Energy Firms Snap Up Weather Services for Trading Edge in Japan

(Bloomberg) -- Weather forecasters are finding a lucrative niche in Japan’s power-trading boom, selling hyper-specialized data to firms seeking an edge in one of the world’s most volatile electricity markets.

Weathernews Inc. is among a handful of companies cashing in on demand for meteorological data. The Tokyo-listed company’s shares have surged 50% in the last year as investors bet on its expanded use of artificial intelligence, among other factors. The firm says it’s supplying — or is in talks to provide — data to several dozen power traders, about a third of which are based outside Japan.

“Two or three years ago, we weren’t in touch with any overseas firms looking to use our services for trading power,” said Yasuaki Takeda, executive officer of Weathernews’ energy and retail business division.

Energy firms are fueling a global boom in weather data, which helps them to anticipate sudden price swings. Even minor shifts in temperature or cloud cover can move wholesale electricity prices, creating opportunities for private meteorologists to offer forecasts more frequently and in more detail than are publicly available. Traders are also keen for precise outlooks on solar irradiance and wind speeds in order to predict output from intermittent renewables.

To meet rising demand in Japan, Weathernews combines public data with readings from its own private observation network, which it says covers 10 times more locations than the country’s national weather agency. As rivals expand their own offerings, Japan’s market for weather services has expanded by nearly a third over the past five years, according to the Yano Research Institute.

“If you’re just setting up a shop trading Japanese power, you definitely need weather information,” said Antony Stace, a Sydney-based weather trader who closely monitors the market in Japan.

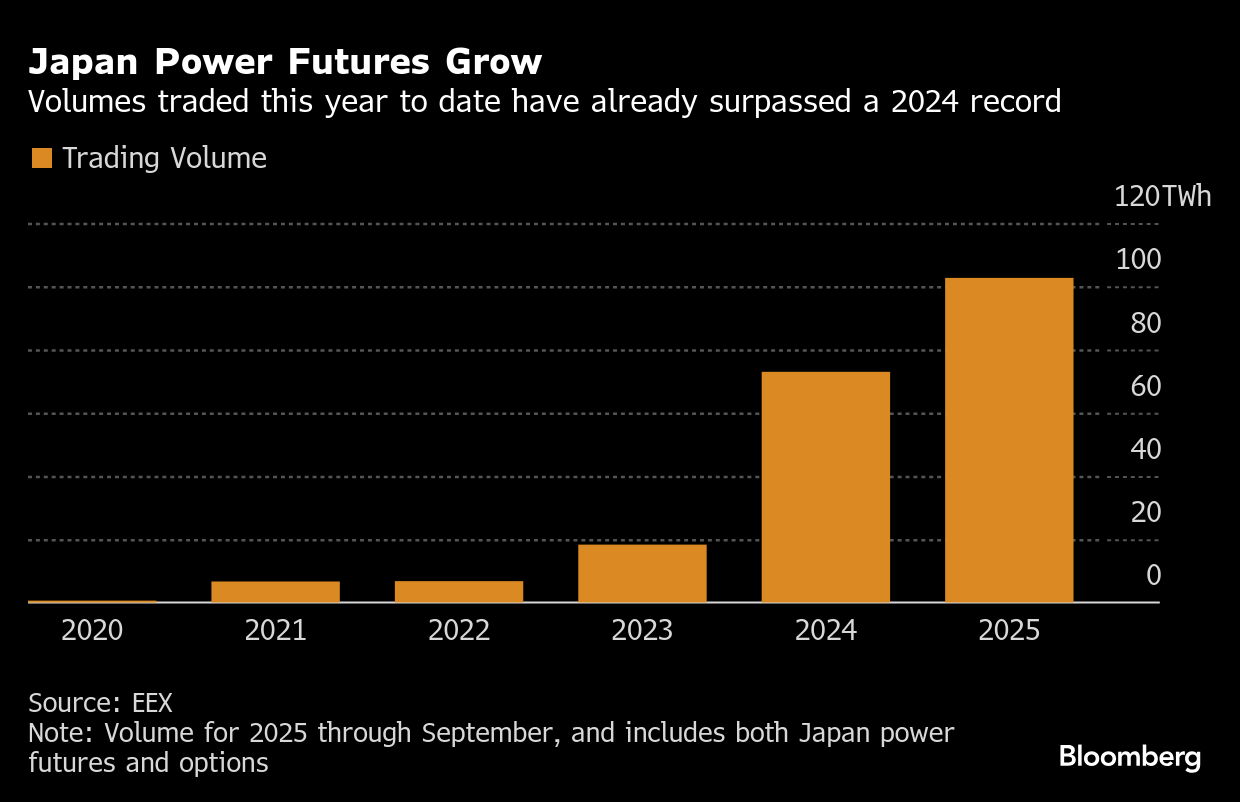

And plenty of new players are coming to Japan, where the relatively young market has ample room for growth. The country’s power market was fully liberalized in 2016 and the world’s largest bourse for power trading, the European Energy Exchange, is in only its sixth year of trading Japanese power futures.

Several factors are driving growth, including a need to hedge against more frequent weather extremes and persistent uncertainty around the restart of nuclear plants idled after the 2011 Fukushima disaster. In May, the number of participants in the EEX Japan power derivatives market crossed 100.

Commercial weather data vendors can charge anywhere from thousands of dollars per year for basic data to “well into the six figures per annum” for advanced trading strategies and use cases, according to Travis Hartman, general manager of the WeatherDesk division of Vaisala Oyj, a Finnish developer of meteorological data and equipment.

“As market participants increase, there’s a more addressable market for us to sell our data, our web applications, our products,” he said. While several dozen weather vendors operate in Japan, Hartman estimated that fewer than 10 have any significant market share in energy trading specifically.

Atmospheric G2 is among several overseas companies pushing into the market. The New Hampshire-based firm has just hired its first full-time employee in the country and this year almost doubled the number of Japanese cities covered by its forecasts, according to Chief Executive Officer Todd Navarra.

New Zealand’s MetService — the world’s only fully commercial national weather agency — launched an English-language daily briefing in April for power traders in Japan. For an additional fee, its consultant meteorologists will interpret the data over a call and explain any area of uncertainty in its forecasts.

“We give that extra confidence to people who are trading,” said Emma Blades, energy account manager at MetService.

Tailored client support is one way for private meteorologists to provide value beyond the services offered by public forecasters. Others offer faster, more precise and user-friendly forecasts. Massachusetts-based Salient Predictions, for example, uses a blend of traditional methods and AI to improve the accuracy of its temperature forecasts, including those for the greater Tokyo area, said CEO and co-founder Matt Stein.

For Weathernews, founded nearly 40 years ago with the aim of protecting ships from storms, the expanding power market is supplementing already-robust demand for its data. And as severe weather events become more frequent and harder to predict, demand for more sophisticated data is poised to grow, said Vaisala’s Hartman.

“Weather just seems a little bit weirder. It’s more extreme,” he said. “There are more impacts to businesses, more reasons for people to try to get ahead of some of these weather events.”

©2025 Bloomberg L.P.