Europe Car Sales Keep Rising as EVs, Hybrids Lure Consumers

(Bloomberg) -- European car sales edged up again in August, as consumers continue to warm to electric and hybrid models produced by the region’s manufacturers in their fightback against Chinese rivals.

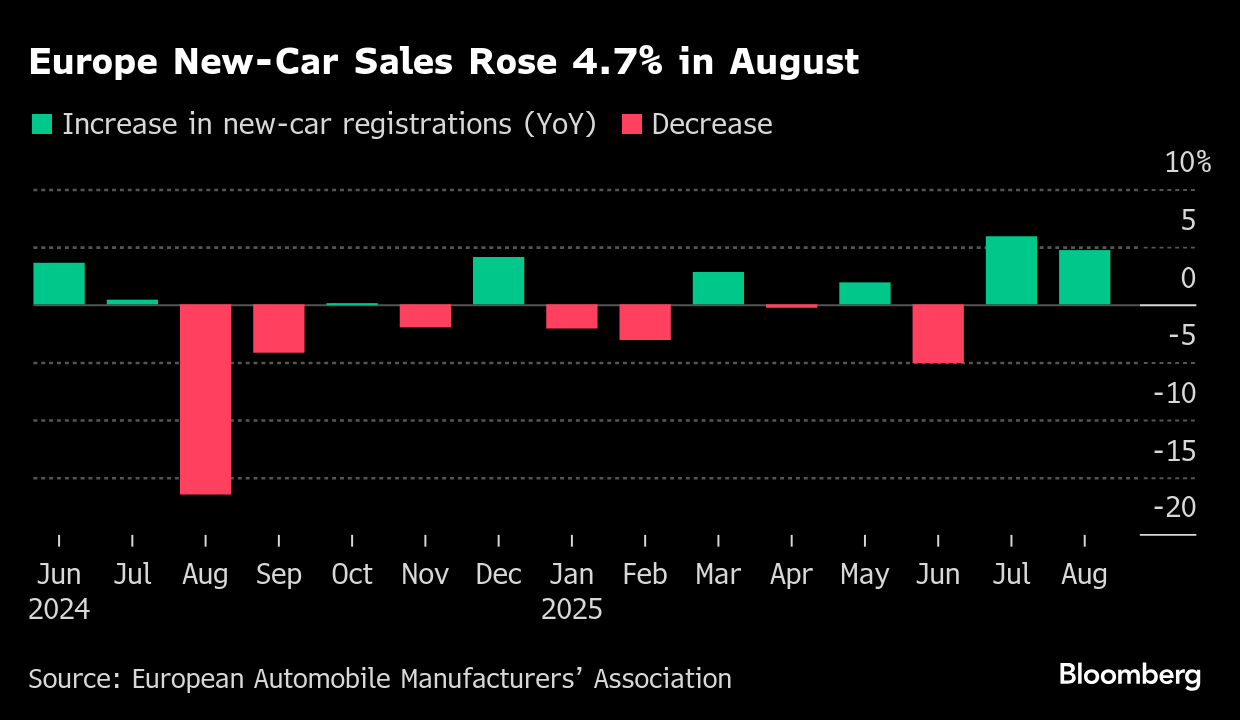

New-car registrations across the region rose 4.7% last month from a year earlier to 791,349 units, the European Automobile Manufacturers’ Association said Thursday. Germany and Spain gained more than 5%, while demand in the UK and Italy dwindled.

Even as electric-vehicle sales pick up pace in Europe, automakers are grappling with a slower uptake than had been predicted. While volume players are starting to gain traction with more affordable EVs, luxury-car makers such as Porsche AG are rolling back their electric ambitions due to weaker demand and high costs.

The German sports-car brand last week shelved a future battery-powered luxury sport utility vehicle as it plans to add more combustion-engine and hybrid models. Parent Volkswagen AG is facing delays to the launch of its electric Golf. Meanwhile, weak demand forced Stellantis NV to scrap plans for an all-electric Maserati sports car.

For car manufacturers, plug-in hybrids are a bright spot, with a 56% rise in registrations last month for cars combining electric driving with a combustion engine. Sales of fully electric vehicles increased 27%.

