Taiwan Expected to Hold Key Rate as Economy Roars on AI Frenzy

(Bloomberg) -- Taiwan will likely hold its policy rate for the seventh straight quarter — the longest stretch since 2021 — as the economy booms on global demand from AI developers for its tech products.

All 32 of the economists surveyed by Bloomberg News expect the archipelago’s central bank to leave the benchmark rate unchanged at 2% at its quarterly meeting on Thursday.

Underscoring the outlook for Taiwan’s growth, the median estimate for the next cut is the end of 2027, versus an earlier survey that foresaw easing starting in the first quarter of next year.

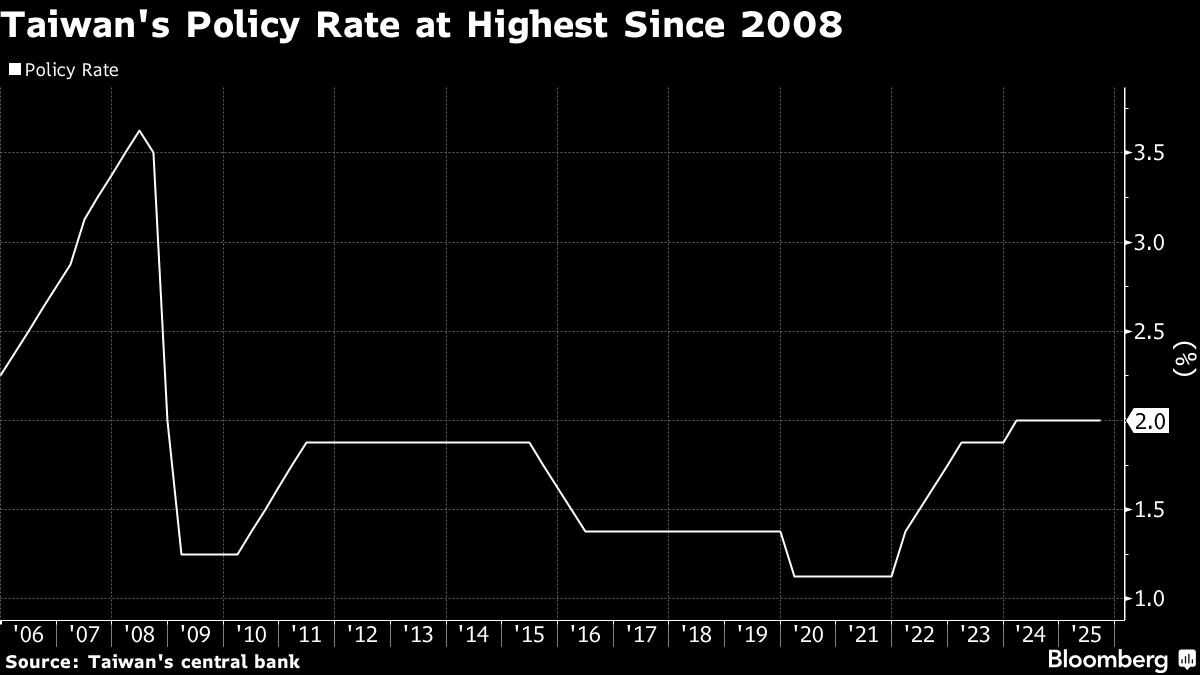

The monetary authority has room to keep the rate at the highest since 2008 because the economy is on pace to be one of the world’s top performers this year. In November, the statistics bureau upgraded its 2025 GDP call to 7.37% — in line for the fastest since 2010.

The self-ruled democracy’s exports surged a whopping 56% in November from a year earlier. Shipments of semiconductors and other electronics jumped some 84%.

And in a sign that momentum for AI infrastructure buildouts is intact, defying bubble concerns, last week Taiwan Semiconductor Manufacturing Co. said monthly revenue rose 24.5%.

“Taiwan is one of the biggest winners of the AI boom in 2025, and the momentum will continue to be driven by US-centric supply chains and investment,” said Gary Ng, senior economist at Natixis SA in Hong Kong. “The key question is whether export-driven growth can be transformed into consumption.”

The central bank has room to ease given inflation came in at 1.23% in November, well under its 2% preferred threshold. It also has reason for concern about the consumer sector.

A key measure of consumer confidence is hovering at the lowest level in a year, according to the Research Center for Taiwan Economic Development, a non-governmental organization.

And Hyosung Kwon, Korea and Taiwan economist for Bloomberg Economics, wrote that household consumption is projected to grow just 1.1% this year, trailing economic growth.

Kwon also warned that economic expansion is likely set to slow going forward, pointing to risks from US tariffs, a high base and weak spending by households.

By holding its benchmark rate again, Taiwan’s central bank is saving its powder should talks with the US to lower a 20% tariff rate stall. Earlier this month, Commerce Secretary Howard Lutnick said that the US expected a large investment pledge from Taiwan in the negotiations but President Lai Ching-te listed several areas that need improvement for projects to be completed.

Lai pointed to US government help in areas like land acquisition, water and electricity supply, and talent development.

©2025 Bloomberg L.P.