Prediction Markets Go From Fringe to Frenzy as Wall Street, Silicon Valley Pile In

(Bloomberg) -- The intimate meal, 60 floors above New York’s financial district, brought together a pillar of the Wall Street establishment and a young crypto upstart.

The host, billionaire septuagenarian Jeffrey Sprecher, CEO of Intercontinental Exchange Inc., the owner of the New York Stock Exchange, arrived in a suit. His guest, 27-year-old Polymarket founder Shayne Coplan, walked in wearing a T-shirt, carrying a disposable water bottle and a paper bag from a bakery.

Over dinner at Manhatta, a high-end Danny Meyer restaurant, Sprecher admitted he’d never used Coplan’s crypto-powered prediction market — it was still closed to US customers at the time. But Coplan’s pitch stuck: a new kind of exchange that makes it possible to bet on politics, sports, culture and just about anything else.

“In 20 minutes, I realized they were onto something,” Sprecher said in an interview. “What they had designed was very profound.”

The investment — of as much as $2 billion — that ICE committed to after that meal was one in a dizzying frenzy of deals that has been announced over the past two months, turning prediction markets from fringe experiment into one of the hottest trends in both Silicon Valley and Wall Street.

Participants are betting that “event contracts” — financial instruments that allow wagers on outcomes in politics, sports and more — can sidestep decades-old rules separating gambling from finance. Proponents promote them as a new way to forecast the future and potentially reshape markets themselves.

The opportunity — and the risk — took center stage this week in Chicago, where Sprecher and other executives gathered for a major trading and derivatives conference. Tarek Mansour, the CEO of Polymarket’s main rival, Kalshi Inc., made an appearance in which he teased several upcoming deals and boasted that prediction markets would become a “trillion-dollar” industry competing with the biggest asset classes.

The scramble to secure investments and strike alliances includes some of the world’s biggest exchanges, gambling giants, trading platforms, VC firms, crypto outfits, pro sports leagues — even the Trump family’s media company. All are trying to stake a claim in a highly contested legal gray zone.

In one case, Polymarket and Kalshi entered into a bidding war to win a partnership with the National Hockey League when it was considering becoming the first professional sports league to officially cooperate with prediction markets, according to people familiar with the negotiations. Eventually, both exchanges paid up to secure the deal.

The NHL declined to comment on the details of the talks. Representatives for Polymarket and Kalshi declined to comment for this story.

Regulatory opening

The recent agreements have helped Kalshi field offers to boost its valuation to more than $10 billion, from $2 billion in June, Bloomberg has reported. Polymarket has followed a similar parabolic ascent and it is now looking to raise additional funds at a valuation over $12 billion — more than 10 times what it was worth just months ago.

Even before the Polymarket investment was announced, ICE and Kalshi had held informal talks, but they never resulted in a deal, people familiar with the matter said. A representative for ICE declined to comment.

Both Kalshi and Polymarket are racing to gain legitimacy and scale, moving quickly into a regulatory opening created by the Trump administration, a sharp shift after years of legal crackdowns on prediction markets. But the backlash is building. Critics warn that embedding gambling into ever more corners of American life could have broad unintended consequences.

“This is a mess for so many reasons,” said Melinda Roth, a visiting associate professor of law at Washington & Lee University, who has written about the legal landscape surrounding event contracts. “We have people taking money they often don’t have and not investing in the stock market or retirement savings.”

State gaming agencies and Native American tribes are in their own race to make legal filings arguing that the nascent industry is steamrolling rules meant to protect bettors and gaming integrity.

Privately, though, two state regulators who requested anonymity to speak candidly about ongoing legal struggles, expressed concern about the wealth and power that are increasingly backing prediction markets. One wondered whether the phenomenon of wagering on sports using prediction markets could become too pervasive to rein in. In industry circles too, there is a sense that the fast action by the industry may overpower the legal doubts.

“If there’s enough institutional support and political support, everyone has just sort of spoken about the way they want the world to be,” according to Chris Grove, co-founder of Acies Investments, which backs gaming companies. “It’s what the relevant economic actors and the relevant political figures say.”

