China Likely to Ditch Low-Grade Coal From Indonesia Due to Glut

(Bloomberg) -- China is likely to cut imports of the lowest grades of coal as a glut of the fuel makes the trade uneconomic and the government tightens up on carbon emissions.

It’s a move that would weigh most heavily on suppliers in Indonesia. China’s benchmark price of thermal coal has slumped to a four-year low, a product of record domestic production and a binge on imports in recent years. Power demand hasn’t kept up as the economy has slowed, while renewables are shouldering more of the burden of electricity generation.

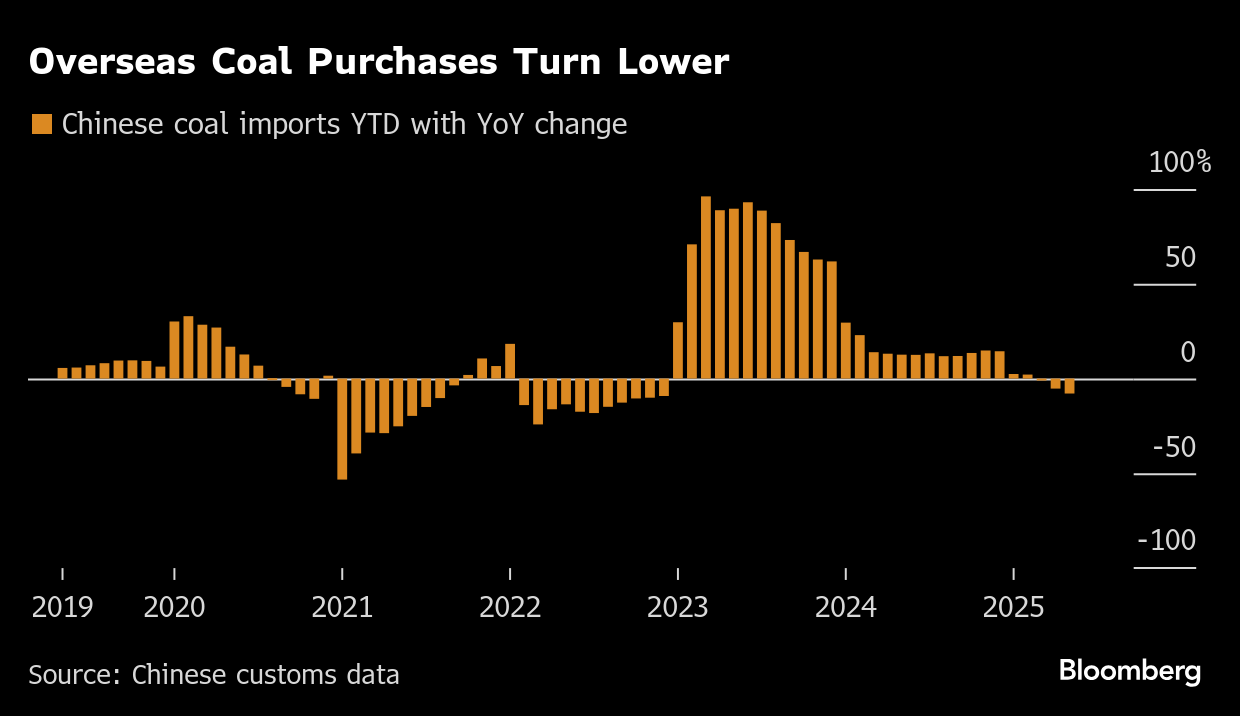

Coal imports fell year-on-year for a third straight month in May, and the decline is likely to accelerate over the rest of 2025, Li Xuegang, an analyst at the China Coal Transportation and Distribution Association, said Wednesday. The government’s “tighter emission controls will slash demand for low-heating and poor-quality grades,” Li told industry representatives at the annual Coaltrans event in Beijing.

