UK’s Two Biggest Energy Suppliers Escalate Spat in CEO Turf War

(Bloomberg) -- A dispute between Britain’s two biggest energy suppliers escalated after Octopus Energy said it would report its rival Centrica Plc to the country’s advertising watchdog.

An Octopus ad was banned earlier this week by the Advertising Standards Authority for misleading consumers about the cost of installing heat pumps. In response, an Octopus spokesperson said it would report Centrica’s British Gas to the regulator for allegedly making similar claims, accusing “fossil fuel lobbyists” of making the complaint against it. A Centrica spokesperson declined to comment.

It’s the latest in an increasingly bitter spat between the two suppliers as they battle for top spot in the UK household energy market. Last week, Centrica Chief Executive Officer Chris O’Shea called for Octopus to be banned from taking on new customers after it failed to meet financial resilience targets — a request that Octopus described as “naked self-interest.”

The falling-out is also part of a growing trend of executives lashing out at rivals. Since Elon Musk’s public disagreement with US President Donald Trump, tensions have risen between OpenAI Inc. CEO Sam Altman and Meta Platforms Inc.’s Mark Zuckerberg over poaching staff. Meanwhile, Nvidia Corp. CEO Jensen Huang hit out at Anthropic co-founder Dario Amodei over his gloomy predictions about artificial intelligence’s impact on white-collar jobs.

The CEOs of Centrica and Octopus — O’Shea and Greg Jackson — have butted heads on almost every aspect of UK energy policy, not least a controversial government plan that’s now been dropped to divide the nation’s electricity market into zones.

Octopus’ Jackson, a member of the government’s Industrial Strategy Advisory Council, had campaigned vigorously for months and the company was including messages in its customer bills to convince them of the benefits. Meanwhile, O’Shea criticized the policy, saying it risked higher prices for consumers in regions with fewer sources of renewable energy.

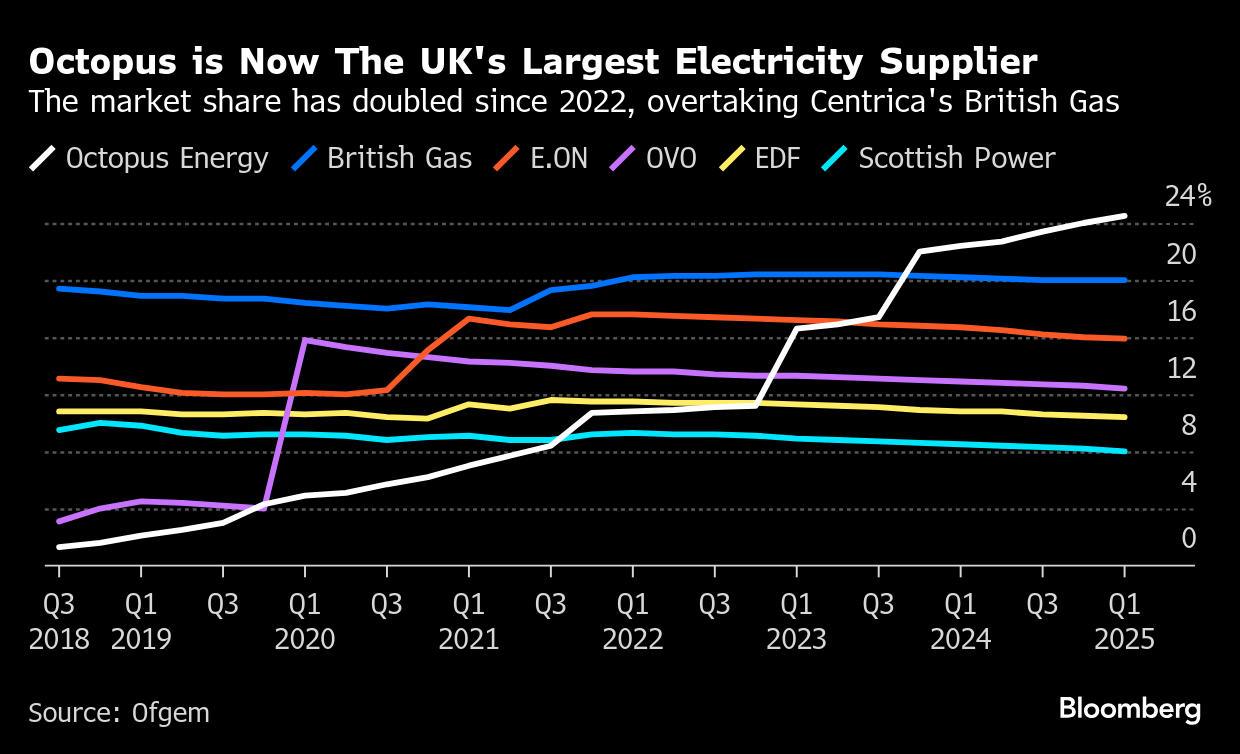

Last year, the tensions were heightened when Octopus overtook British Gas, the former state-owned monopoly, as the biggest domestic supplier of electricity after it took on customers of failed rival Bulb Ltd. during the energy crisis.

“The most striking thing about these conversations is that they are more like political-speak than business-speak,” said Randall Peterson, a professor at London Business School. Both companies are attacking each other in part to win consumers’ business, he said.

The UK’s main suppliers acknowledge that the shift to greener energy will protect the country from volatile international gas markets, but differ on the way to achieve that goal, said Simon Cran-McGreehin, head of analysis at the Energy and Climate Intelligence Unit think-tank.

Octopus is a renewable energy supporter pushing heat pumps, while Centrica has advocated for the role of natural gas in decarbonizing the grid, focusing on energy security. “We should expect to see ongoing debates as they jostle for position in the clean power race,” Cran-McGreehin said.

©2025 Bloomberg L.P.