UK Energy Prices Are Down, But Consumers Still Face Higher Bills

(Bloomberg) -- British households are heading into a new kind of energy crisis: bills are rising even as wholesale power and gas prices are falling.

The growing gap is adding to the government’s political headache as it seeks billions of pounds for the clean-energy transition and tries to convince voters it will lower electricity costs. With UK Chancellor Rachel Reeves preparing her budget for later this month – amid expectations of broad tax hikes – ministers are under pressure to explain why consumers face higher costs at a time when global energy markets are easing.

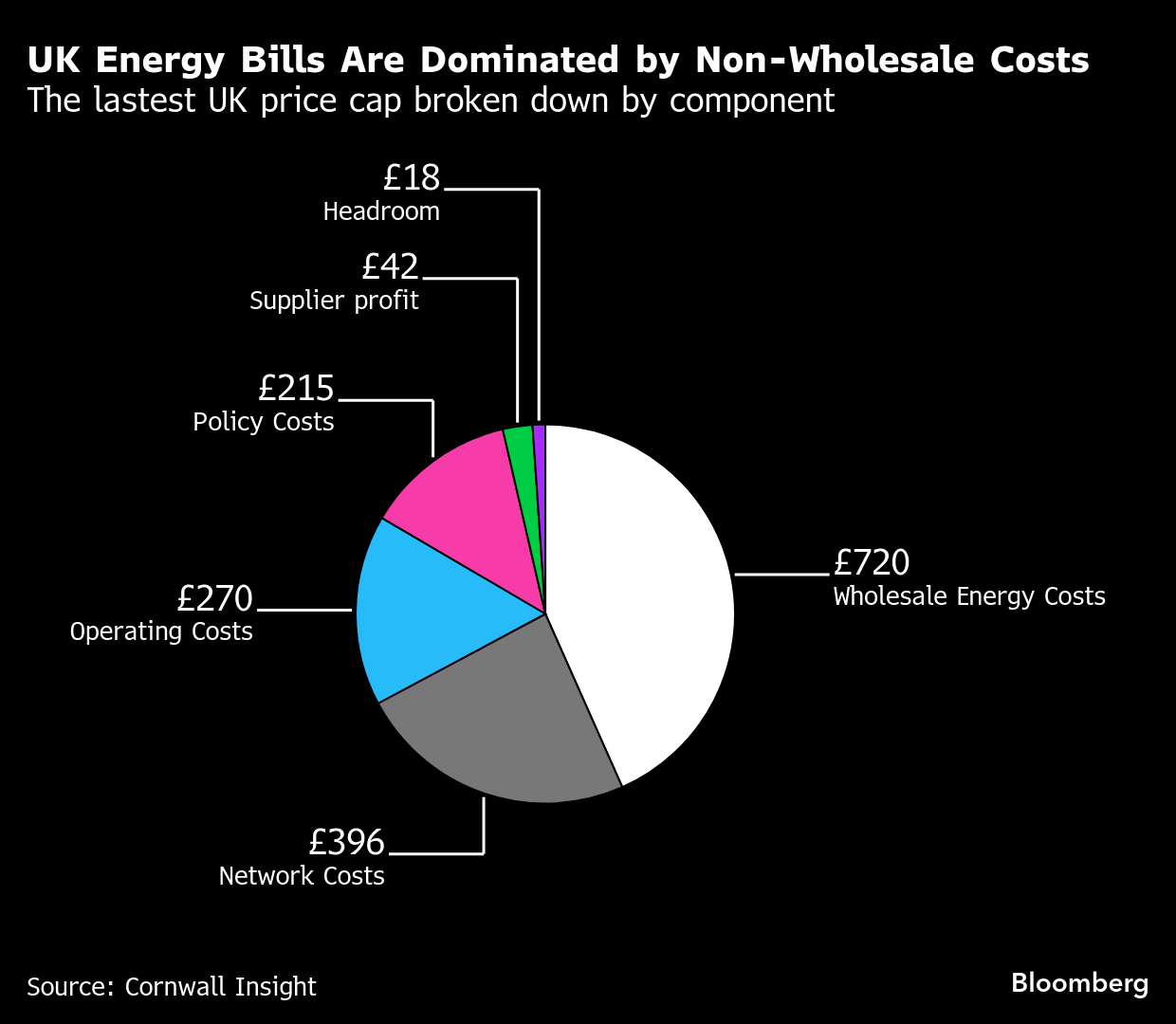

Domestic energy bills, already among the most expensive in Europe, are set to climb again by April because of higher network charges and policy costs, according to energy consultancy Cornwall Insight Ltd. Yet wholesale energy prices are forecast to drop over the same period, forecasts compiled by Bloomberg show.

