German Factory Orders’ Unexpected Drop Hurts Rebound Hopes

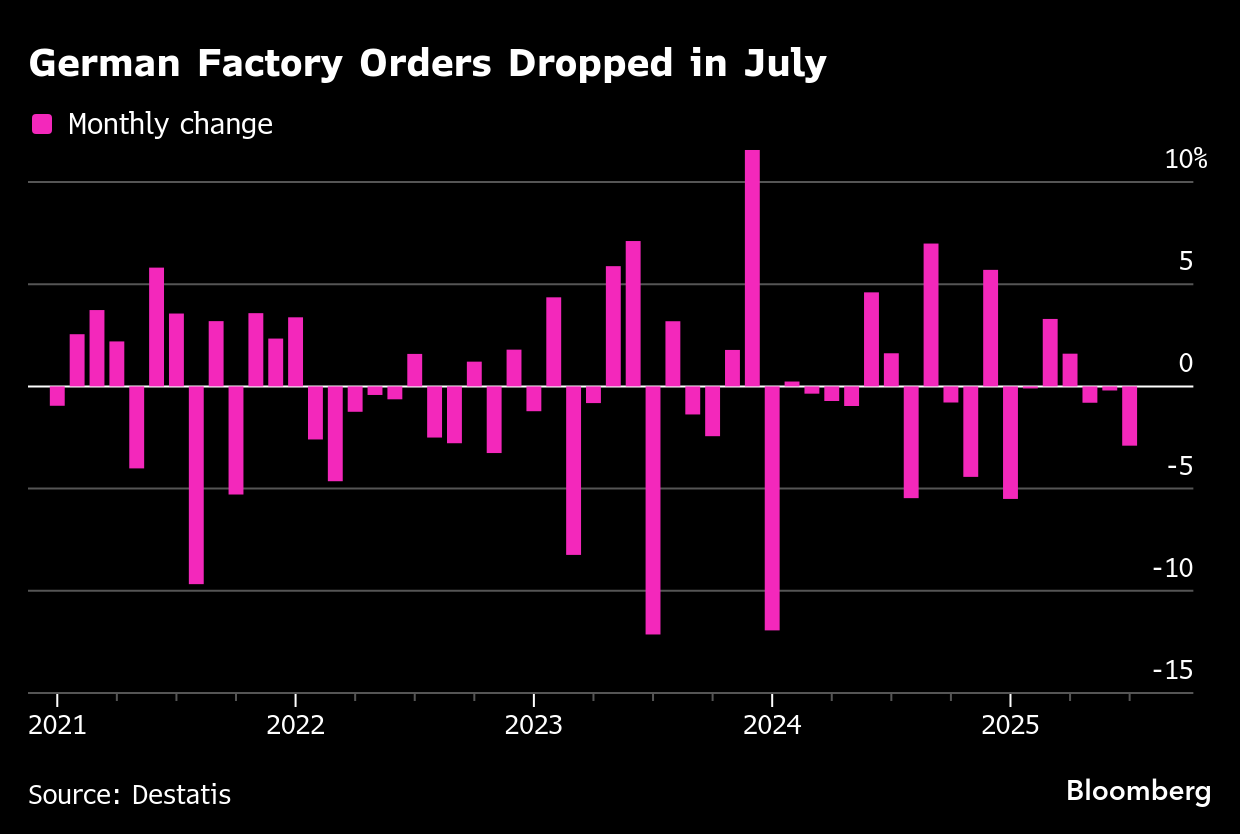

(Bloomberg) -- German factory orders unexpectedly slumped the most since January, undermining optimism that the sector can soon emerge from three years of recession.

Demand dropped 2.9% in July from the previous month, driven by declines in large-scale orders, the statistics office said Friday. Economists polled by Bloomberg had predicted a 0.5% gain. Without major orders, there would have been a 0.7% increase.

“Incoming orders have now fallen for the third month in a row, and institutes have revised down their growth forecasts for this year and next,” Economy Minister Katherina Reiche said in a statement. “No further warning signals are needed to recognize that we must now act decisively and consistently align our entire policy with competitiveness — in energy costs, non-wage labor costs, and the reduction of bureaucracy, both in Germany and in Europe. It’s about jobs and preserving locations.”

The report underscores the challenges faced by Europe’s biggest economy as it tries to leave behind a prolonged downturn while grappling with higher US tariffs and Russia’s war in Ukraine. Despite businesses becoming more optimistic that a government spending push will restore growth, they also continue to judge their current situation as difficult.

The European Union’s agreement with the US foresees 15% tariffs on most exports to the country and officials are seeking to extend this level to cars, which are currently facing steeper duties. That would be a relief for a sector that recently got a rare boost in the form of higher electric-vehicle demand.

Other firms still face significant challenges. Chemical plants operated at just 72% capacity in the second quarter — the weakest level in more than 30 years amid volatile output preceding the EU’s deal with President Donald Trump.

Any rebound in Germany’s economy still looks some way off, according to research institutes who this week lowered their 2025 predictions to expansion of just 0.1%-0.2%. They all see a pickup next year, helped by public spending and the European Central Bank’s interest-rate cuts.

“Overall, the hard economic data in recent months has been disappointing,” Commerzbank Chief Economist Joerg Kraemer said in a note. “We only expect a significant increase of 1.4% for the coming year because the German government will be spending much more money and the ECB has halved its rates.”

(Adds economy minister in third paragraph)

©2025 Bloomberg L.P.