A Stock Trader’s Guide to Navigating the EU Parliament Election

(Bloomberg) -- An anticipated boost for populist parties in next week’s European Parliament election is threatening to shake up the bloc’s climate ambitions and policy priorities, with shares in renewable energy, carmakers and industrial firms likely to feel the impact.

The June 6-9 election is expected to see Europe’s 370 million voters tilt further to the right, largely at the expense of Green groups. That would potentially bring in an assembly that opposes, above all, the EU’s plans to green its economy, but could also make it trickier to find consensus on industry, farm policies and foreign trade.

“If there’s indeed a shift to the right in Parliament, then trends such as curbing immigration and implementing protectionist barriers will grow further,” said Vincent Juvyns, global market strategist at JPMorgan Asset Management. “Big exporters are likely to suffer most, given the likely backlash from trading partners.”

Smaller companies focused on the European market could end up benefiting from a renewed focus on re-industrialization, Juvyns expects.

Here are the stocks and sectors which could be most impacted by the election:

Green Pressure

Adopted in 2019, Europe’s Green Deal aims to reach net zero emissions by mid-century but parts of the plan are in trouble as voters become wary of laws that could exacerbate price pressures. Farmers’ protests have erupted, climate-skeptic far right groups have latch on to the issue, and even mainstream candidates have moved their rhetoric toward protecting domestic industries and households.

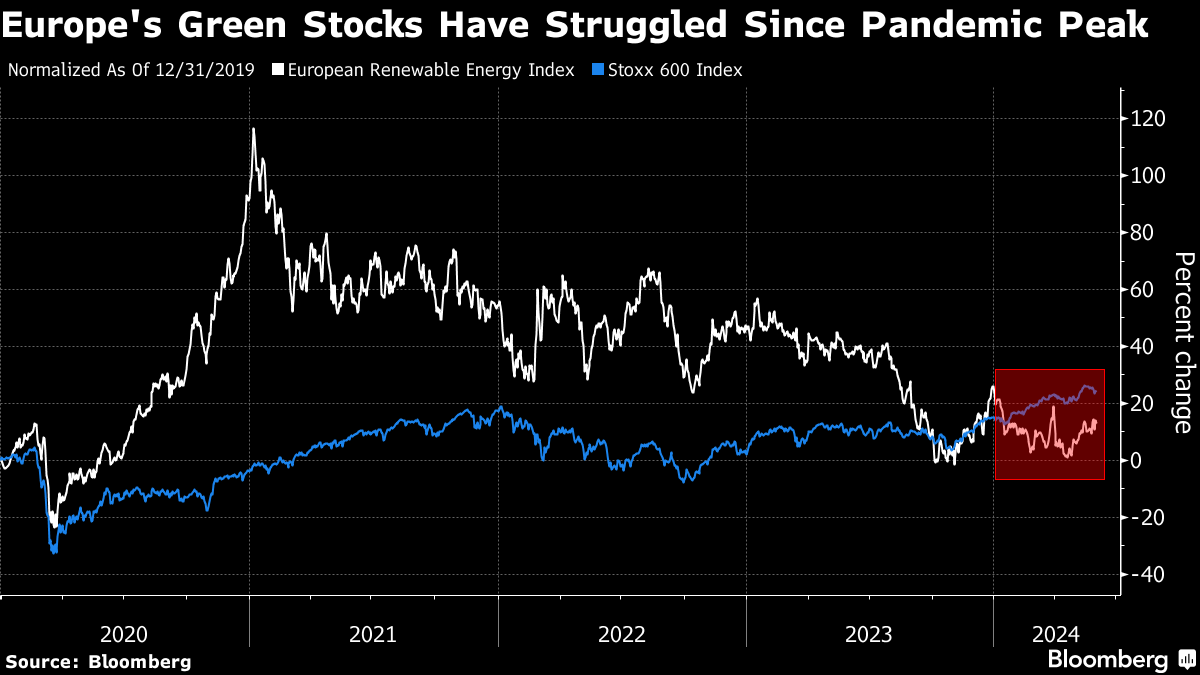

All that puts green stocks at risk of watered-down legislation. The sector has already been dented by high interest rates, with renewable energy index down 11% this year, versus an 8.3% gain for Europe’s Stoxx equity benchmark.

Jean-Baptiste Rouphael, ESG analyst at Oddo, notes the EU parliament has yet to pass three flagship bills — an emissions target, a greenwashing directive and a law governing the restoration of nature. These “could be threatened if the rise in the far right is confirmed at the elections,” he said.

