US Looks to Boost Uranium Reserves for Nuclear Power

(Bloomberg) -- The Trump administration’s top energy official said the US should look to boost its strategic uranium reserve to buffer against Russian supplies and increase confidence in the long-term prospects of nuclear power generation.

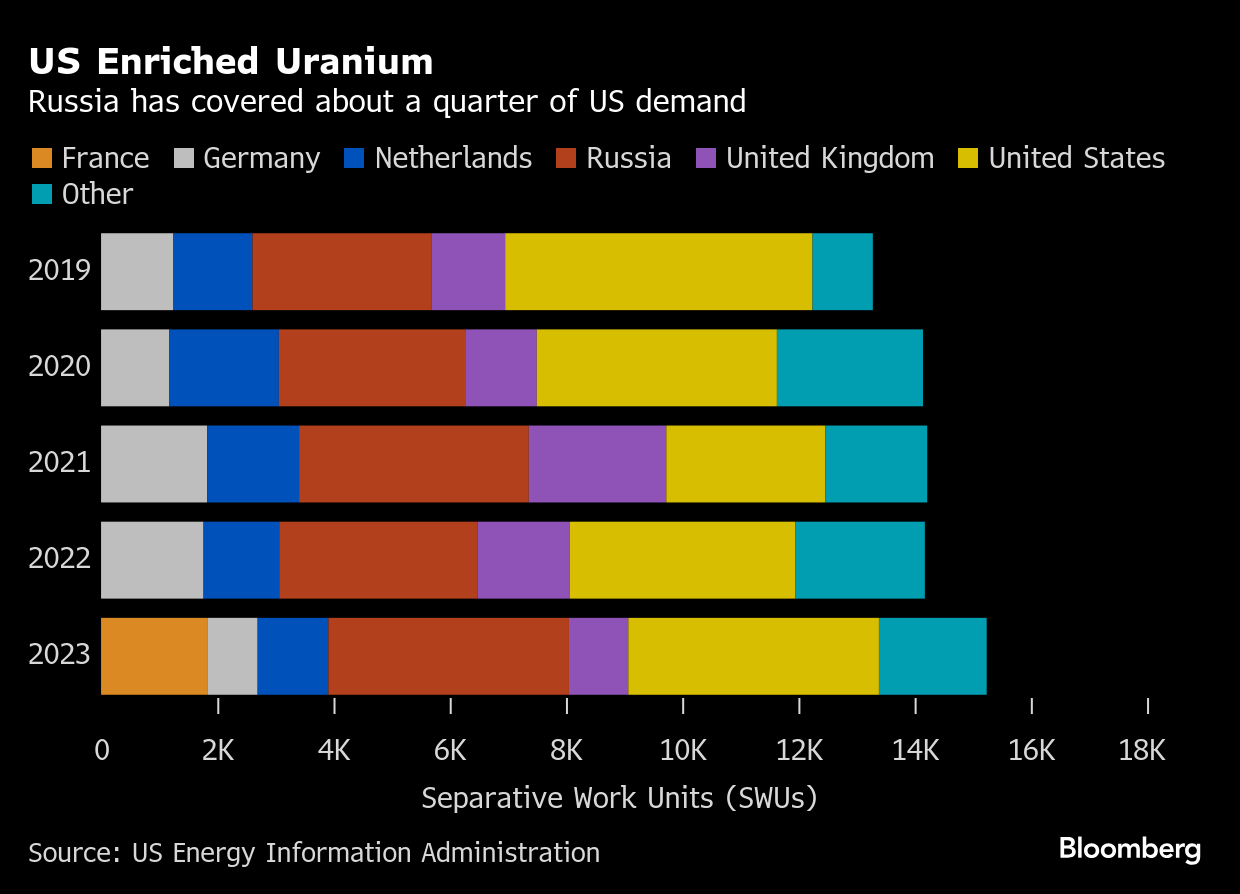

US Energy Secretary Chris Wright’s comments underscore the Trump administration’s plans to promote nuclear energy as the demand for power soars with the electrification of the economy. Russia supplies about a quarter of the enriched uranium needed by America’s fleet of 94 nuclear reactors, which generate about a fifth of US electricity. Turning the tap off too quickly from that source could endanger about 5% of electricity in the absence of alternative suppliers or additional stockpiles.

“We’re moving to a place — and we’re not there yet — to no longer use Russian enriched uranium,” Wright told Bloomberg News Monday in Vienna, where he’s attending the IAEA’s annual general conference.

“We hope to see rapid growth in uranium consumption in the US from both large reactors and small modular reactors,” Wright said. “The size of that right buffer would grow with time. We need a lot of domestic uranium and enrichment capacity.”

Shares of uranium miners jumped after Wright’s comments, with Cameco Corp. rising as much as 9.4%, Centrus Energy Corp. climbing as much as 9.3%, Uranium Energy Corp. soaring above 10% and Uranium Royalty Corp. jumping as much as 13% in US trading.

The first Trump administration proposed a uranium reserve in 2020 and sought $150 million to purchase the metal directly from US producers, though Congress only provided half of that. The concept also gained support from the administration of former President Joe Biden. The US Energy Department in 2022 awarded contracts for the purchase of hundreds of thousands of pounds of uranium for the reserve from miners including Energy Fuels Inc. and Uranium Energy.

With an average of just 14 months of uranium on inventory, data compiled by the International Atomic Energy Agency shows inventories held by US companies trail peers in Europe and Asia. The European Union has enough fuel on hand to power existing reactors for two-and-a-half years, while China maintains stockpiles equivalent to 12 years current generation, according to IAEA data published last quarter.

The US is “furiously at work” in its effort to remake nuclear-fuel supply chains, Wright said. In May 2024, the Biden administration signed into law legislation which requires utilities to shift away from Russian supplies by 2028. Six months later, Russia retaliated by temporarily limited exports of enriched uranium to the US.

While Wright declined to say how much additional uranium inventory the US should build, he suggested the increase could be measured on a sliding scale as more reactors are built.

The US has just two commercial enrichment facilities. The largest in New Mexico, which is owned by the British, Dutch and German consortium Urenco Ltd., produces fuel for traditional light-water reactors. Centrus Energy in Ohio also recently began separating uranium isotopes for new models of advanced reactors which require higher enrichment levels.

The White House issued an executive order in May that’s intended to accelerate the deployment of advanced reactors. The energy department expects the first of those models to undergo testing by next year.

Nuclear fuel-making historically has been dominated by state-controlled entities — a function of the fact that the same industrial processes that make reactor fuel also can be used to help manufacture bombs. But Wright said the US wants to attract more private capital to the endeavor, pointing at Peter Thiel’s General Matter Corp., a startup founded to enrich uranium.

“That’s key for efficiency and innovation and pace,” he said. “That’s how you drive progress.”

(Adds share prices in the fifth paragraph.)

©2025 Bloomberg L.P.