Tesla’s Shrinking China Market Share Compounds Global Woes

(Bloomberg) -- The global slowdown in electric vehicle demand that contributed to Tesla Inc.’s biggest-ever quarterly sales miss is hurting Elon Musk’s standing in China, the world’s biggest automotive market.

Confronted with unprecedented local competition and weakened consumer sentiment in Asia’s largest economy, Tesla’s market share shrank to around 6.7% for the quarter ended in December, from 10.5% in the first quarter of last year, according to Bloomberg calculations based on China’s Passenger Car Association data.

While the PCA has yet to provide a breakdown of how many vehicles leaving Tesla’s Shanghai factory were shipped locally in March, figures for the first two months of the year show the carmaker’s share slipped to around 6.6% from 7.9% during the same period a year ago, when Covid restrictions were just lifted.

The US company’s sales and production are consistently backloaded in China, with the third month of each quarter being the strongest for local shipments.

Tesla shares fell as much as 1.2% before the start of regular trading Wednesday after falling 4.9% on Tuesday, their biggest drop in a month.

While Tesla has long prided itself as a disruptor with cutting-edge technology, it’s having a hard time competing with just two vehicles in China: the Model 3 sedan and Model Y sport utility vehicle. The company first unveiled both models before 2020 and has made relatively minor updates since their introductions.

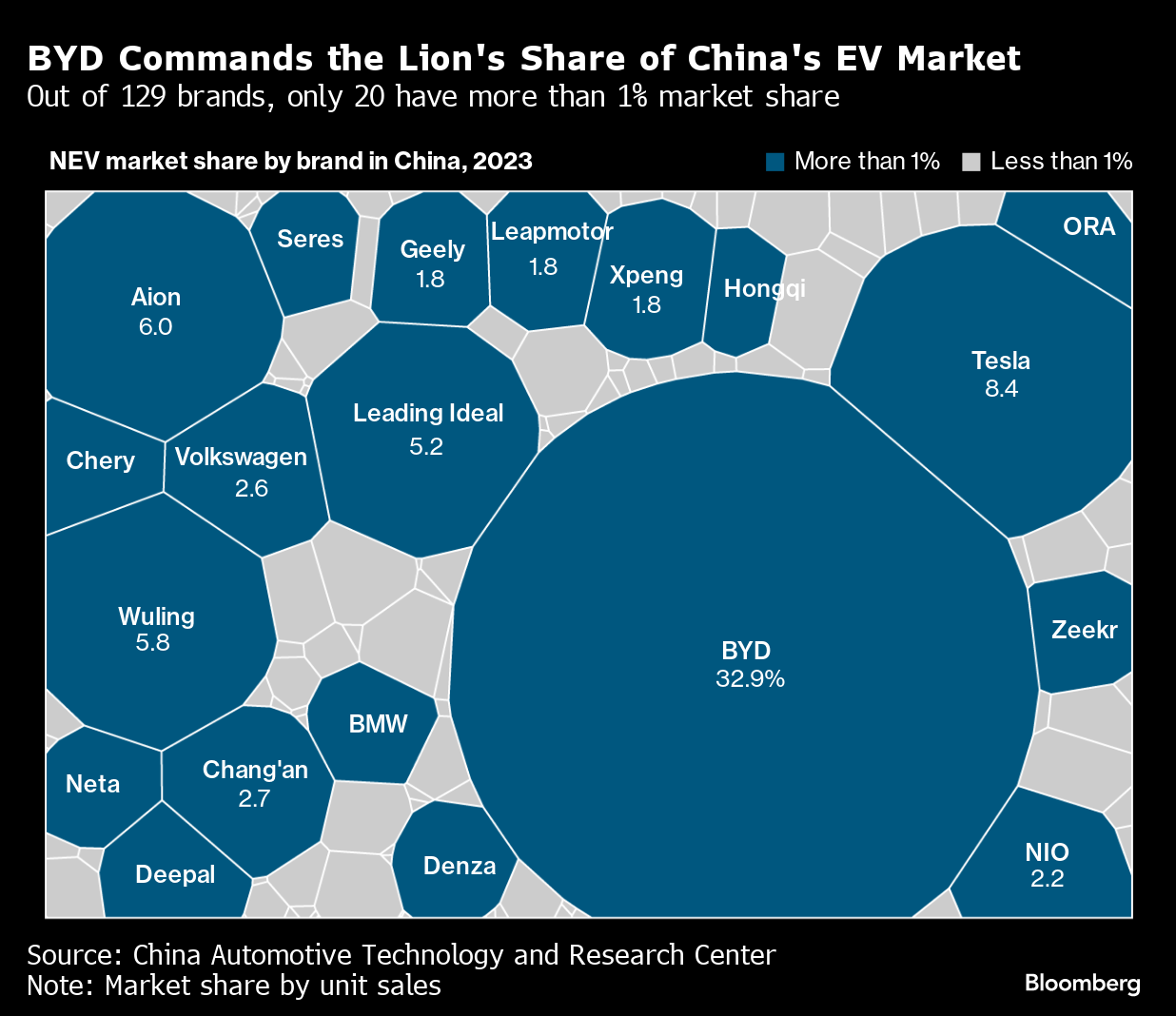

By contrast, a slew of rivals — from carmakers BYD Co., Nio Inc., Xpeng Inc. and Li Auto Inc., to smartphone giants Huawei Technologies Co. and Xiaomi Corp. — offer newer or more extensive lineups of vehicles packed with tech features.

BYD, in particular, offers a wide spectrum of vehicles. Its Seagull hatchback has a 10-inch rotating touchscreen and retails for under $10,000. On the high end, its Yangwang U8 plug-in hybrid SUV boasts 1,200 horsepower, can float on water and makes a 360-degree “tank turn” on the spot.

Discounting used to be a deliveries booster for Tesla, which has been one of the most successful practitioners of the direct-sales model. But China’s automakers have proven determined to join the price war Tesla kicked off in late 2022 and continued early this year. Many domestic manufacturers marked down models further early this week, seizing on Tesla’s pre-announced price hike that took effect Monday.

As is the case in many parts of the world, growth in China’s EV market is slowing. Shipments of new-energy vehicles are projected to increase 25% to 11 million units this year, the PCA has said. While still expanding, that’s down from 36% in 2023 and 96% in 2022.

Tesla recently pared back production schedules at its Shanghai factory, Bloomberg reported late last month. Shipments from its Shanghai plant — which makes EVs for China and for export to other parts of Asia, Europe and Canada — declined in the first two months from the same period a year ago. Overall passenger-vehicle sales in China increased.

The PCA said Tuesday that Tesla delivered an estimated 89,064 vehicles in China in March. That’s up from 60,365 in February — the lowest monthly total since December 2022 — and broadly in line with 88,869 in March 2023.

In a separate release on Wednesday, the association said China’s total passenger-vehicle sales increased 7% in March to 1.7 million units. Meanwhile, total retail sales of plug-in hybrid and battery-electric cars rose 28% to 698,000 units, with the help of stronger performance from companies including BYD.

Globally, Tesla delivered 386,810 vehicles in the first three months of the year, missing Bloomberg’s average estimate by the biggest margin ever in data going back seven years.

“It’s been an epic disaster, not just in terms of the delivery number, but the strategy,” Wedbush Securities Inc. analyst Dan Ives said in an interview with Bloomberg Television on Wednesday. “This is probably one of the most challenging periods for Musk and Tesla in the last four or five years.”

(Updates with early share move in the fifth paragraph.)

©2024 Bloomberg L.P.