GQG’s Adani Investment Reaches $10 Billion as Stocks Rebound

(Bloomberg) --

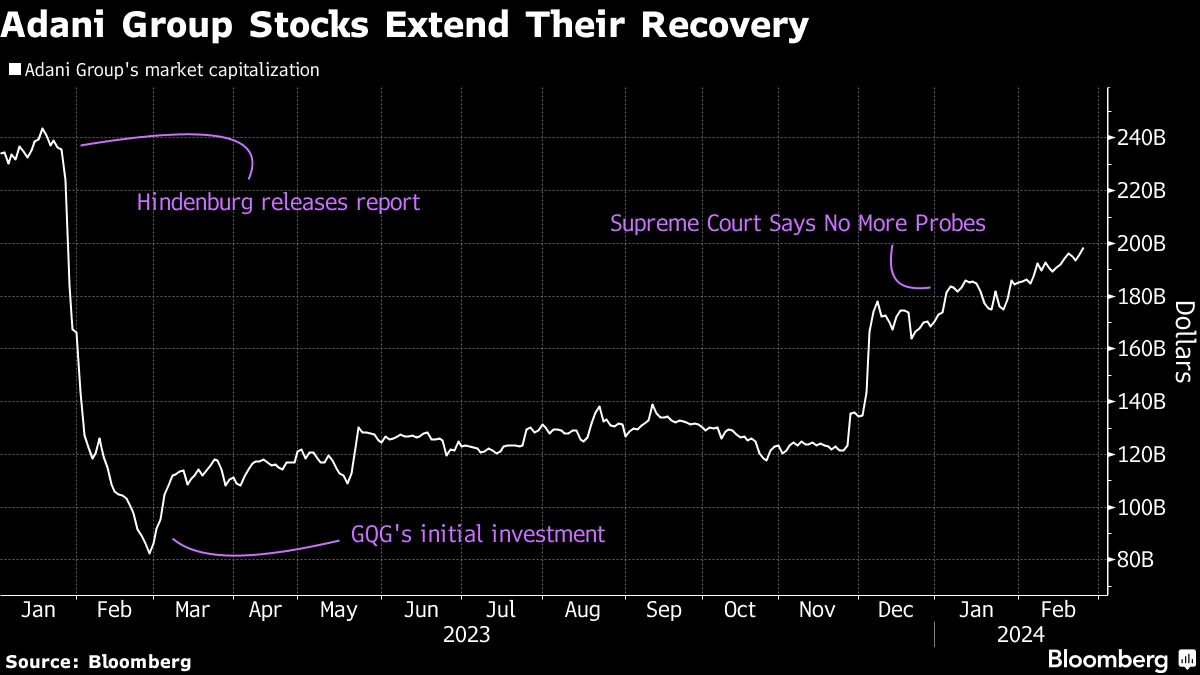

The total value of GQG Partners LLC’s stake in Adani Group companies has grown about fivefold, as the stocks extend their recovery from short-seller Hindenburg Research’s scathing report.

The firm’s initial investment of $1.9 billion in March has ballooned to $10 billion in value, helped by market gains and additional stakes, according to fund manager Sudarshan Murthy. This marks a big win for the contrarian bet by veteran Rajiv Jain’s firm after Hindenburg accused the Adani Group of stock-price manipulation and accounting fraud — charges that the conglomerate has repeatedly denied.

The Gautam Adani-led group has recovered more than two-thirds of the market capitalization that it lost following the report, after it wooed investors and bankers. India’s top court has also rejected a high-level probe into Hindenburg’s allegations. Shares of flagship firm Adani Enterprises Ltd. have more than doubled since a trough last February, and are less than 5% away from levels seen before the report.

The GQG Partners Emerging Markets Equity Fund has about $2.23 billion invested in seven Adani companies, of which $1.06 billion is in Adani’s energy and utility companies.

“Adani Power is the country’s largest private thermal power producer,” and may double its capacity through 2029, Murthy said. Meanwhile, Adani Green Energy Ltd. has secured land “that gives them a clear runway where they can build in the next five years,” he added.

(Adds performance of Adani Enterprises in third paragraph.)

©2024 Bloomberg L.P.