Oil Traders Adrift Without Positioning Data Amid Shutdown

(Bloomberg) -- Rick Bandazian trades oil, writes a newsletter on what he calls “asymmetric trade opportunities” and hosts a YouTube show with tips on making money in the market, doled out from his office in a converted fire house.

The former investment banker and buy-side analyst with 25 years of experience has a calm, confident demeanor and he speaks with authority about complex trading issues. But when the host and author of learned that key government data coveted by oil traders wouldn’t be released during the government shutdown, his reaction was “sh-t, now what?”

He’s hardly the only one feeling the loss of the weekly Commitments of Traders report. Since the Commodity Futures Trading Commission began publishing the current version of COT reports in 2009, market participants from retail investors to major trading houses have grown reliant on them as a one-of-a-kind dataset to gauge sentiment. They’re compiled using confidential positioning information that only regulators can access, making the final report extremely hard to replicate.

COT reports cover a host of markets, among them the most liquid, oil. The data contain a granular breakdown of who’s buying and selling, distinguishing hedge funds and other money managers from commercial players like producers and refiners, as well as smaller participants like Bandazian. Oil producers lean on the data to inform their hedging strategies, while speculative traders use it to figure out where smart money is moving, positioning with it – or against it — when extremes appear.

Cut off from that insight, traders may grow more cautious and take on fewer positions to scale back risk, experts say. A thinner market is more vulnerable to manipulation since even small transactions can significantly move prices. But unlike other instances of low-volume trading, such as periods of political uncertainty or holidays, the CFTC’s enforcement arm has also been hamstrung by the shutdown, leaving the market effectively unsupervised by the government.

This isn’t the first time traders have been forced to go without but it will likely be the longest. Following a 35-day government shutdown in 2018, the CFTC resumed publishing the COT reports in chronological order, releasing two to three a week. That means it could take several weeks for traders to catch up once the government reopens.

The CFTC will aim to release its first missed report in the first full week of normal government operations, a commission spokesperson said in an email. After that, it plans to release data in chronological order “at a greater frequency” until it catches up with the backlog.

For Bandazian, who religiously scans the Friday reports for excessively bullish or bearish stances and then places contrarian bets to profit when the market corrects, “this data is always my North Star.”

Though it’s hard to know exactly to what extent COT data figures into hedge fund moves, about half of those trading decisions can be explained by historical price patterns captured in the reports, said Ilia Bouchouev, a managing partner at Pentathlon Investments who also teaches at New York University.

“It’s like playing poker,” said Bouchouev. “You’re trying to take a peek at somebody else’s cards. If you know what they’re holding, you have a tremendous edge.”

The duration of this shutdown — which started on Oct. 1 and is now the longest on record — poses an unprecedented challenge, mainly to investors in US-centric commodities markets like West Texas Intermediate crude and natural gas, said Darrell Fletcher, managing director for commodities at Bannockburn Capital Markets.

The missing reports could flush speculative traders out of risky assets, like oil, amid seasonally low market participation ahead of the winter holidays. Reduced liquidity would make it even trickier to make money in a trading environment investors have been lamenting all year.

“Week after week after week, it’s getting to be a bigger deal,” he said.

In late September, hedge funds were close to the most bearish on US oil on record, according to the last available set of data. Since then, Washington imposed sanctions on Russia’s biggest oil companies, even with the market still seen headed for oversupply — meaning that positioning could be all over the map.

And just a few weeks ago, hedge funds held record-short positions on Brent oil, before reversing course at the fastest pace ever, highlighting how quickly and unpredictably positioning can shift. Because Brent trading reflects regional dynamics outside of the US, it’s an imperfect proxy for the missing COT data.

Limited surveillance

The CFTC has pulled back on most of its surveillance activities until funding is restored, furloughing about 91% of its 543 employees, it said in documents outlining its plan for the shutdown. That also includes many staff who typically would be in charge of surveilling markets for derivatives tied to oil and other commodities.

Several staffers focused on market oversight and surveillance are working through the shutdown, according to a CFTC spokesperson.

“It’s unfortunate that some in Congress have chosen to oppose the very budget that they’d supported many times in the past, resulting in a lapse in appropriation and the consequences that follow,” the spokesperson wrote. “In the meantime, the CFTC will continue its core functions to safeguard our markets.”

Even before the shutdown, the CFTC had come under political pressure, firing about a dozen probationary employees earlier this year as the Department of Government Efficiency, or DOGE, worked its way through the federal workforce. It put even more on administrative leave and sent out reduction in force letters, including to many enforcement staff. President Donald Trump’s administration has slashed thousands of federal jobs and programs, from building inspectors to clean energy initiatives. He’s also fired the head of the Bureau of Labor Statistics after the highly regarded monthly jobs report showed weaker hiring.

“The president has declared that there’s no such thing anymore as independent regulators, all regulators are now political operations operating out of the White House,” said Tyson Slocum, the director of the energy program for Public Citizen, a nonprofit consumer advocacy organization. “There’s an ideological lean here, to not engage in aggressive oversight.”

A significant amount of surveillance is also conducted by the energy and commodity exchanges, operated by CME Group.

“We continually surveil our markets and prosecute any violations of our rules,” a spokesperson for CME Group said in an emailed response to questions.

But some industry participants warn that self-regulation can be risky.

“The exchanges are positioned to provide a type of oversight and enforcement mechanism,” Slocum said. “But it is limited and severely conflicted due to the fact that the exchanges are all for-profit entities.”