The UK government, like many others in Europe, argues that a rapid buildout of cheaper renewables will lower bills in the long run, a message that intensified after Russia’s invasion of Ukraine in 2022 sent gas prices soaring. Yet the upfront cost of shifting a system built around gas to one dominated by renewables is increasingly being paid by households today.

“Unfortunately there’s the immediate impact that customers see on bills, and they won’t see the benefit until further down the line,” said Craig Lowrey, principal consultant at Cornwall Insight.

By 2030, ministers have promised that expanding wind and solar will reduce bills. But Octopus Energy, one of the country’s largest energy suppliers, told lawmakers last month that bills could increase as much as 20% in the next few years even if wholesale prices halve, as the costs of everything else are going up.

The scale of investment needed to support the transition is significant. Ofgem says network upgrades alone could reach about £80 billion ($105 billion) by 2030. In December the energy regulator is expected to approve new spending plans for transmission grid operators that could add more than £50 to annual bills starting next year and more than £100 by 2031. This will fund a slew of projects including new overhead lines to transport huge amounts of wind energy towards demand centers like London.

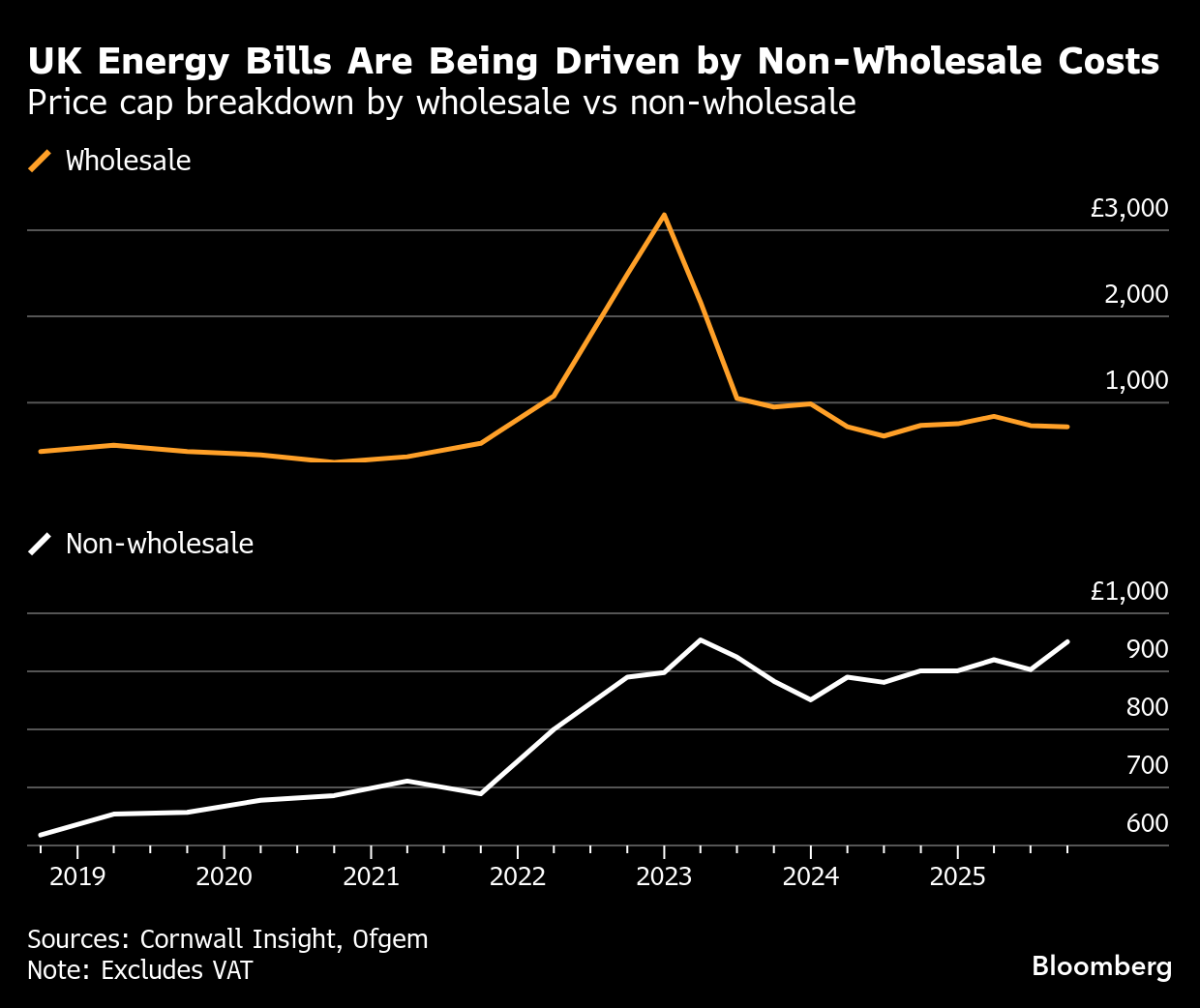

Data from recent years show how sharply the cost balance is shifting. The wholesale portion of UK energy bills has fallen about 77% since the beginning of 2023, according to Cornwall Insight. Policy costs, which fund some of what the government is doing to build out renewables, have risen 41% in the same period.

