Oil’s Middle Eastern Benchmark Grade Flashes Signs of Oversupply

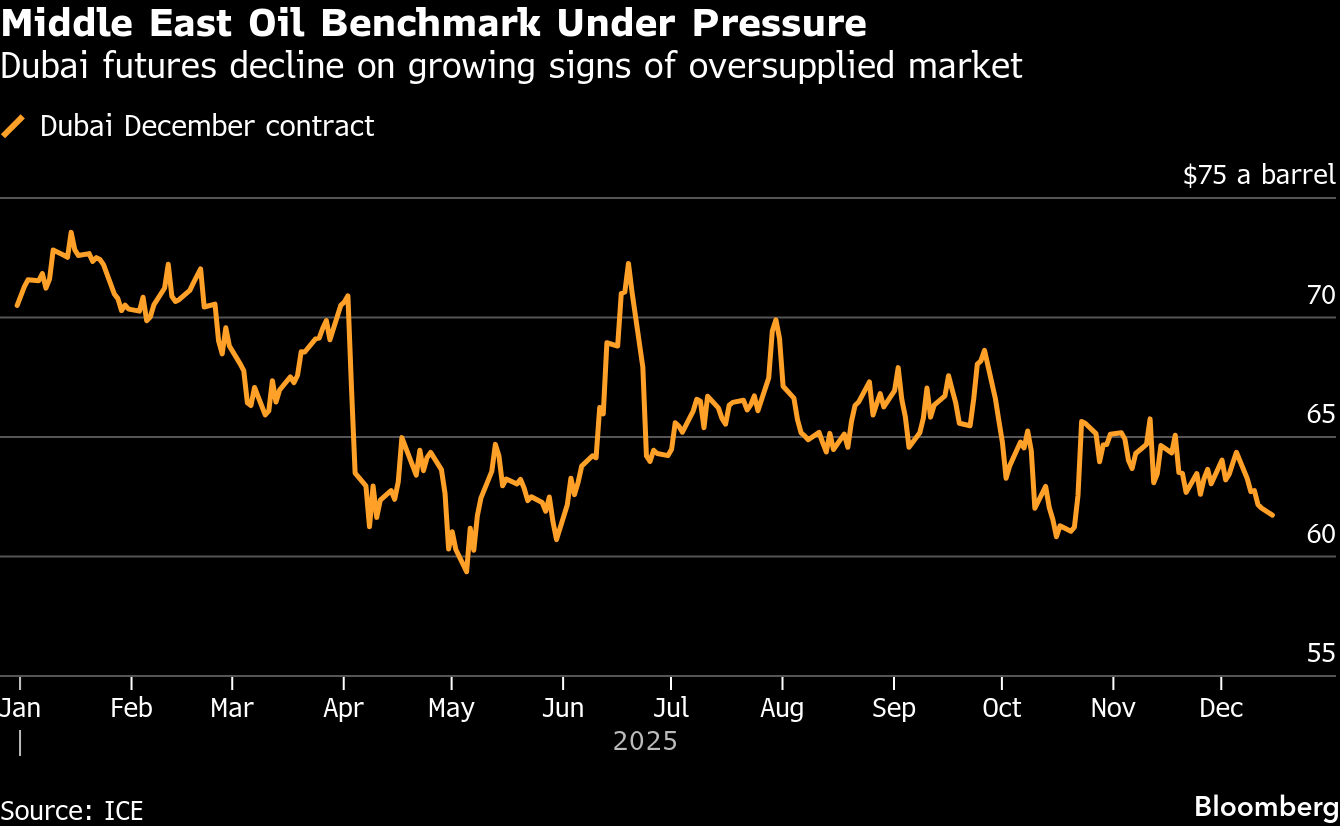

(Bloomberg) -- The Middle East’s Dubai oil benchmark is showing signs of worsening oversupply, adding to a slew of indicators pointing to a global glut.

The forward curve for Dubai crude — a grade Asian traders and refiners price transactions against — is fast weakening. The spread between January and February contracts briefly turned negative on Tuesday morning, with one January-February lot changing hands at minus $2 a barrel, according to traders and brokers familiar with the matter. That’s a bearish pattern known as contango.

The global oil market is beset by concerns that there’s a worldwide surplus after drillers including OPEC+ stepped up production. That’s dragged futures prices lower in key pricing centers, with Brent contracts nearing a return to the $50s a barrel. Among leading forecasters, the International Energy Agency has predicted that there’ll be a substantial glut in 2026.

For the Dubai market, the brief trade that indicated February as pricier than January highlights plentiful near-term supply of Middle Eastern barrels compared with later-loading dates. Dubai derivatives are largely traded in an over-the-counter market, rather than on futures exchanges.

Timespreads for Dubai oil derivatives on the Intercontinental Exchange, although less heavily traded than OTC products in Asia, also show weakness. The spread between ICE Dubai for January and February was as much as 2 cents a barrel in contango on Tuesday. That’s the weakest in more than a year.

The broader forward curve is also showing softness, with the gap between consecutive months beyond February at parity or slightly negative. That’s apparent in both the OTC market, according to brokers and traders, as well as futures.

Globally, signs of oversupply are building. Physical markets in the US are flashing similar warnings, with some key domestic indicators in contango. Elsewhere, volumes in floating storage has also been growing, with oil loaded onto ships that haven’t moved in at least seven days near the highest since the Covid-19 pandemic, according to Vortexa Ltd.

©2025 Bloomberg L.P.