Traders Scour Fuel Markets for Profits as Crude Prices Drift Sideways

(Bloomberg) -- Trading activity in fuels is surging the most in years as a listless crude market pushes investors to seek money-making opportunities in more niche products.

While crude has drifted in a $10 band this year, fuel markets have been roiled by attacks in the Red Sea, refinery outages and heavy maintenance, a deep freeze in the US and Ukrainian drone attacks on Russian refineries. The end result is one of the most active trading periods for refined products in several years.

“Traders are betting on product differentials performing as an expression of their view, rather than outright crude prices,” said Greg Newman, chief executive officer of Onyx Capital Group. “Summer products have performed consistently over the last few years, so are being seen as a safe bet.”

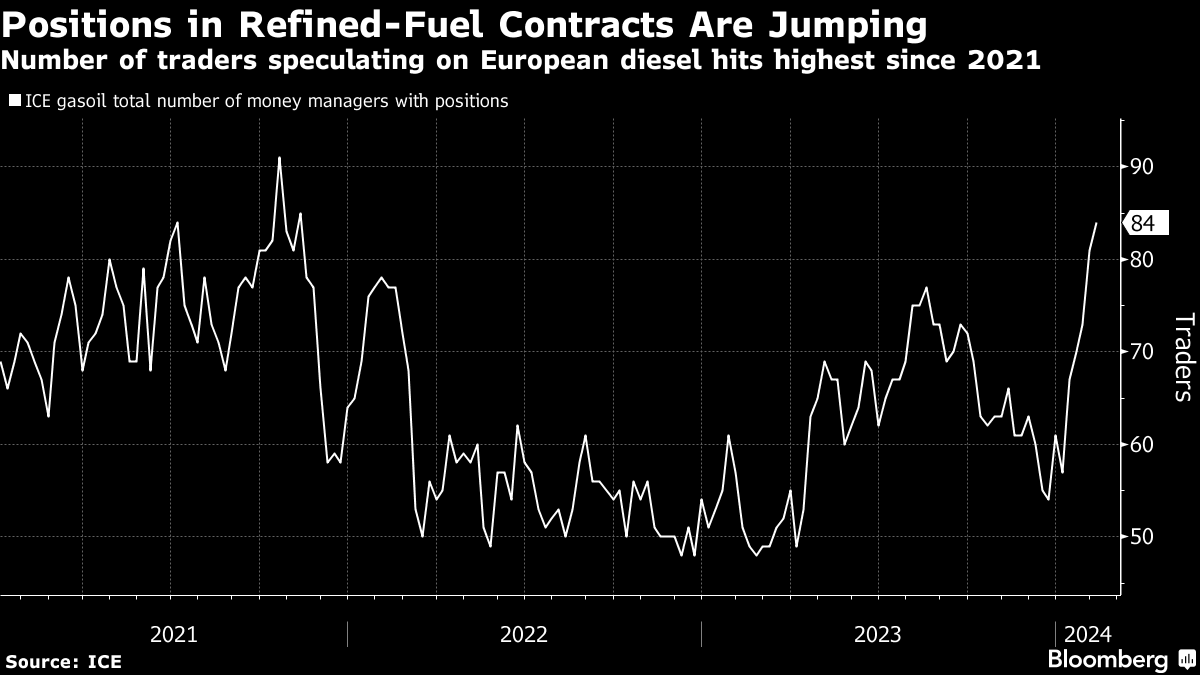

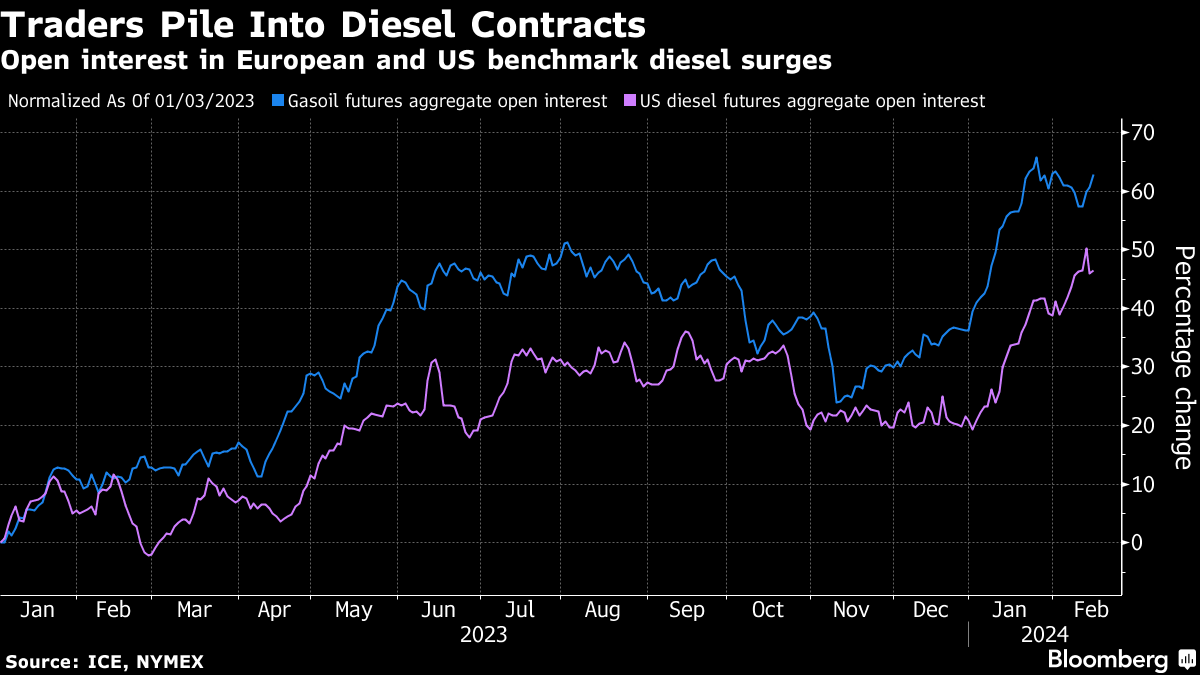

The number of money managers holding positions in Europe’s benchmark diesel contract rose to the most since 2021 last week, and the US diesel contract also achieved a similar milestone.

Trading activity is booming as well, with the surge showing up in the three most active fuels contracts: CME Group Inc.’s gasoline and heating oil futures, as well as Intercontinental Exchange Inc.’s gasoil futures. ICE says gasoil volumes are up almost 40% from a year earlier, while CME says average heating oil volumes have risen more than 20% and gasoline activity is also higher.

The bonanza is also spreading into some of the oil market’s most esoteric corners.

For example, the difference between diesel prices in Europe and Asia — a measure known as the east-west spread, which is traded on ICE — saw huge swings and traded a record volume in January. The activity was driven by refinery disruptions in Europe as well as the surging cost of freight as ships sailed thousands of miles around Africa to avoid attacks by Yemen’s Houthi rebels in the Red Sea.

Of ICE’s 10 most-actively traded fuel-swaps contracts, six had volumes that averaged multiyear highs in January, data compiled by Bloomberg show.

