Fossil Fuels Set to Fill Europe’s Power Gap as Wind Plunges

(Bloomberg) -- Europe’s fleet of coal and gas plants could come to the rescue as wind power generation is set to slump this summer, driving up both electricity prices and emissions.

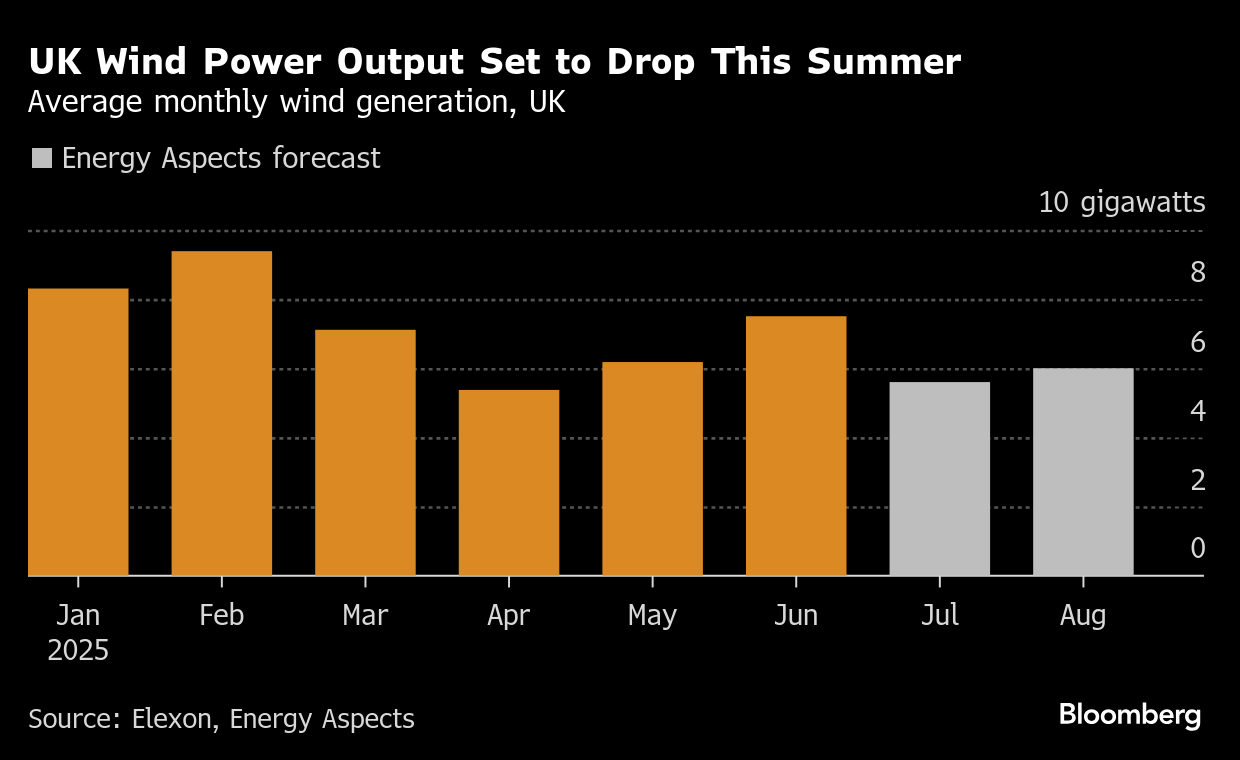

Output from coal plants in major markets including Germany, France and Spain is poised to jump 50% this month compared with June, according to a forecast by BloombergNEF. That’s in response to a 40% plunge in wind power estimated by Energy Aspects Ltd. for July and August.

The likely comeback for the region’s legacy fossil-fuel plants shows just how important they are even after utilities have spent decades and a fortune to expand the renewable energy sector. When solar generation surges during spring and summer months, there isn’t yet an effective way of storing all the electricity that the panels generate. The same holds true for wind.

Over the past few weeks, temperatures have approached 40C (104F) in some places in Germany. During the evening of July 1, hourly electricity prices jumped to €557.34 per megawatt-hour on the EPEX Spot SE exchange in Paris, or almost 9 times higher than the lowest period for that day.

“The longer the wind lull continues amid the scorching heat, the longer fossil fuels will have to fill the evening demand gap in power markets,” said Florence Schmit, energy strategist at Rabobank.

Wind generation surged to a record in June in both Germany and the UK, according to data from the European Energy Exchange. July’s expected slump would be a throwback to last winter and spring when output was much lower than normal and plants burning fossil fuels plants had to boost output to help keep the lights on.

Emissions from European Union power plants this month could jump by 14% compared with in June, according to a BloombergNEF forecast.

German next-month power futures are trading at €80.94 per megawatt hour, about a third higher than in April when cooling demand had not yet ramped up in Europe.

©2025 Bloomberg L.P.