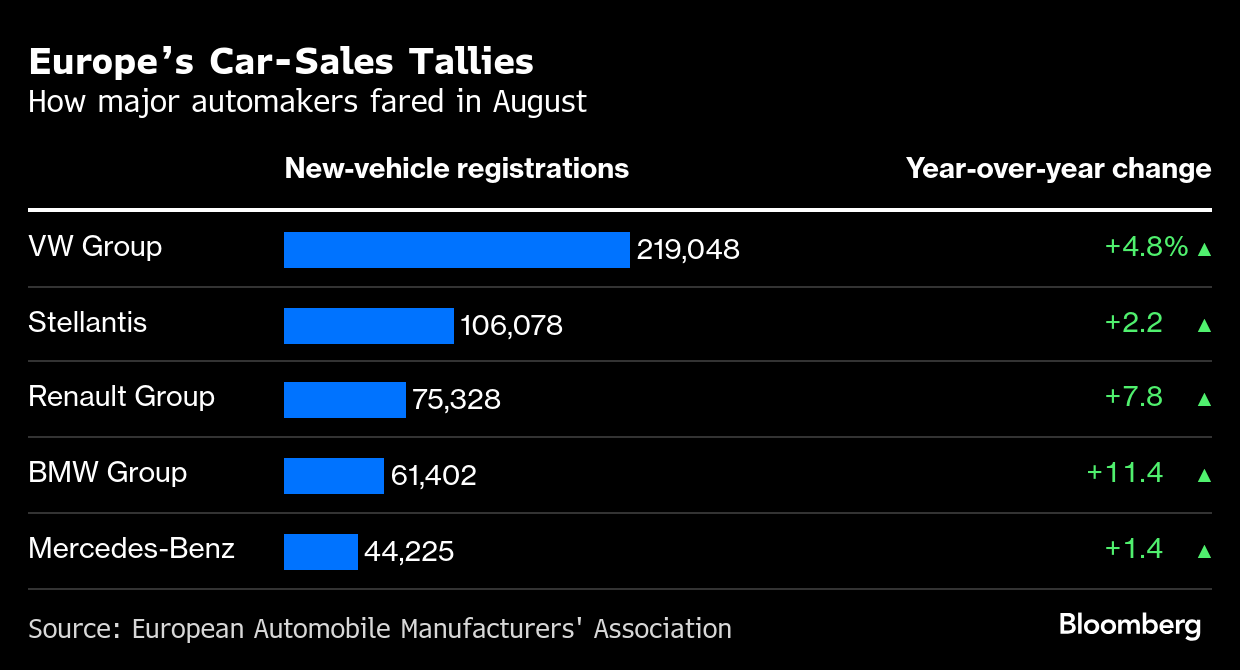

European automaker shares rose on Thursday on the back of the robust sales. Volkswagen rose as much as 2.6%, Stellantis 2.3% and Renault SA 2.5%. It builds on gains made in late trading Wednesday after the US formalized lower auto tariffs for the European Union.

The rising sales for all cars with a plug offer some respite for the region’s beleaguered industry that’s grappling with US President Donald Trump’s tariff onslaught and pressure from affordable EVs made by Chinese brands like BYD Co. A cyberattack at British carmaker Jaguar Land Rover is causing chaos for some parts makers, putting more pressure on the industry.

At the Munich car show earlier this month, German automakers vowed to fight back with new EVs. BMW AG showed off its €68,900 ($80,830) iX3 SUV and Volkswagen presented the ID.Polo, a more affordable compact car aimed at mainstream consumers that’s expected to be priced below €25,000 when it goes on sale next year.

US EV pioneer Tesla Inc. continued its downward spiral. European sales of the brand led by Elon Musk dropped 22% in August, giving it a market share of just 1.9%.

Volkswagen, BMW and Mercedes-Benz Group AG all gained, while BYD outshone them all as it more than tripled deliveries, though sales still remain relatively low.

(Updates with share price reactions in 6th paragraph.)

©2025 Bloomberg L.P.