Sports betting

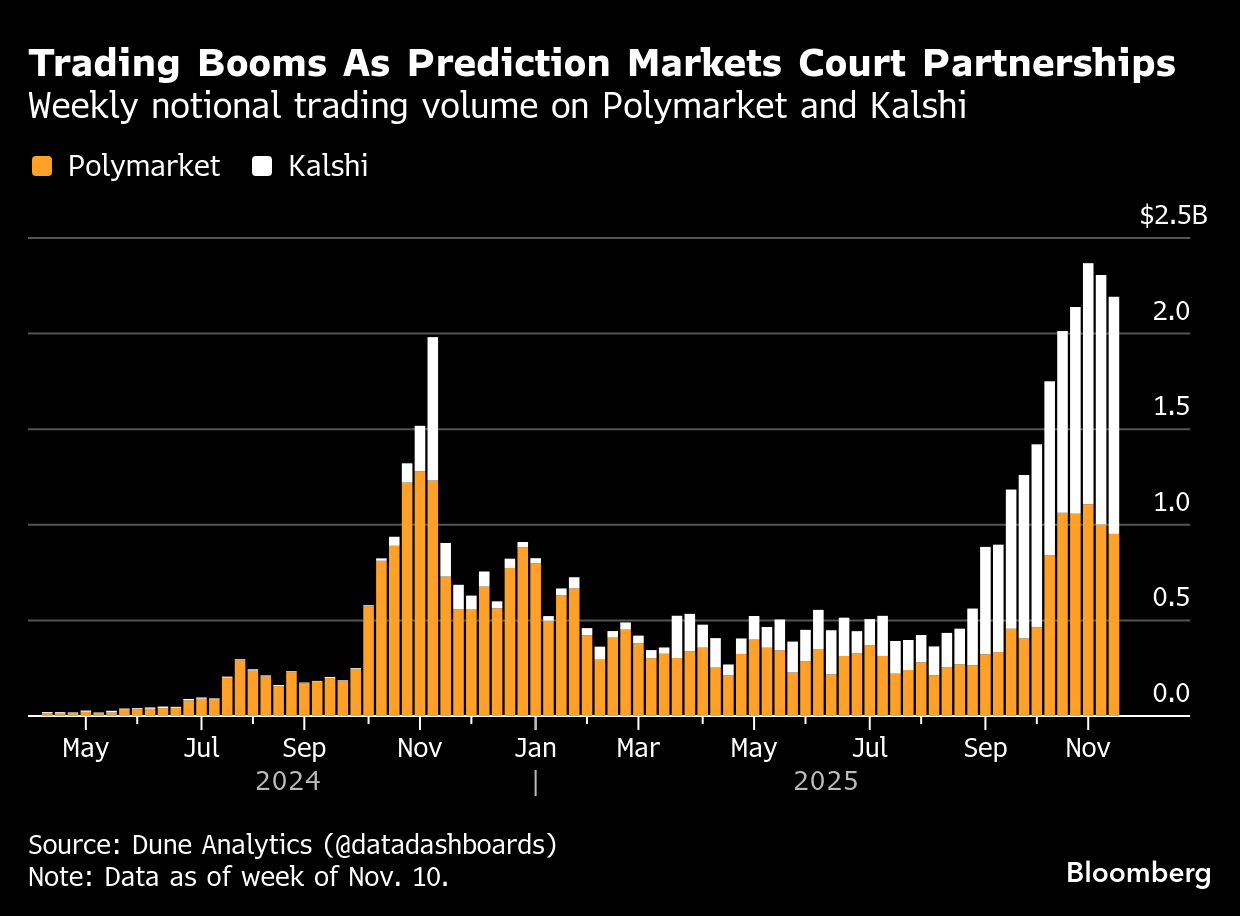

The actual trading on prediction markets today is still a tiny fraction of the existing business at traditional exchanges and gambling companies, but momentum is building, and many of the established players are jumping in.

Terry Duffy, the CEO of CME Group Inc., said that he went to the New York offices of the gambling company Flutter Entertainment Plc early this year to personally pitch the company’s CEO on a partnership, which they announced over the summer.

