Activist Investor Reveals Bargain in Japan’s Utility Shares

(Bloomberg) -- Kansai Electric Power Co.’s deeply discounted valuation underscores its appeal to activist investors such as Elliott Investment Management which just revealed a stake in the Japanese utility company.

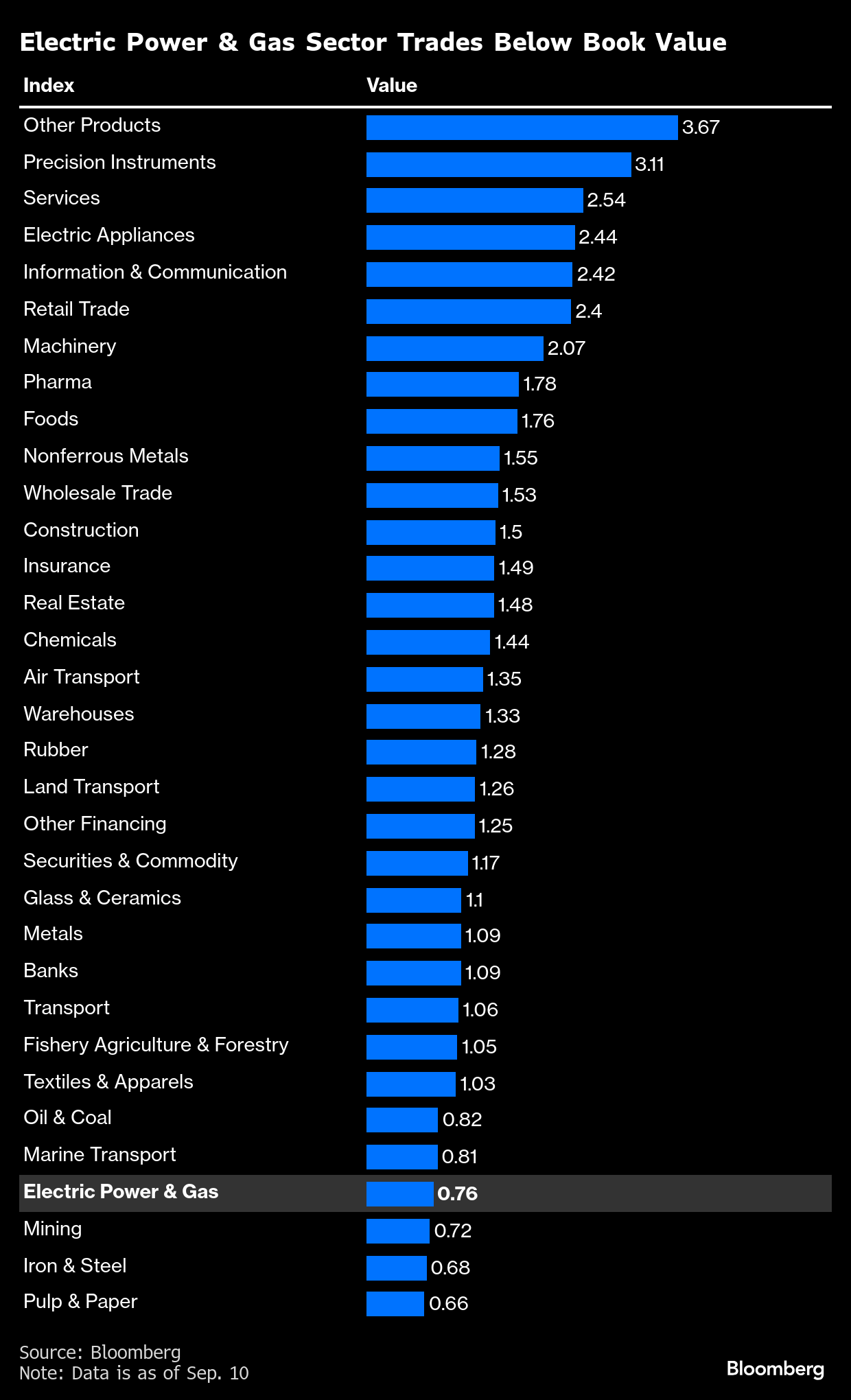

Kansai Electric trades below book value at a price-to-book ratio of 0.82. That’s around the average of 0.76 times for the sector, fourth lowest of the 33 industries in the Topix Index.

Since the Tokyo Stock Exchange called on companies to improve corporate value and capital efficiency in March 2023, Japanese firms have announced record numbers of buybacks and dividends, helping lift valuations. As of Wednesday, six sectors on the Topix trade below a PBR of 1, down from 16 sectors when the exchange announced its campaign. The bourse said that valuations at these levels show “issues in terms of profitability and growth potential.”

“With the activist coming in, it may accelerate the pace of improvements in capital efficiency,” said Naoki Fujiwara, senior fund manager at Shinkin Asset Management. Given the tailwind from resumption of nuclear power plant, “Kansai Electric could be among the first within the sector to recover to a PBR of one,” he said.

Elliott has urged Kansai Electric to sell ¥150 billion ($1 billion) a year of non-core assets, and use the proceeds to boost dividends and repurchase shares, Bloomberg reported on Wednesday.

Valuations may improve as Kansai Electric moves forward with plans to explore expanding nuclear power generation, more than a decade after the Fukushima disaster. The Osaka-based company, together with Kyushu Electric Power Co., have brought all of their available reactors back online. This means they’re better positioned for stronger profitability than other peers, as they can curb reliance on costly imported LNG and coal.

(Adds comment in fourth paragraph)

©2025 Bloomberg L.P.