China’s Scorching Heat Poses Summer Test for Electricity Grid

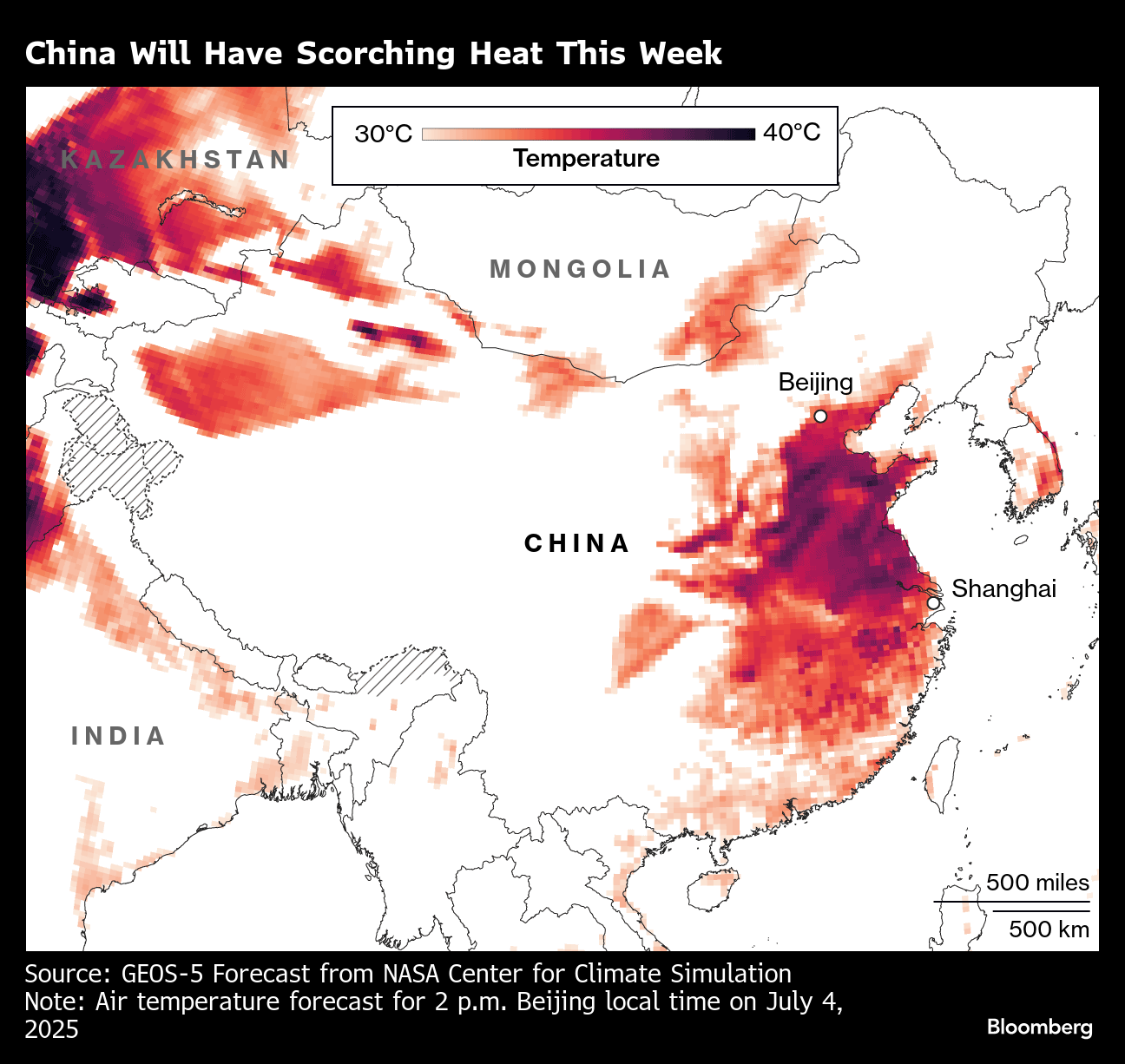

(Bloomberg) -- A sizzling start to July is on the cards for China, where nationwide temperatures are poised to climb almost 3C above historical averages in the first week of the month.

That’ll pile pressure on electricity supplies as people crank up their air conditioners, demand for which has nearly doubled in the past decade.

Swathes of eastern China, home to major population centers including Shanghai, Nanjing, and Hangzhou, will see temperatures around 35C to 39C (95F to 102F), with some places touching 40C, according to a forecast from the China Meteorological Administration. The region may face a “long-lasting high temperature war,” the state weather bureau said last week.

Key rice growing areas will also bake in the heat, threatening to damage the crop during a crucial development stage and risking lower output in one of the country’s top-producing regions.

As the mercury climbs, government officials will be feeling the heat in more ways than one: they must ensure stable power supplies even as demand spikes — potentially to record levels. The National Energy Administration expects peak electricity demand to be about 100 gigawatts higher this summer than last, the equivalent of needing to turn on all the power plants in the UK at once.

Preparations have been years in the making. After major blackouts struck China earlier this decade, the authorities built up a massive surplus of coal, the country’s mainstay fuel, amply supported by a world-beating roll-out of wind and solar power.

There are already indications that authorities are gearing up for a sweltering few days. Last week, the National Development and Reform Commission, the country’s top economic planning agency, took pains to emphasize the electricity grid’s readiness for soaring temperatures.

While the network is in better shape to take on peak summer demand this year, “extreme and continuous high temperatures” can tighten power supplies, said an NDRC spokesperson, who also warned that extreme events like typhoons and floods can amplify threats to the grid.

Rains may bring some relief, although heavy downpours — especially in the southwest, where the ground is already saturated after recent drenching — could threaten inundations. A broad band of precipitation is predicted to move through southwest, north and northeast China this week. In Beijing, cooling, thundery rains are forecast in the first half of the week, although the humidity could make it feel hotter than the thermostat suggests.

For now, there is disagreement between major weather models on how long China’s heat wave will last. Among those keeping a close watch will be coal traders: the benchmark price for thermal coal crept up from multi-year lows last week due to the sweltering conditions.

On the Wire

China’s envoy to Canberra urged Australia not to be “incited” by NATO’s support for US demands to sharply raise defense spending and instead cooperate with Beijing to resolve regional disputes.

Serbia has received assurances from China that it would support speeding up exports of materials critical for electric-vehicle production, benefiting companies like Stellantis NV, which operates a factory in the Balkan country, President Aleksandar Vucic said on Sunday.

President Donald Trump said he has identified a buyer for the US operations of TikTok, the social media app owned by Chinese company ByteDance Ltd., but he won’t provide details for two weeks.

This Week’s Diary

(All times Beijing)

Monday, June 30:

- China official PMIs for June, 09:30

Tuesday, July 1:

- Caixin’s China factory PMI for June, 09:45

- HOLIDAY: Hong Kong

Wednesday, July 2:

- CCTD’s weekly online briefing on Chinese coal, 15:00

- CSIA’s weekly polysilicon price assessment

Thursday, July 3:

- Caixin’s China services & composite PMIs for June, 09:45

- CSIA’s weekly solar wafer price assessment

Friday, July 4:

- China’s weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

©2025 Bloomberg L.P.