China’s Kweichow Moutai Plans Another Buyback as Shares Falter

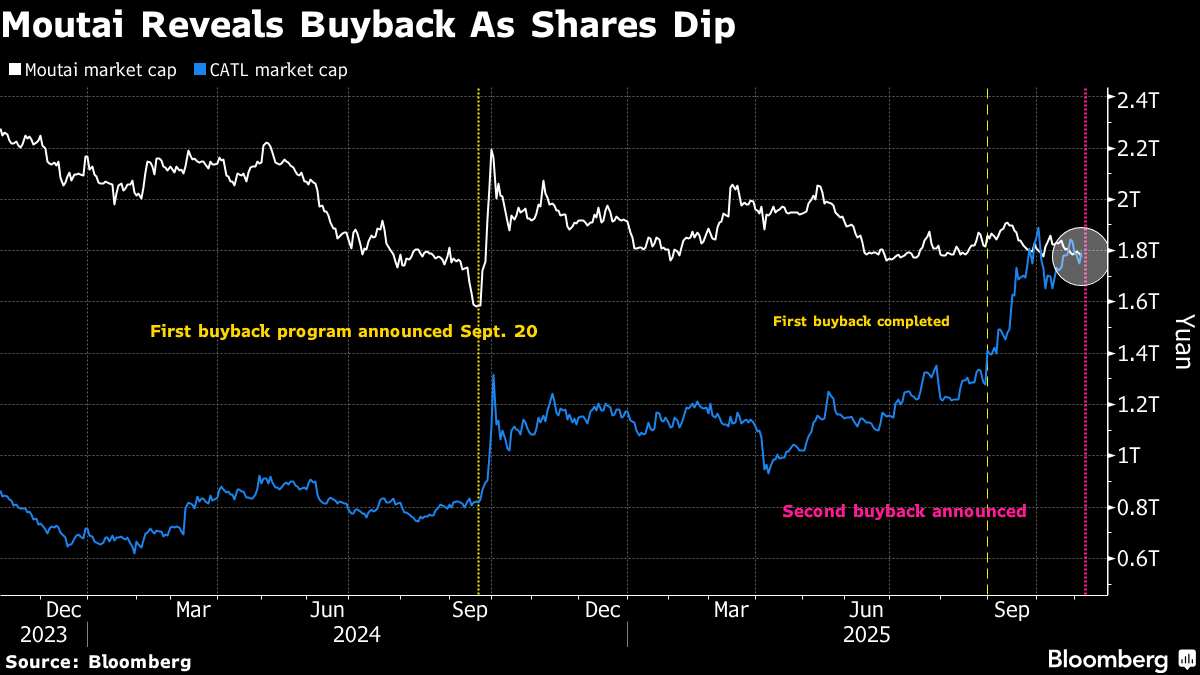

(Bloomberg) -- Liquor maker Kweichow Moutai Co., once the largest listed company in China, has announced another plan to buy back shares in a move that may lift its flagging stock price.

The company said after the market closed on Wednesday that it will buy back as much as 3 billion yuan ($421 million) of stock, half the size of a series of repurchases it completed by September. Its shares rose as much as 1.5% in morning trading, their best performance in over two weeks, according to Bloomberg-compiled data.

The company was for years one of the most popular picks for investors in China’s stock market, but it has now dropped from No. 1 to fifth place in the ranking of the country’s largest listed companies. Battery maker Contemporary Amperex Technology Co., which has capitalized on global demand from electric-vehicle companies, has jumped ahead of it.

Moutai, along with many other traditional consumption companies, has largely missed out on China’s policy- and tech-driven stock market rally since last year, held back by sluggish household spending. Shares of the distiller are down more than 17% since a peak last September, a level it hit just days after it announced the earlier buyback.

©2025 Bloomberg L.P.