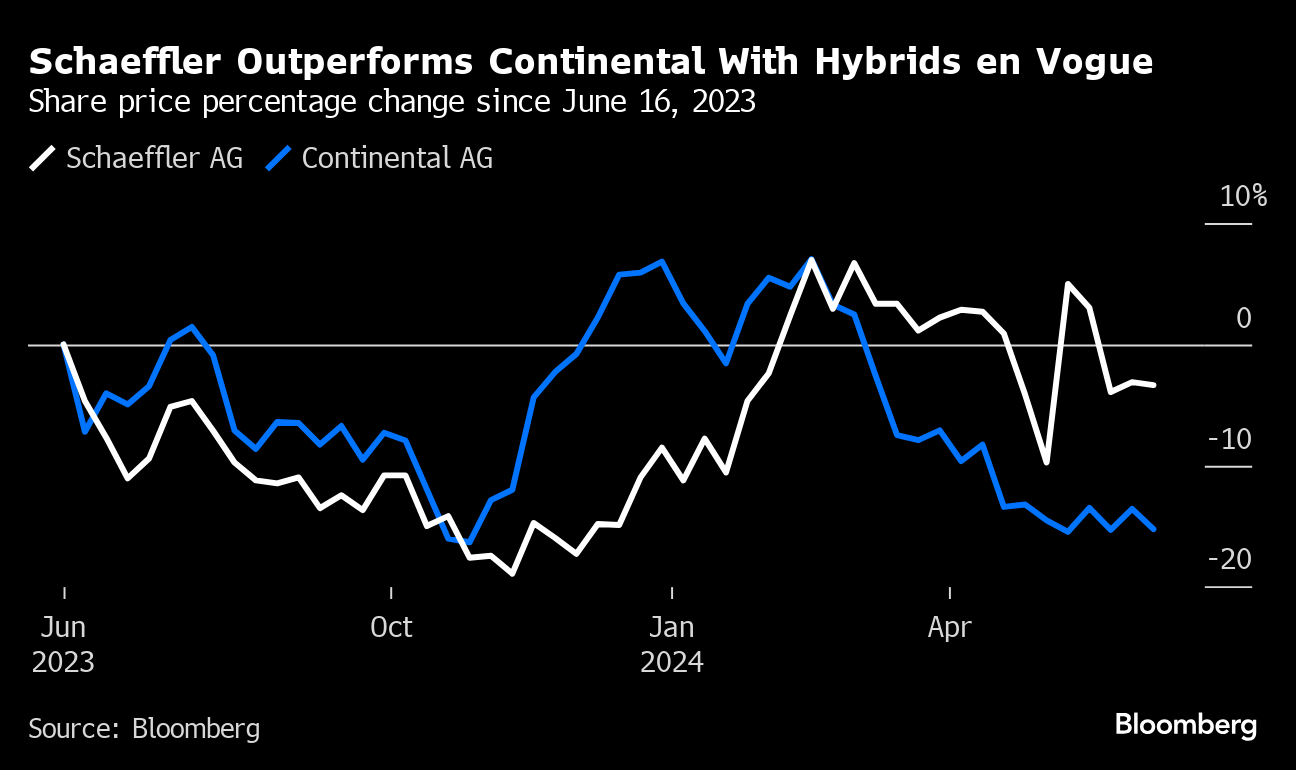

Schaeffler Boosted by Hybrid Car Demand in China and Europe

(Bloomberg) -- Schaeffler AG is seeing greater demand for parts used in hybrid cars, a welcome boost for the German parts maker attempting to shift its business toward battery technology.

The ball-bearings maker, with a long history in components for combustion engines and transmissions, is picking up more business for hybrid car parts in China and parts of Europe, said Matthias Zink, who heads Schaeffler’s automotive business. In the US, customers have been doubling orders related to some smaller-volume contracts.

Demand for electric-vehicle products, on the other hand, is “flattening, especially in Europe and Germany,” Zink said in an interview. Schaeffler supplies major carmakers including Volkswagen, General Motors, Ford and Stellantis.

The pickup in hybrid technology is giving the German supplier some breathing room as VW and General Motors Co. tweak strategies to cope with volatile EV demand. Schaeffler and its peers are under pressure from clients to make cheaper products as sales for battery-powered cars wane in Europe.

Stellantis NV is considering dropping some suppliers and producing components on its own to reduce costs, while also adjusting battery investments. Continental is struggling to improve profitability of its automotive business as it cuts thousands of jobs and considers asset sales. At the same time, Chinese brands expand in the region, with BYD Co. planning to offer its electric Seagull hatchback next year below €20,000 ($21,500).

Schaeffler’s billionaire owner family — which also controls parts maker Vitesco Technologies Group AG and is the dominant shareholder in Continental AG — has been reshaping its industrial empire to keep pace with the EV shift.

Herzogenaurach-based Schaeffler makes combustion-engine components and systems for transmissions that aren’t needed needed in electric cars. It’s merging with Vitesco to bolster its position on EVs, in a deal expected to close in the fourth quarter.

Pressure to lower the cost of EV components is rising even as batteries remain the most expensive part of an electric car, Zink said.

Combining with Vitesco will allow Schaeffler to drive down costs for EV components more effectively, the executive said. Potential levers include reducing material input, benefiting from the high level of vertical integration and developing electric motors that can be shared among different platforms.

“Many potential EV buyers want affordable cars — therefore, we cannot supply car manufacturers with expensive components,” Zink said.

©2024 Bloomberg L.P.