European Gas Prices Gain as Traders Tap Storages Amid Cold Snap

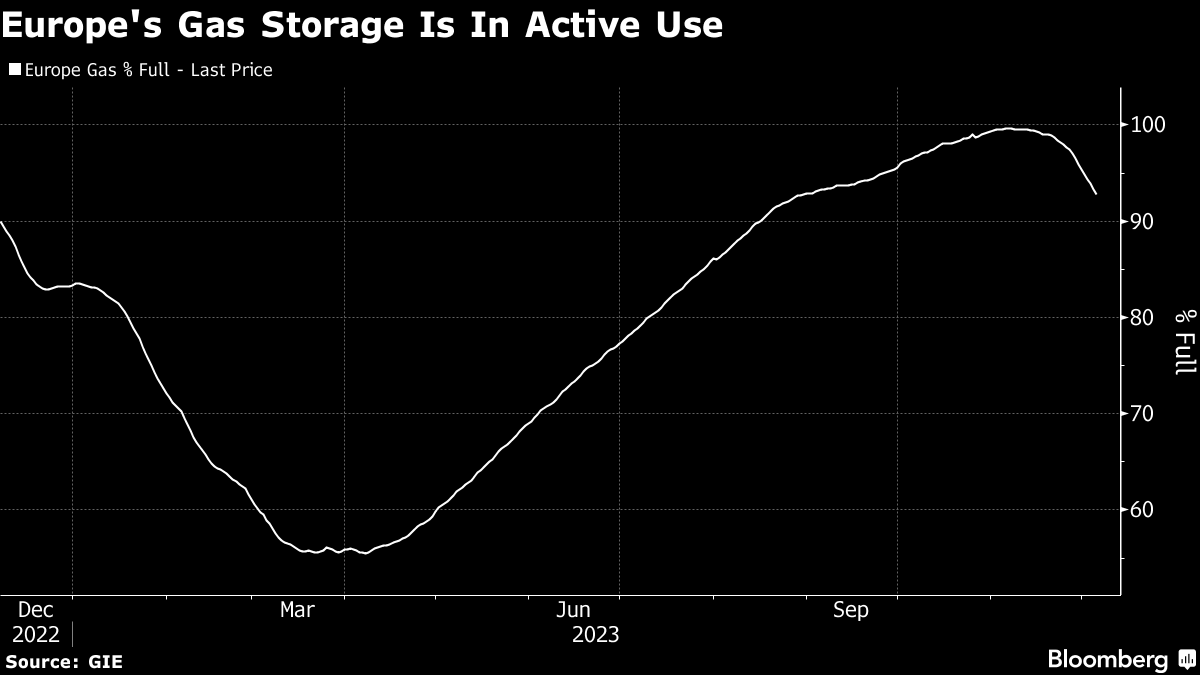

(Bloomberg) -- European natural gas prices gained for a second day as traders increased the pace of withdrawals from storage sites during the first major cold snap this winter.

Benchmark futures rose as much as 3.4% on Thursday. While European Union reserves are at a healthy 93%, withdrawals since the end of November have been higher than the same period last year, according to data from Gas Infrastructure Europe.

Most analysts now expect end-of-winter inventories to drop below this year’s levels, indicating more of a challenge next summer to refill the sites. That’s likely to support prices beyond the winter season too.

With the worst of the energy crisis now in the past mirror, storage levels are playing an instrumental role as a key indicator of where prices are headed, along with the level of liquefied natural gas imports and curbs in consumption. The surging Norwegian flows are also closely watched by traders.

The current cold snap is poised to ease by the weekend, with temperatures in Germany moving from below normal levels to as much as 6.6C above average in Frankfurt on Monday, according to forecaster Maxar Technologies.

Dutch front-month futures, Europe’s gas benchmark, added to € a megawatt-hour at 9:39 a.m. in Amsterdam.

©2023 Bloomberg L.P.