Norway’s Power Supply to Europe Threatened by Low Hydro Levels

(Bloomberg) -- Low water levels in Norway’s key southern reservoirs are raising the risk of tightly supplied power markets across northwest Europe this winter as hydro exports dwindle.

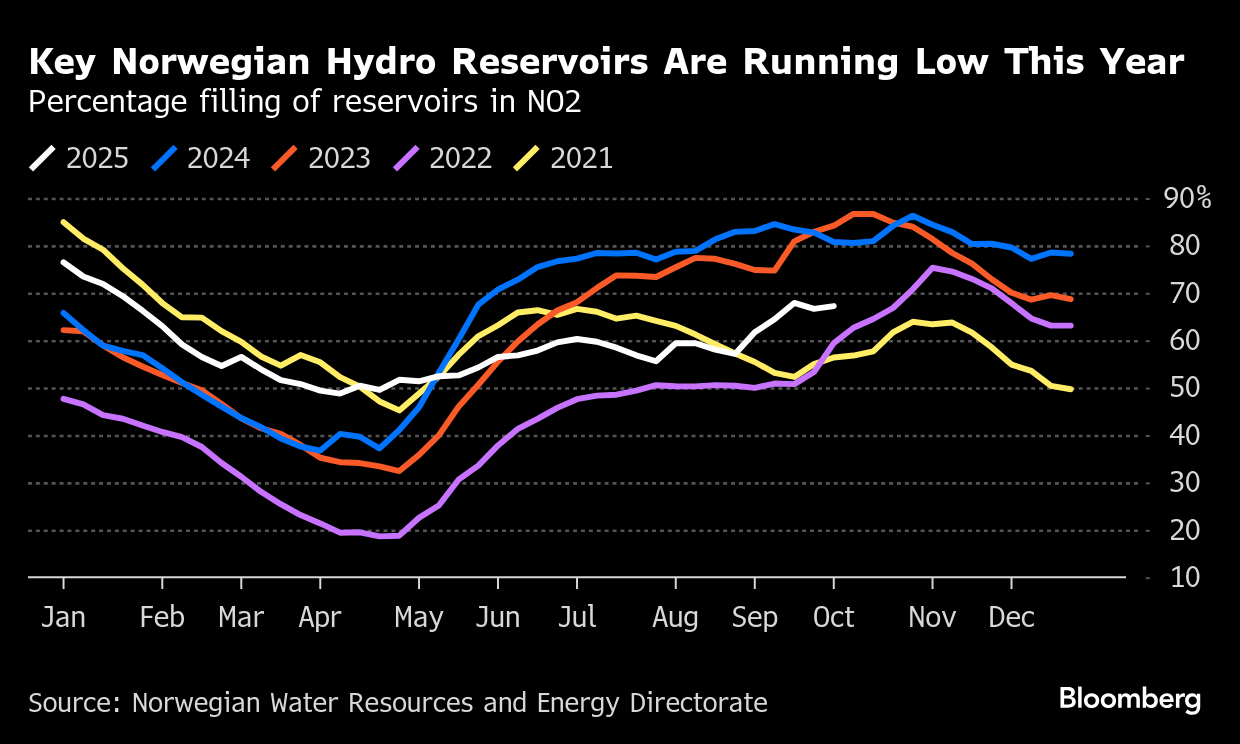

Hydro reservoirs in Norway’s NO2 price zone, which links with the UK and Germany, are 67% full, or around 17 percentage points lower than a year ago, according to data from the Norwegian Water Resources and Energy Directorate. Water levels are also below the 20-year average in the two neighboring price zones. Despite some rain in recent weeks, inflows remain weak, curbing the region’s ability to rebuild stocks before winter demand peaks.

Power exports and their effect on domestic energy prices have been a fraught political issue in Norway in recent years. After installing new cables to the UK and Germany in 2021, Norway became a net-exporter of power every day last year — a feat not achieved by any other European country. Sales to the UK and other markets have caused price spikes, particularly in the south of the country.

The debate boiled over in February, triggering the collapse of the ruling coalition. The recently re-elected Labor party subsequently adopted a so-called Norway price to protect consumers from sky-high energy costs. As of this month, consumers will be able to choose between a floating or fixed rate through 2026. The latter is likely to be adopted by many in southern Norway, softening the impact of volatility.

While the tool reduces the pressure on politicians at home, it doesn’t address or limit exports, something the Norwegian government has mulled in the past. Though Norway isn’t an EU member, it is part of the single energy market. Under the rules, countries aren’t allowed to curtail flows to neighbors for prolonged periods.

Prime Minister Jonas Gahr Store argued in February for “national control,” saying that “it is Norwegian democracy that shall decide over Norway’s power resources.”

Elisabeth Saether, state secretary in Norway’s energy department, said restrictions on foreign connections can be set in situations where “there is a real risk” of energy shortages. “However, we are far from such a situation now,” she said in an e-mail on Thursday.

Britain’s grid operator expects comfortable electricity margins overall this winter, but flagged that tight days are possible in December and January, especially if low wind coincides with weaker Nordic flows. Power usually flows from markets with lower prices to higher ones. So if Norway sees tighter conditions, it could start importing from the UK more often, which is not the norm.

The spread between the Nordic and UK quarter-ahead power contracts is at its lowest level for this time of year since 2019, reducing the incentive for moving power from Norway to the UK this winter.

The North Sea Link, stretching between the two countries, is capable of sharing up to 1,400 megawatts of electricity — enough to power around 1.4 million UK homes.

Citizens of the Nordic nation have historically enjoyed some of the lowest power prices in the world, with stable supplies sourced from more than 1,000 hydroelectric plants scattered up and down the country. But with markets more connected, volatile prices on the continent have driven Nordic rates higher too.

Alessandro Armenia, an energy analyst at Kpler Ltd., said the “bullish factor” of hydro scarcity may still be “underappreciated” by power traders.

Still, with additional renewable production coming online across Europe, exports from Norway are likely to decline over time, according to Tor Reier Lilleholt, head of analysis at Volue. The power analytics firm estimates that exports to the UK from Norway will go from 10 terrawatt-hours last year, to 2 terrawatt-hours in 2030.

“The cables will be in use, but the flow of power will be more balanced,” he said. In the short term, “if we do have a really dry fall and cold winter and the prices end up being high, that will still be noticed. Norwegian businesses will continue to feel it in particular.”

Elsewhere in Europe, reservoirs in France are also below previous years, according to data from RTE.

(Updates with market prices in 9th paragraph)

©2025 Bloomberg L.P.