Japan Regional Utility Stock Surges on Nuclear Reactor Report

(Bloomberg) -- Shares of a Japanese regional utility jumped the most in a decade after a report from the nation’s regulator brought the company closer to restarting a nuclear reactor.

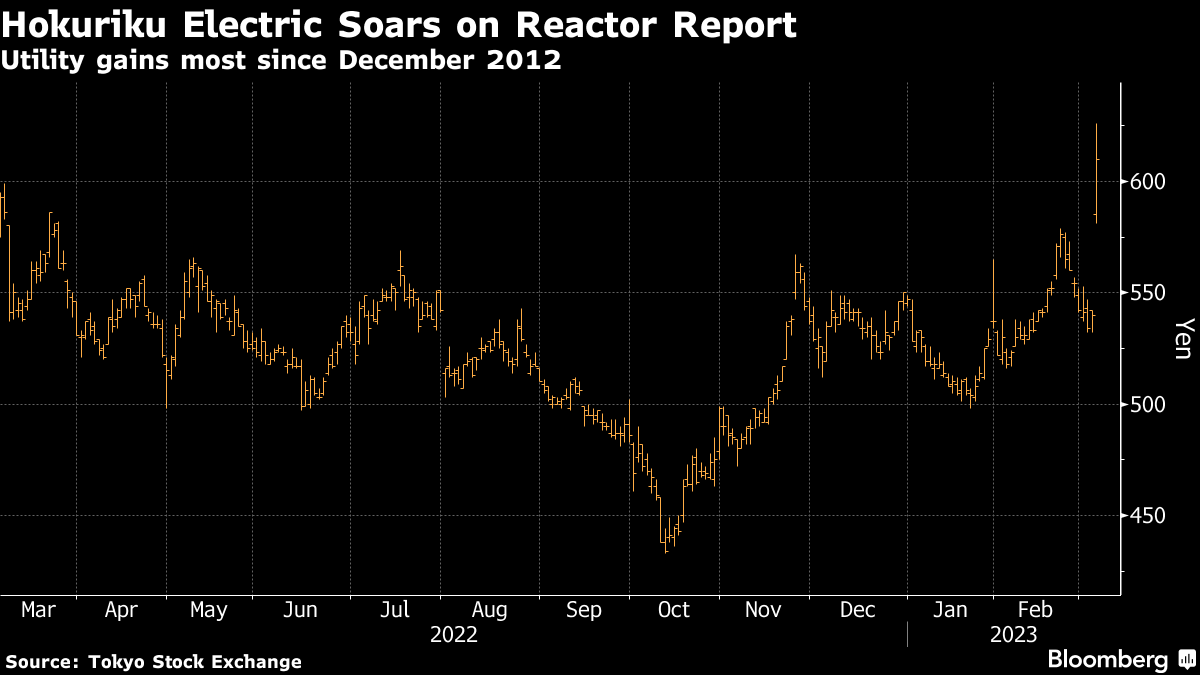

Hokuriku Electric Power Co. gained as much as 16%, the most since December 2012. Japan’s Nuclear Regulation Authority, which oversees restart protocols for the country’s idled reactors, determined that the company’s Shika No. 2 nuclear reactor in Ishikawa prefecture isn’t on an active fault line, NHK reported Friday.

That’s a significant breakthrough for the utility’s plans to restart the unit, which has been offline since 2011. It’s also a boost for proponents of nuclear in Japan, where the government has been forced to hand out subsidies to rein in the effects of soaring power prices on consumers and inflation after the costs of liquefied natural gas and coal imports soared last year.

While the decision is a positive for Hokuriku Electric, the reactor is unlikely to produce power anytime soon. The company still faces a rigorous restart procedure overseen by the NRA and will need to clear other hurdles such as getting approval from the prefecture’s governor, gaining the support of the local community and finishing any additional safety construction.

Meanwhile, Japanese Prime Minister Fumio Kishida has instructed his administration to create additional measures to combat rises in energy, farm feed and food prices, according to a Kyodo report on Friday.

The country’s average electricity price for next-day delivery was 9.7 yen per kilowatt-hour on Monday, down 11% from a week earlier, according to data from the Japan Electric Power Exchange. Temperatures across the nation are increasing, with Tokyo set for a high of 22C (72F) later this week, according to a forecast from the Japan Meteorological Agency.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.