Climate Claims Group Issues New Guidance for Carbon Credits

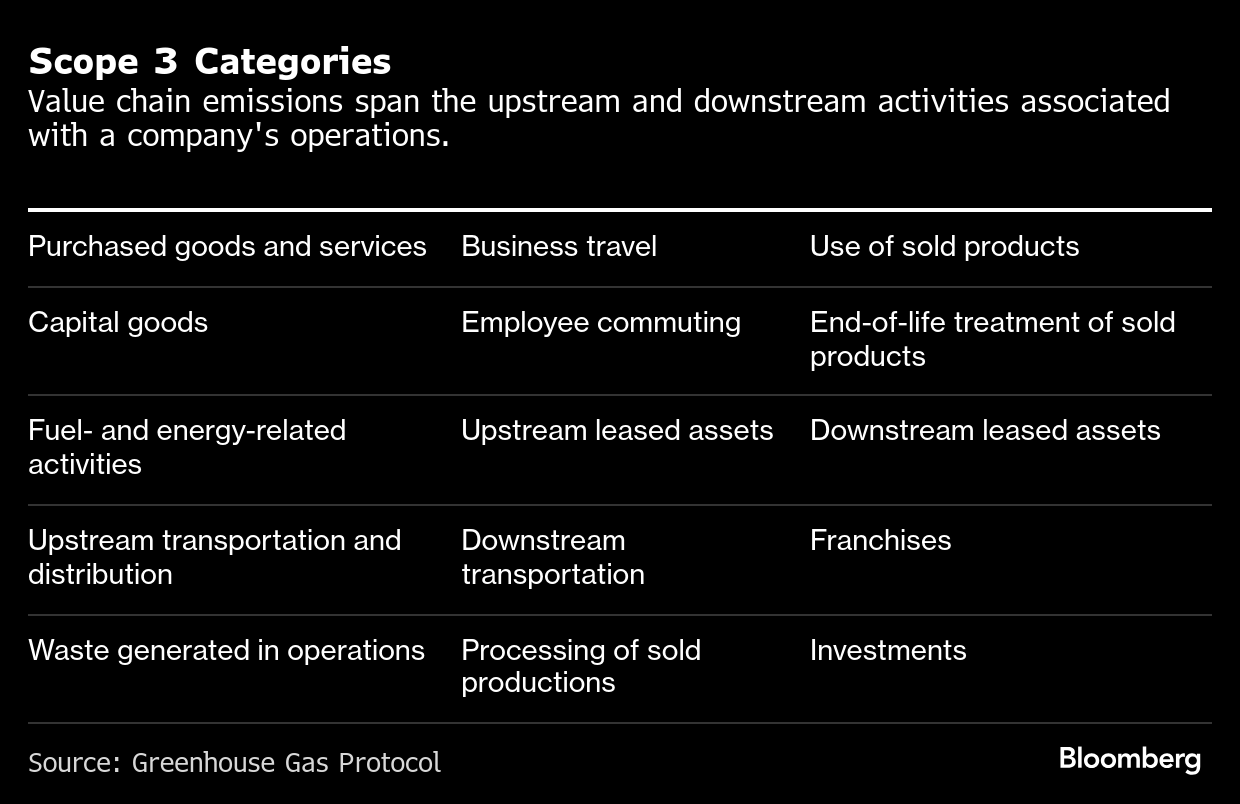

(Bloomberg) -- Companies focused on taking climate action can now voluntarily use carbon credits through 2040 to address the greenhouse gas emissions from their value chains.

That’s according to fresh guidance from the Voluntary Carbon Markets Integrity Initiative, a nonprofit founded in 2021 with backing from Alphabet Inc.’s Google, Children’s Investment Fund Foundation and Bezos Earth Fund to help advise companies on the kind of green claims they can credibly make based on their use of carbon credits.

“Addressing Scope 3 emissions is one of the most pressing challenges in corporate climate action, yet many businesses lack the tools and frameworks to act effectively,” Mark Kenber, executive director of VCMI, said in a statement. VCMI’s latest directions provide a “practical” solution for companies to “close the gap between ambition and action,” he said.

The guidance from VCMI emerges as companies globally walk back their climate commitments. Some, including HSBC Holdings Plc, have cited restrictive guidance on the use of carbon credits as a reason to delay their emissions-cutting targets. Others are failing to meet targets they have set.

VCMI estimates there’s a 1.4-gigatons gap between what companies have committed to in terms of Scope 3 emissions cuts, and what they’re currently achieving. That’s equivalent to the annual emissions of Germany, the UK and Italy combined and is estimated to grow five-fold by 2030, according to VCMI.

VCMI’s new ground rules say companies must first establish the gap between their value-chain emissions and their target; disclose the barriers they’re facing to cut those emissions; and list measures implemented to overcome those. They can then purchase carbon credits to address that gap until 2040 when they are expected to be back on a clear pathway to net zero.

In addition to the new guidance, VCMI also removed a requirement for companies to have a public commitment to reach net zero emissions by 2050 for their climate strategy to be seen as robust, a spokesperson for the group said. Companies can instead set near-term targets as long as they’re validated by a third party.