“I had been watching the retail revolution for years and was particularly interested in its evolution into sports,” Duffy said. “The intersection of sports and trading is powerful.”

The two companies are working on a consumer app, FanDuel Predicts, that is set to be released by the end of the year.

The CEO of DraftKings, Jason Robins, questioned whether event contracts could compete with traditional sports gambling at a recent industry conference. But his company also hedged its bet by purchasing a small regulated financial exchange, Railbird, that is set to allow DraftKings to offer event contracts itself.

Jay Snowden, CEO of the casino operator Penn Entertainment Inc., said on a Nov. 6 earnings call that prediction markets are a “major threat to the industry.”

“We’ve got to play some offense here,” he said.

Trump’s Embrace

When Kalshi initially began offering contracts tied to sports games early in the year, just months after it won a court battle to open trading on election results, it was not clear if regulators would allow them to move ahead.

A number of gaming regulators said the activity violated state laws governing sports gambling. Kalshi countered that its products were financial instruments, regulated by the Commodity Futures Trading Commission — not subject to state oversight. It has said that unlike a sportsbook, which sits on the other side of every bet, it offers an exchange where traders with different views can meet.

Kalshi Co-founder Tarek Mansour during an event at Securities and Exchange Commission headquarters on Sept. 29.Photographer: Kent Nishimura/Bloomberg

Kalshi Co-founder Tarek Mansour during an event at Securities and Exchange Commission headquarters on Sept. 29.Photographer: Kent Nishimura/Bloomberg

The CFTC hasn’t intervened. Meanwhile, the Trump family has increasingly aligned itself with the industry. Donald Trump Jr. became an advisor to both Kalshi and Polymarket. And Trump Media & Technology Group took part in a blitz of negotiations this fall with one of Kalshi’s competitors, Crypto.com, ultimately announcing its own marketplace, Truth Predict.

Devin Nunes, who has served as an adviser to President Donald Trump and is the CEO of Trump Media, was a key part of the agreement, which came together in a matter of weeks, according to people familiar with the discussions who asked not to be named because the talks were private.

Polymarket started from behind. It had been closed to US customers since a 2022 settlement with the CFTC. But in July, the CFTC and Justice Department told Polymarket they were ending their investigations of the company. In order to open in the US and offer CFTC-regulated contracts, Polymarket paid $112 million for a little-known derivatives exchange, QCX, which was in the process of gaining regulatory approval.

Marketing Deals

Many of the recent deals are partnerships that will get the big prediction markets exchanges in front of a broader audience.

Kalshi and Polymarket both reached agreements to offer their contracts through PrizePicks, a fantasy sports app. And Polymarket is collaborating with the mixed martial arts company Ultimate Fighting Championship, to display a scoreboard with fan predictions during broadcasts. At the industry conference this week, Mansour said he expects to announce more sports deals soon, as well as “very large news network partnerships,” though he declined to provide details.

Ultimate Fighting Championship President Dana White, left, and Coplan on the floor of the New York Stock Exchange on Nov. 13.Photographer: Michael Nagle/Bloomberg

Ultimate Fighting Championship President Dana White, left, and Coplan on the floor of the New York Stock Exchange on Nov. 13.Photographer: Michael Nagle/Bloomberg

It is still possible that the surge will hit a legal wall. A federal judge in Nevada recently expressed skepticism about the legality of Kalshi’s sports contracts and academics have flagged examples of “artificial trading” on Polymarket.

When Cboe Global Markets Inc. announced its own prediction markets product, it said it would steer clear of sports.

“We can jump on any trend or fad, and I suppose we could make a lot of money, but that’s not really what we’re interested in doing,” Cboe CEO Craig Donohue said in an interview.

The sports leagues have approached all this with caution, especially after the Department of Justice announced the latest sports gambling indictments. But while the NHL became the first major US sports league to publicly announce a deal with both Kalshi and Polymarket, other leagues have held conversations with the exchanges to determine how they can cooperate, according to people familiar with the matter.

This month, to mark the UFC tie-up, Coplan joined Sprecher on the floor of the New York Stock Exchange to ring the opening bell — the crypto founder in a crewneck, the exchange chief in a suit.

©2025 Bloomberg L.P.