However, Rouphael said the election will lead to a “less divisive green deal” that’s more focused on industry.

Morgan Stanley analyst Michael Canfield highlights concerns amongst many parties that the green transition risks making Europe less competitive. Post-election, this could possibly lead to dilution of corporate disclosure rules, pesticide curbs and mandatory energy efficiency standards for the property sector.

Focus is also on utilities, as Europe seeks to diversify gas imports away from Russia. With energy security overshadowing climate policies, “there is a risk of decline in renewable energy investment programmes,” Oddo strategists said in a note.

However, they expect more investment in electricity transmission infrastructure, potentially benefiting firms such as Engie SA, Iberdrola SA and RWE AG.

EV Bust

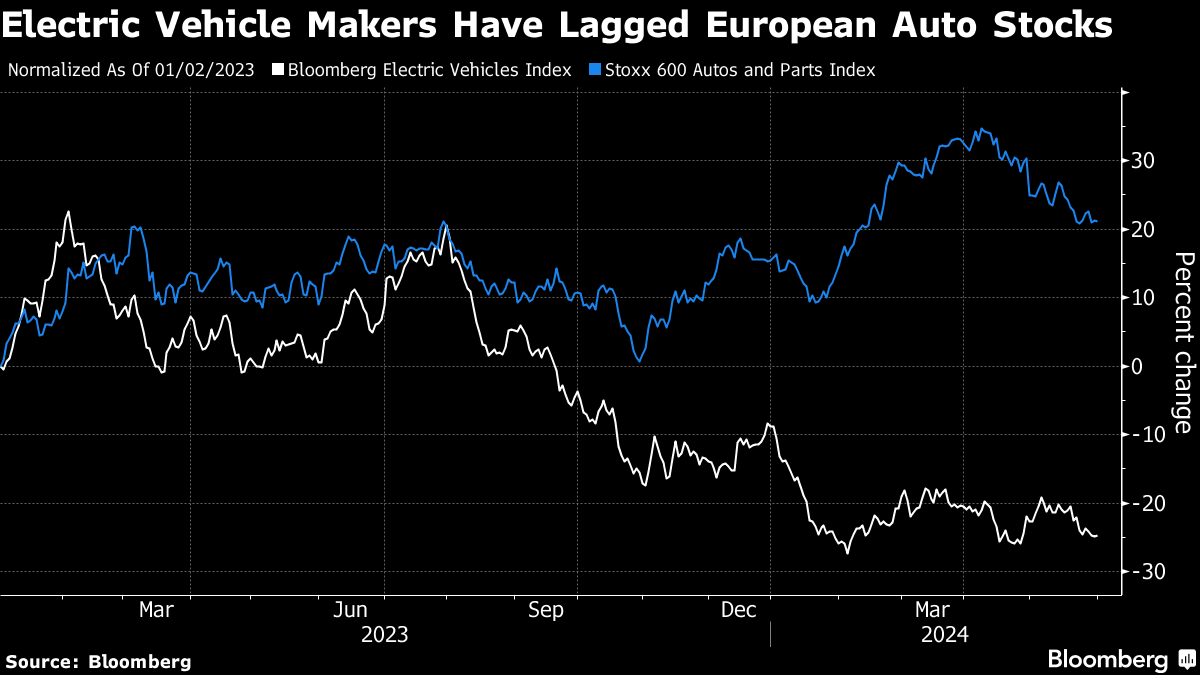

The Green Deal includes a de facto ban on combustion engine vehicles from 2035. But the road to an all-electric future is proving trickier to navigate as drivers balk at pricey EVs, and carmakers such as Volkswagen AG and Porsche AG push regulators to delay emissions targets that kick in next year.

With the Green Party expected to lose a third of its seats, UBS strategist Felix Huefner sees the possibility of vetoes to some climate laws, impacting measures such as stricter carbon emissions for new cars.

European car manufacturers, which have invested billions in electrification, are feeling the strain from cooling EV demand. Any relief on penalties for not meeting emissions targets could be viewed as a positive, so keep an eye on Germany’s Volkswagen, as well as peers including France’s Renault SA and Sweden’s Volvo Car AB.

Citi analyst Harald Hendrikse sees a 25% to 30% chance of CO2 legislation being deferred, reducing the risk of penalties for the auto industry. With other regions such as the US deferring their auto CO2 goals, “any change in European politics could impact the outcome of such discussions,” Hendrikse added.

