Spain’s Power Grid Spending Fell Behind as Solar Energy Boomed

(Bloomberg) -- Spain’s nationwide blackout this week has put a spotlight on potential vulnerabilities in its system that may offer warnings to others, as rising electrification and clean energy place new demands on power grids around the world.

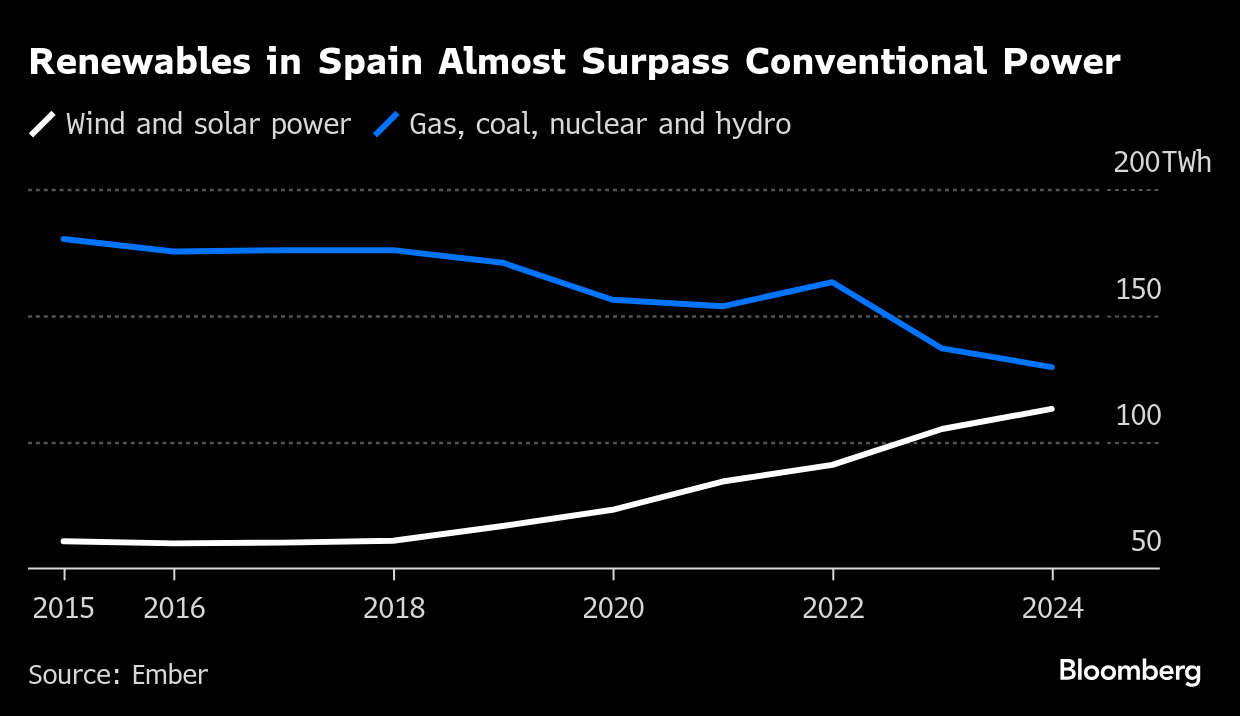

Spain lags behind other European states in grid spending relative to renewables investment, according to an analysis by BloombergNEF. Its solar capacity has more than doubled in the past five years, producing frequent surges in generation that far surpass demand. Yet much of Spain’s grid equipment was built and installed decades ago, before the solar rollout.

The shift to renewables brings particular challenges. Solar and wind create intermittent supply that must be carefully managed, while renewables-heavy networks require additional measures to maintain stability. Compounding that challenge, Spain is a power “island,” with few of the cross-border cables that help other countries stabilize their networks when things go out of kilter.

Authorities are still hunting for answers to Monday’s unprecedented outage, and the sparse explanations offered by the grid operator make it difficult to say whether — or how — these risks contributed to the failure. But as the first major blackout in a European nation that depends largely on renewable energy, the outcome of the investigation will offer critical lessons for countries across the region and the world.

The crisis in Spain is just the latest in a series of big outages from Texas to Chile in recent years. As more and more of the world’s energy comes from electricity — for cars, home heating and industry — the need to invest in and upgrade grids is becoming increasingly urgent. Experts have warned repeatedly that spending is not happening fast enough to respond to rising power consumption and the growth in renewables.

Across the globe, at least $21.4 trillion needs to be invested in electricity grids by 2050 to reach net zero, according to BloombergNEF.

“The stronger grids you have, the better possibilities you have to route power in different ways,” said Felicia Aminoff, a networks analyst at BloombergNEF. “If you have strong grids and a bit of spare capacity in power lines and substations, it becomes easier to deal with issues that come from generation.”

