Thames Water Fails to Publish Plans Critical to Its Survival

(Bloomberg) -- Thames Water Plc hasn’t published a crucial business plan outlining information about the company’s financial stability, a move that’s prompting concern among bondholders.

The water company, which provides services to around 15 million people in London, has so far only submitted a 13-page summary which lacks details needed for a full assessment, analysts say. Thames Water has been under intense scrutiny after it’s debt costs increased, which led the UK government to draw up contingency plans which at one point included a temporary nationalization, Bloomberg reported in June.

For comparison, Southern Water’s business plan published Monday was 244 pages long.

Thames Water’s business plan was set to be a key indicator of how the company was going to manage it’s financial situation in the years to come. The prospect of its nationalization receded after shareholders agreed this summer to put up £750 million ($906 million) of equity. While the summary made reference to £2.5 billion of additional needed equity investments, the utility didn’t specify commitments to plans to reduce debt.

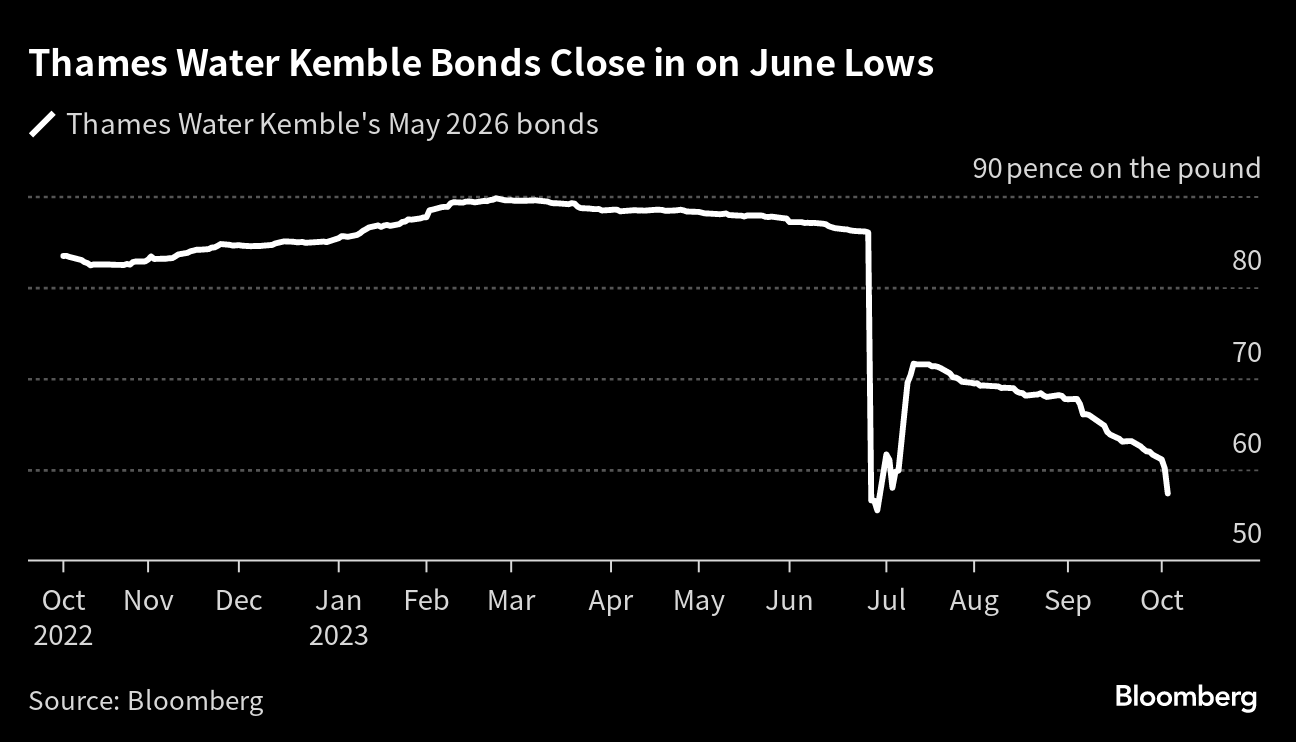

Bonds issued by Thames Water Kemble Finance plc, which are unsecured and most vulnerable to any negative news, plunged deeper into distressed territory to a cash price of 56.5 pence on the pound on Wednesday. At this level, it has erased almost all of the gains made since shareholders offered conditional support in July.

“Debt investors are left in limbo and unable to take a view on whether Thames Water will get shareholder support and therefore avoid being placed into an special administration regime,” said Paul Vickars, a senior credit analyst at Bloomberg Intelligence. “It’s critical to Thames Water’s survival that its Price Review 2024 business plan meets the needs of all stakeholders, which may explain why it’s the only water company yet to publish the full version.”

The summary documents showed Thames Water increasing bills by at least 40%, with plans to invest £18.7 billion to fix a crumbling network.

The Water Services Regulation Authority, Ofwat, confirmed they had received the business plans from Thames Water on October 2. Ofwat’s guidelines around the submission mean they “expect all documents submitted to Ofwat to be published on company websites on the same day.” Yet the full plan was not uploaded on its website as of Wednesday morning.

In response to the situation a Thames Water spokesperson said, “We have submitted our full PR24 business plan on time to Ofwat and are in the process of uploading the detailed plan and accompanying data tables to our website. Our abridged customer friendly plan can be found on our website, which provides a high level summary of what our plan consists of.”

“The lack of business plan has not gone unnoticed, and we eagerly await it to make a full assessment of the company’s plan,” said Martin Young, an analyst at Investec.

(Adds details on drop in bonds in fifth paragraph.)

©2023 Bloomberg L.P.