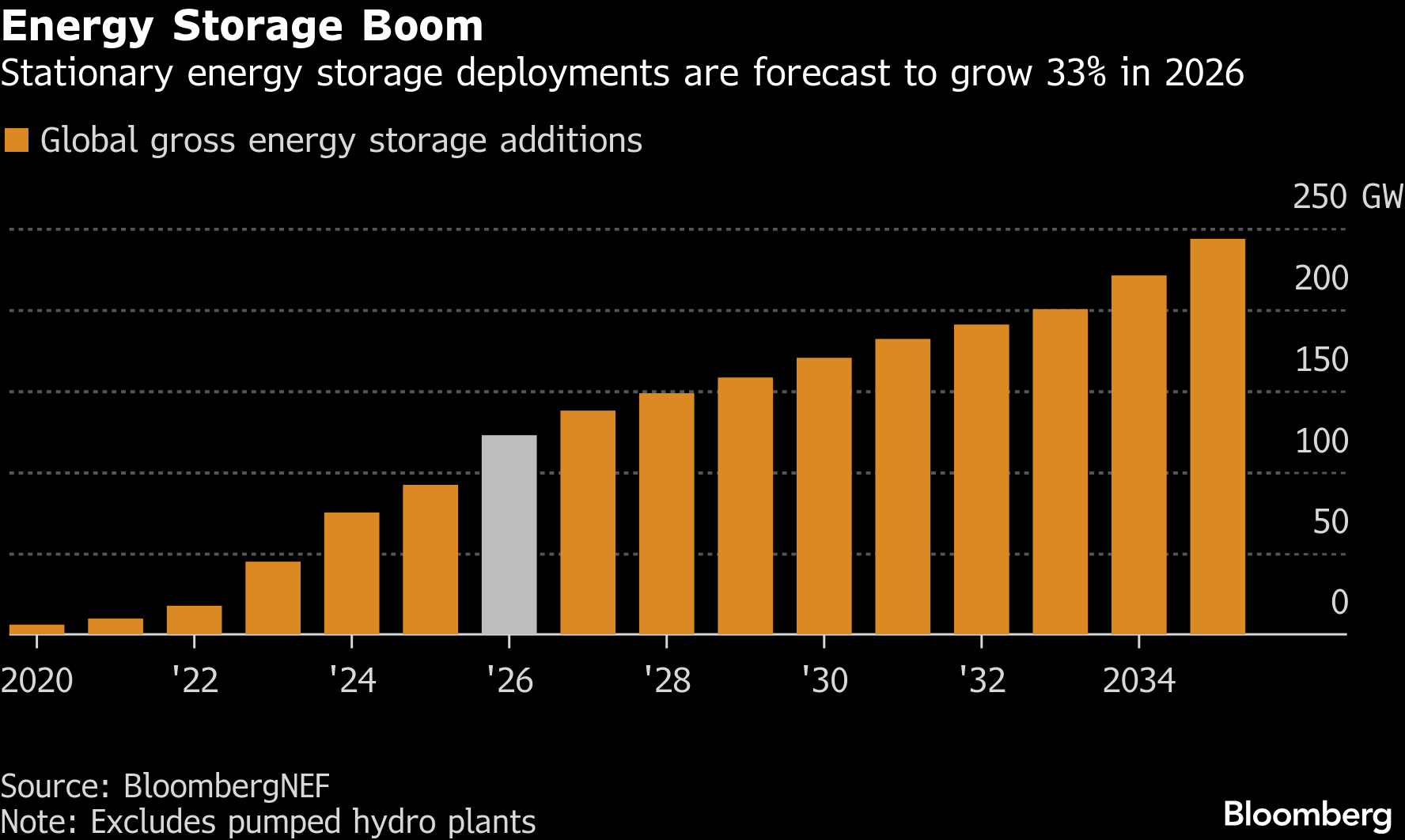

Stationary energy storage deployments, excluding pumped hydro, are forecast to increase by a third in 2026 to 122.5 gigawatts, led by growth in Europe, the Middle East, Africa and Latin America, BNEF said in a separate report last month.

Installations are being supported by the expansion of utility-scale projects, residential demand and the co-location of batteries with solar farms.

Even with higher financing costs and the impacts of protectionist policies and supply-chain snarls, further innovation and competition should enable further cost reductions across clean energy, BNEF said in the Wednesday report. By 2035, additional levelized cost of electricity reductions could total 30% for solar, 25% for battery storage, 23% for onshore wind and 20% in offshore wind.

©2026 Bloomberg L.P.