Other drivers have been more seasonal. A deep freeze in the US last month affected both refinery capacity and fuel demand, causing an outsized impact on refined-products markets even as crude remained relatively unmoved. CME’s Mont Belvieu propane contract — a heating fuel for which demand usually surges over winter — saw record trading volumes in January.

“Geopolitical events during the winter heating season have added new supply risks, driving a spike in trading with strong participation from commercials as market participants manage these risks in our markets,” said Peter Keavey, global head of energy at CME.

The activity comes against a wider backdrop of generally robust fuel demand, with the recovery from the coronavirus pandemic all but complete. Europe and the US are also still adjusting to the loss of supplies from Russia in the aftermath of Moscow’s invasion of Ukraine, further tightening supplies.

Reliance Industries Ltd., a major Indian refiner, said last month that consumption of both jet fuel and gasoline have been robust and that aggregate demand was looking strong in both Asia and the Americas. In the US, Marathon Petroleum Corp., the biggest US crude refiner by market value, expects record global consumption in 2024. Valero Energy Corp., the nation’s second-largest fuelmaker, sees a strong outlook for gasoline and diesel usage.

“We have active markets for managing exposure to all of the shifts in flows stemming from geopolitical conflicts and resulting disruptions,” said Jeff Barbuto, global head of oil markets at ICE. “We’ve worked with our customers for years to develop derivatives markets to manage their oil risk anywhere in the world, and this has been especially clear in our refined-products markets.”

Market participants expect rising activity in fuels to keep driving the energy complex for the next few months as even products with similar uses are showing wildly different returns. For example, US natural gas has plunged 36% this year while heating oil is up almost 9%.

“What we see overall in the energy sector is massive return dispersion,” Benjamin Hoff, Societe Generale SA’s global head of commodity research, said in an interview. “That’s really where the opportunity lies and probably will coming into the summer.”

©2024 Bloomberg L.P.