Defense Ramp-Up

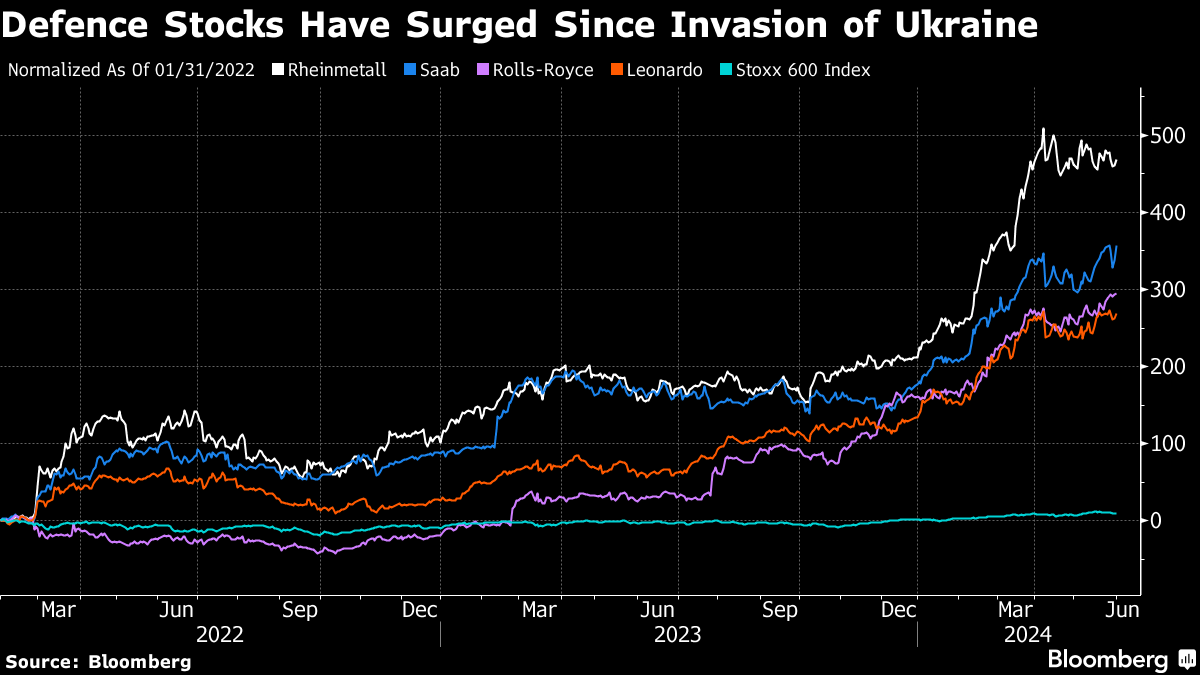

Plans for greater military spending to counter Russian belligerance have spurred huge rallies in the shares of defense companies such as Rheinmetall AG, Saab AB and Rolls-Royce Holdings Plc. With French President Emmanuel Macron urging a “buy European” strategy in defense and space, there could be more gains ahead.

The risk is of opposition from the far right, where there are pockets of sympathy for Russian leader Vladimir Putin.

“Assuming Europe does not elect a high proportion of China/Russia leaning populists, we expect the cross-party support for increased defense spending to continue,” Citi analyst Charles Armitage says.

If Europe decides to up military spending to 2.5% of GDP at the July Nato summit, equity fair values would rise by 15-20%, Armitage estimates.

Financial Unity

Europe’s banking stocks have been on a tear this year, thanks to robust profits and an M&A resurgence. Investors hope EU lawmakers will now prioritize policies for completing a banking union.

Mooted as a way to protect taxpayers when lenders collapse, the union will become reality only with the creation of a common deposit insurance scheme, something that’s been resisted by Germany. The lack of a banking union makes it harder for lenders to move funds from one EU country to another, complicating dealmaking and putting European banks at a disadvantage against US rivals.

Recently though, an EU Parliament body voted to create a deposit insurance fund, building momentum for a full-fledged insurance scheme. And politicians may be softening their stance on financial integration — Macron signaled he is open to a French bank being taken over by an EU rival, while German Chancellor Olaf Scholz said banks should be able to move capital freely throughout the bloc.

Chips Win

Makers of chip and chip equipment look set to benefit, whatever the outcome, given that the EU’s €43 billion Chips Act — an initiative to boost domestic production — is pretty much consensual across the bloc. On Friday, STMicroelectronics NV announced plans for a €5 billion chip plant in Italy, a project partly funded by the act.

“We do not see any scenario in which the ambition in semiconductors could be called into question,” Oddo analysts wrote.

©2024 Bloomberg L.P.