For its part, the CME Group said it is a neutral facilitator of risk and not a participant in the market. “Whether the government is shut down or open, market integrity is critical for the entire marketplace. Our standards for regulatory oversight will never be compromised under any circumstance,” it said.

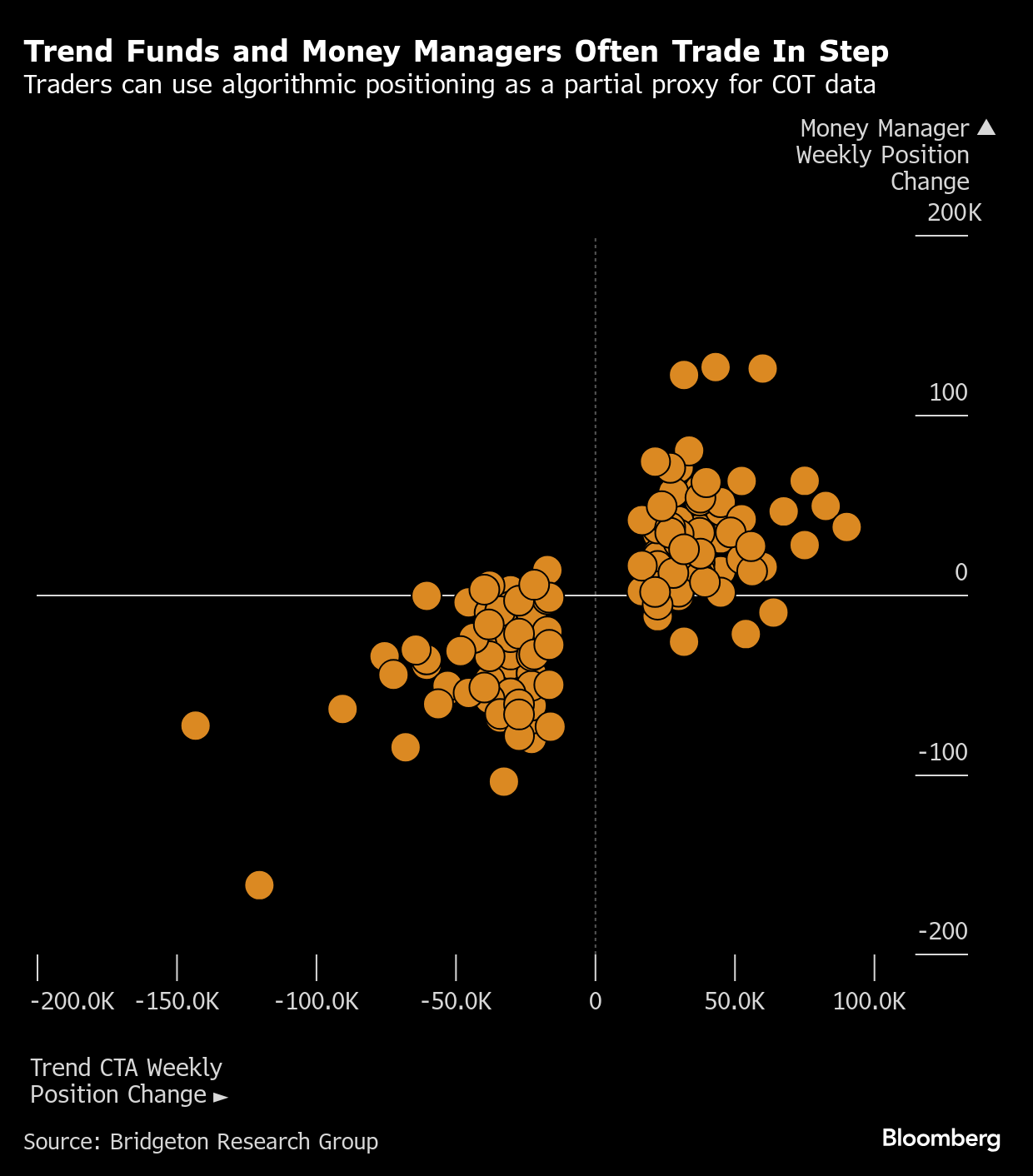

The shutdown is heightening the focus on alternative data providers. Firms like Energy Aspects Ltd. publish data that approximates positioning across oil and other commodity markets. Bridgeton Research Group LLC. offers insights on algorithmic trader positioning, which typically moves in tandem with that of money managers. But it is far from a complete picture. Algorithmic traders only make up roughly 15% to 20% of total speculator positioning covered in the COT reports, though “their positions are often more dynamic than other players,” according to Bridgeton.

Investors can also look at ETF flows, stock moves and COT reports still being released by the Intercontinental Exchange Inc., the Europe-focused equivalent of CME’s reports, for clues on market stance.

Slocum also serves on the CFTC’s Energy and Environmental Markets Advisory Committee and its Market Risk Advisory Committee. Six years ago, members received briefings on CFTC operations despite the government closure, he said.

This time, he hasn’t heard a word.

For smaller traders like Bandazian, the data deficient period has been an experiment in resourcefulness. He’s using this time to form new habits for taking the market’s pulse, including increased reliance on news and technical indicators.

“These black box guys have their hands in everything, whether it’s economic data or breaking M&A news,” Bandazian said. COT reports are important because they’re “the last frontier of data that can’t be instantaneously arbitraged.”

(Updates in seventh, 17th and 18th paragraphs with CFTC comment.)

©2025 Bloomberg L.P.