Kerry McCarthy, the UK’s minister for climate, welcomed VCMI’s guidance. The British government sees “a clear and appropriate role for the responsible voluntary use of high-integrity carbon credits and welcomes the ambition set out” by VCMI, McCarthy said in a statement. “Now is the time to embrace this approach, unlock momentum, and ensure companies deliver the speed and scale of global climate action required.”

Not everyone backs VCMI’s new approach. It risks “dialing back the already insufficient levels of corporate climate ambition” and may ultimately mislead investors, consumers and regulators, said Thomas Day, a carbon market analyst at the NewClimate Institute. That’s because it allows “companies with ambitious-sounding emission reduction targets to actually continue increasing their emissions in the short-term,” he said.

A group of nonprofits, including the Environmental Coalition on Standards and Carbon Market Watch, said VCMI’s new approach “has no basis in science” and “could disadvantage frontrunners and be used by others to mask climate inaction.”

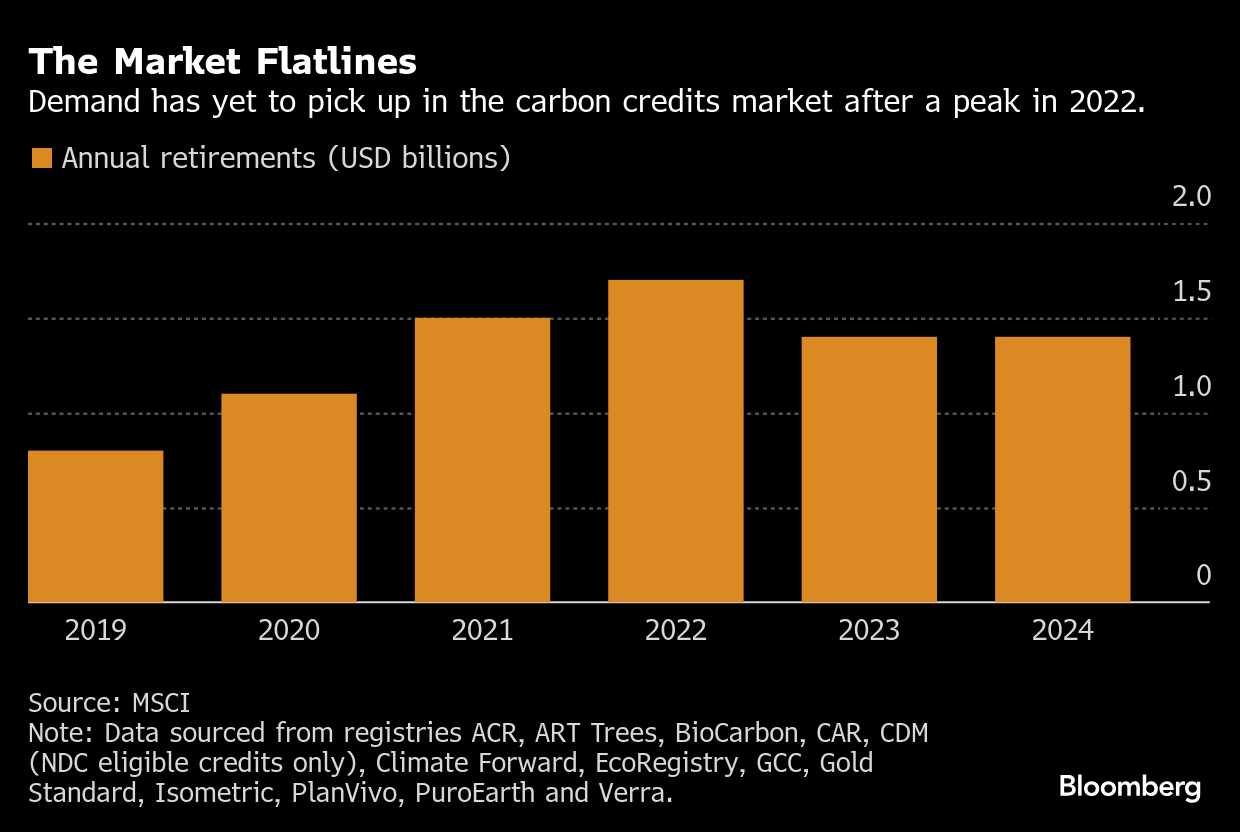

Rachel Kyte, former co-chair of the VCMI, has previously estimated that bolstering corporate “confidence” in how to use carbon credits may help grow the market to $50 billion by 2030.

The use of carbon credits to tackle value-chain emissions is a highly contentious topic. Skeptics point to the fact that it’s proved difficult to reliably measure the climate impact of projects underpinning carbon credits, and worry that buying inexpensive offsets deters companies from investing in technologies to curb their own emissions.

The Science Based Targets initiative, the leading global standard setter for corporate climate targets, has historically restricted companies from adopting the practice.

Market proponents, including VCMI, have berated SBTi’s position for stymieing corporate climate action and efforts to get more funds to developing countries, where most carbon credit projects are based.

(Adds more detail about VCMI’s guidance in seventh paragrap and comment from nonprofit groups in 10th.)

©2025 Bloomberg L.P.