Power China Undeterred by African Defaults But Changes Approach

(Bloomberg) -- Power Construction Corp. of China, one of the world’s largest engineering and construction companies, said it plans to continue to seek African business despite a series of sovereign defaults.

The Beijing-based state-owned company, known as Power China, has built a portfolio of some of Africa’s most prestigious infrastructure developments. It has has worked on projects ranging from a giant Ethiopian hydropower dam to solar and wind plants across the continent.

“We focus more on the financial performance of the project. Let’s do the projects with good cash flow first,” Chen Guanfu, an executive vice president at the company in charge of foreign business, said in an interview last week. And “we pay more attention to the medium-size or small-size projects” he said, reflecting on the approach in the wake of sovereign debt defaults in Zambia, Ghana and Ethiopia.

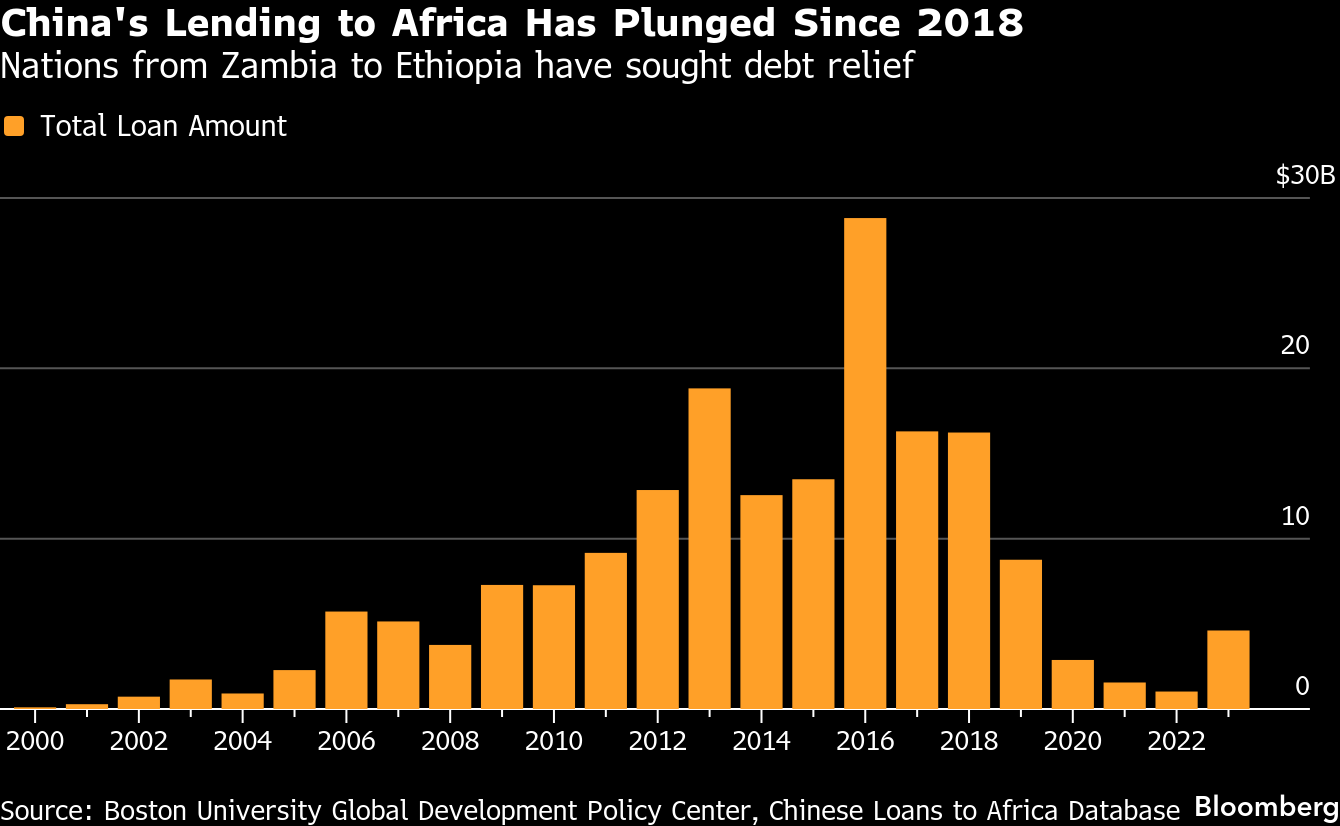

Some Chinese companies have been more wary due to the debt problems. Chinese lending to Africa peaked in 2016, with nearly $29 billion committed that year.

After the pandemic, nations including Zambia, Ethiopia and Ghana embarked on painful debt-restructuring exercises that have precluded them from borrowing commercially. At the same time, Beijing has drastically scaled back lending to regional governments, shifting to what it’s dubbed a “small and beautiful” approach to projects.

The new focus gives Power China a better chance of securing finance from lenders, who are more wary after the defaults, he said.

“Only in this way we can secure the financing from lenders,” Chen said, while speaking to Bloomberg in Johannesburg. “If there is no financing there is no project.”

In the past, Power China largely relied on state lenders like Export-Import Bank of China to finance projects in nations including Zambia. This year, a Standard Bank Group Ltd. unit stepped in to fund the majority of a 100 megawatt solar-power plant in the copper-rich country.

While the company now has projects across about 140 countries it’s had a strong focus on Africa since it started winning business in Kenya in 1962, leading Chen to describe the continent as Power China’s “second home town.”

“We always look at the African market as one of our most important markets even though sometimes it develops quickly, sometimes slowly,” he said. “There is huge potential not only for electricity, for water, for industrialization and also for infrastructure.”

That potential has led Power China to keep its focus on the continent despite its indebtedness.

“It’ll be better in the near future,” he said of African economies. “We have to hold hand-in-hand for the temporary tough period.”

©2025 Bloomberg L.P.