Breaking Down the Numbers

Still, the debate over what drives UK energy bills often misses the full picture, says Andrew Sissons, deputy mission director at British research agency Nesta. This is because most households pay a combined electricity and gas bill.

“When we look at what has driven the rise in dual-fuel bills, it is clear that wholesale costs — the bit that is driven by high gas prices — is still the main culprit,” he said in a recent Nesta blog. “This is one reason why we argue that Britain needs to stop using gas for home heating so urgently, and switch to cleaner electric heating.”

At present, almost all the costs of supporting renewables and other low-carbon programs are recovered through electricity bills rather than gas. Analysis by Nesta shows that policy costs now make up just under one-fifth of the average power bill but only around 7% of a gas bill, a distortion that makes electricity disproportionately expensive.

Reeves has already said she will take action to deal with the financial squeeze average Britons are feeling in preparation for her budget announcement on Nov. 26. The chancellor is looking at a range of options to help reduce the cost of energy bills, including potential tweaks to tax and climate levies, according to a person familiar with the matter. Reeves wants to ensure any changes are progressive, rather than solely removing VAT from energy bills, which would benefit wealthy people most as they tend to consume more energy, they said.

Britain’s household energy debt has ballooned to over £4.4 billion, from just £1.8 billion four years ago, as a growing number of Britons struggled to pay their bills after gas and power prices soared to historically high levels in 2022.