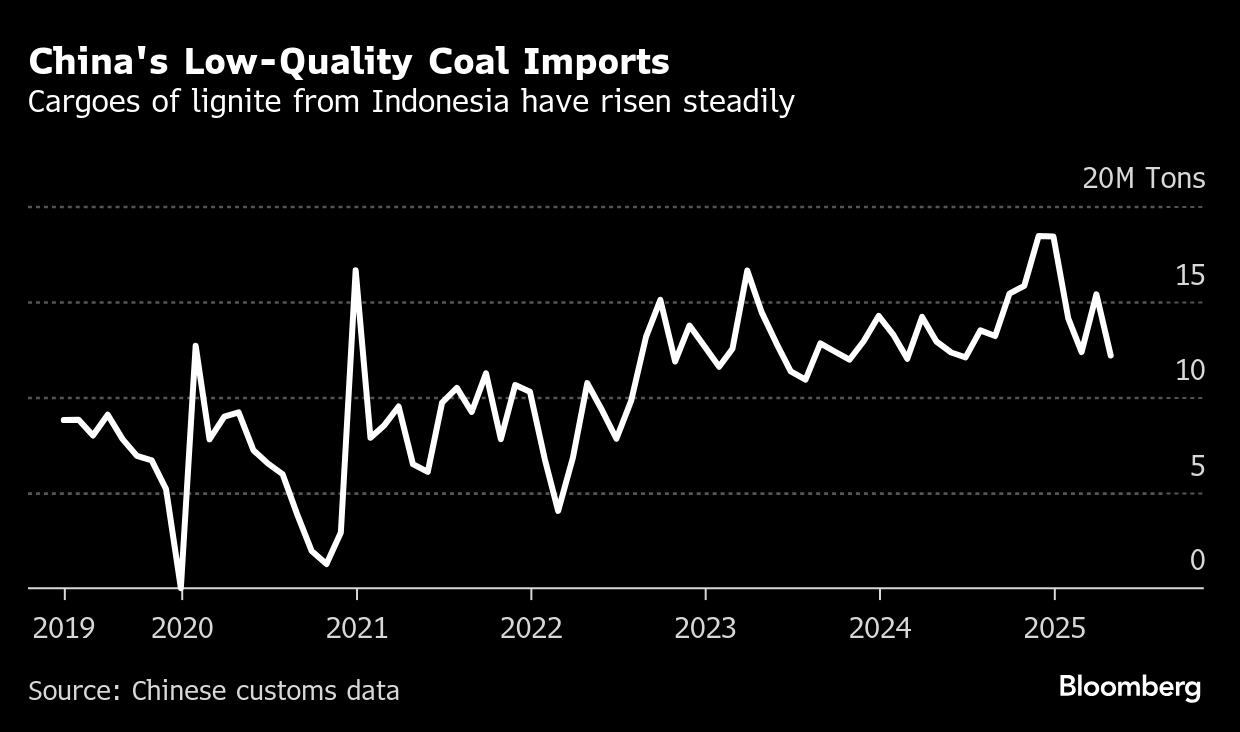

Over the past three years, China has stepped up imports of lignite, or brown coal, from its biggest overseas provider Indonesia, blending the lower calorie and heavily polluting fuel with higher grades for use in power stations. That trade has come unstuck as prices have dropped and utilities are able to source better-quality supplies more cheaply.

The shift away from the worst kind of coal would also represent progress at the margins for the country’s ambitions to reduce emissions to meet its climate goals.

China Huadian Corp., one of the country’s biggest power generators, expects total imports to slide to about 400 million tons this year, from the record 543 million tons purchased in 2024, according to Zhang Aipei, deputy director of production. Purer, high-calorie grades should be enough to fill any seasonal or regional gaps in supply, he told the Coaltrans conference.

Coal demand more generally is holding up, however, putting the government’s pledge to start reducing consumption from next year in doubt. Having endured a spate of economy-crippling blackouts earlier this decade, China has greenlit a massive expansion of coal-fired power capacity to lock-in security of supply.

Moreover, electricity consumption is likely to get a boost from the rollout of data centers, and the expansion of green and high-tech manufacturing, while coal is also finding other outlets for demand from the chemicals sector, according to other speakers at the conference.

Domestic production, which topped 4.7 billion tons last year, is China’s main source of supply. Huadian’s Zhang said he doesn’t expect that to peak until 2027.

On the Wire

President Donald Trump said a trade framework with China has been completed, with Beijing supplying rare earths and magnets “UP FRONT” and the US allowing Chinese students into its colleges and universities.

For months Donald Trump pushed tariffs and trade restrictions on China to unprecedented levels. Beijing turned the tables, essentially shutting down exports of one thing the modern world can’t function without: rare earth magnets.

Beijing has learned it can use its control over critical minerals to secure concessions from the US, according to Bloomberg Economics.

This Week’s Diary

(All times Beijing)

Thursday, June 12:

- China to release May aggregate finance & money supply data by June 15

- SNEC PV+ solar and smart energy conference & exhibition in Shanghai, day 3

- Coaltrans China in Beijing, day 3

- China’s monthly CASDE crop supply-demand report

- CSIA’s weekly solar wafer price assessment

- EARNINGS: Chow Tai Fook

Friday, June 13:

- SNEC PV+ solar and smart energy conference & exhibition in Shanghai, day 4

- China’s weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

©2025 Bloomberg L.P.