Solar Expansion

The need to manage renewables in Spain will only grow as the country is poised to expand solar capacity a further 70% by the end of the decade, BloombergNEF data show. The government wants the grid to be 81% clean power by 2030, up from just over 50% last year, as part of a broader target to cut emissions to net zero by midcentury.

But investment in the systems that take electricity from solar panels and wind turbines across the country into factories and people’s homes isn’t growing at the same pace.

Spain has Europe’s lowest ratio of grid spending to clean-power investment. During the past five years, the country invested an average of 30 cents for every $1 it spent on renewables, according to BloombergNEF. That compares with an average of 70 cents in the majority of European markets.

Grid operator Red Electrica says it has significantly increased investment in the network to adapt it to the requirements of the energy transition. The company invested €1.1 billion ($1.2 billion) last year and plans to spend €1.4 billion in 2025, it said in a written reply to questions. Investment will total more than €4.2 billion from 2021 to 2025.

Aging System

Most of Spain’s grid equipment was built and installed decades ago. That means substations — the nodes that connect the different electricity lines — weren’t designed to handle the high variability inherent in wind and solar power.

The government, like others in Europe, limits the amount of money companies can spend on power networks to prevent excessive costs being passed on to consumers. It’s now considering whether it should raise the cap, noting that the current limits were set more than a decade ago, before the huge renewables rollout.

The Ministry of Environmental Transition says Spain’s grid is among the world’s most robust and investment fits with renewables growth and the country’s needs. When investing in the network, the government focuses on making sure it can support new industrial projects as well as strengthening the system overall, a ministry spokesperson said in an emailed response to questions.

Iberia also differs from the rest of Europe in terms of cross-border connections. Cables between neighboring countries can be critical to balancing power systems, allowing a swift transfer of flows should a key source of generation shut off.

But the peninsula is among the least interconnected areas in the region. Spain’s system is linked up to Portugal, France, Andorra and Morocco, yet the exchange capacity is only about 3 gigawatts. That’s less than 3% of total capacity, compared with a European Union target of 15% by 2030, according to the ministry. Spain can’t increase its connectivity by itself and the government hopes the issue will become a priority for the European Commission, the spokesperson said.

A new link being built to France will increase the interconnection to about 5 gigawatts when it comes online in 2027.

“Interconnections help because they help you balance,” said Janusz Bialek, a research fellow at Imperial College London. “If they had more connections with France, maybe they could have helped and solved the problems.”

Spain’s isolation contrasts with Great Britain, a literal island, which has multiple subsea links to almost all its nearest neighbors, including France, the Netherlands and Belgium. It also has connections across the North Sea to Norway and Denmark.

The importance of such joined-up markets was evident last winter when the country’s Danish link brought in extra electricity as a dearth of wind power left the grid with an insufficient buffer of supply.

Grid Balancing

As more and more of Spain’s power comes from renewables, the nation may also need to invest more in storage — its installed battery capacity is far below that of the UK — and grid-balancing services.

Reliance on renewables has increasingly raised questions around a lack of “inertia,” a term referring to the energy created by rotating generators at conventional power plants, which is used to maintain frequency.

The network operator has described a series of disruptions over just a few seconds that plunged the country into darkness on Monday. But before that, the system was already under stress: The frequency of the grid had started to fluctuate unusually just after noon, half an hour before the blackout occurred.

Frequency is the “heartbeat” of the grid, and has traditionally been kept steady by inertia provided by fossil-fuel, nuclear and hydropower plants. But Spain was using little of those sources Monday afternoon, instead getting most of its electricity from solar panels.

There are other ways to provide that inertia, including flywheels that essentially mimic the spinning generators, but there’s a lack of them in the Spanish system.

There’s no proof that a renewables-heavy grid is more vulnerable, according to the environment ministry, which said it’s not about how the power is generated, but about technologies that can make the network more stable. Renewables have been present in Spain’s grid for a long time, in similar conditions as it experienced April 28, without prior troubles, the spokesperson said.

Red Electrica said it doesn’t decide on the energy mix at any given time. The operator looks at the mix and must decide whether it’s compatible with supply safety and make the necessary changes to guarantee security, the company said.

It’s not yet clear what Spain did Monday to try and keep the grid running, or why those efforts failed. There was nothing unusual about the weather that day and it’s too early to say what role — if any — the reliance on solar played, said Emeric De Vigan, an independent energy-market consultant.

Still, “it’s pretty intuitive to understand,” he said. “There’s less-to-no inertia with solar panels. It does create challenges for the grid and a bit less buffer when things go really wrong.”

©2025 Bloomberg L.P.