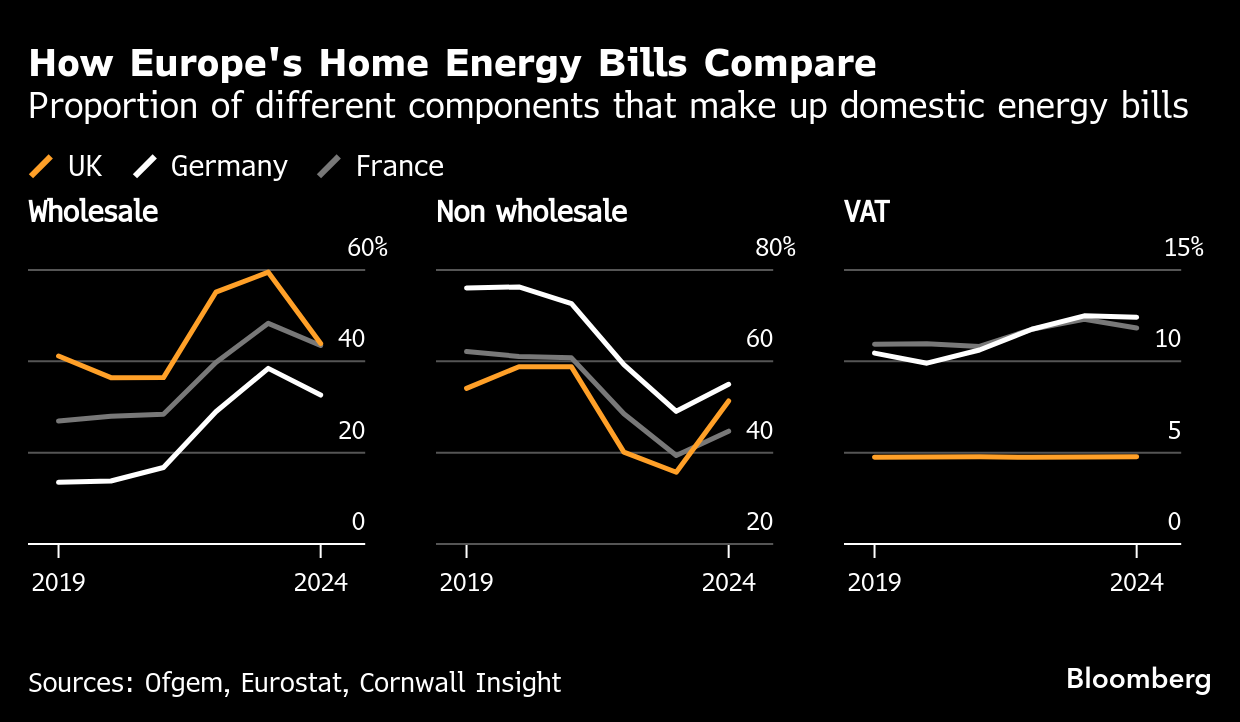

How Britain Stacks Up

Across Europe, other governments are also risking voter anger as they ask citizens to help pay for decarbonization. In Germany, energy bills remain a strain: about 4.2 million people — roughly 5% of the population — were behind on electricity or gas payments in 2024, according to the federal statistics office.

Household power prices have fallen since 2023, but far less than wholesale rates. Wholesale electricity prices dropped 36% over the past two years, while consumer prices fell only 16%, data from energy lobby group BDEW show. Taxes and grid charges now make up a larger share of bills, with network fees rising 47% since 2020, according to Verivox.

The biggest obstacle is geography. Most wind farms sit in the windy north, while energy-hungry industries cluster in the west and south. That mismatch demands massive grid expansion — including Germany’s largest transmission line, now under construction, stretching more than 700 kilometers (435 miles) across the country.

Consumers will ultimately foot the bill. Grid-related charges are set to climb about 22% by 2030, according to Agora Energiewende. To cushion the blow, the government plans to subsidize grid fees with €6.5 billion next year, trimming household costs by an average 6%, Verivox estimates. Similar support is expected through 2029.

France stands apart in Europe. Its large nuclear fleet has helped keep wholesale power prices among the lowest in the region, roughly €30 per megawatt-hour cheaper on average than in the UK or Germany. It is adding renewables and upgrading its grid, but on a smaller scale. France’s highest-level grid infrastructure needs fewer major upgrades because nuclear and hydro generation are already spread across the country, according to Jonathan Hoare, research associate at Aurora Energy Research.

Over the long-term, the logic behind the UK’s transition remains intact: A system dominated by renewables should, eventually, be cheaper and less exposed to global markets than one reliant on gas. National Grid Chief Executive John Pettigrew said the grid investments now under way are essential to keeping the system reliable and affordable in the years ahead.

Yet the demand side has to keep up. Rachel Fletcher, director for regulation and economics at Octopus Energy, said that investment needs to shift toward electrifying homes and transport, arguing that policymakers have focused too heavily on supply.

“Fundamentally, what is driving up bills is that we are prioritizing building stuff over thinking about whether there are any other ways and other things that we could do to decarbonize our electricity use, which might be cheaper and require fewer new assets in the ground,” she said.

©2025 Bloomberg L.P.