What to Watch as Commodities Markets Brace for Hits to Supply

(Bloomberg) -- Supply issues in commodities markets will return to the fore in September, after prices edged lower last month as central banks stepped up the fight against inflation.

For the energy sector, a crucial OPEC+ meeting at the start of the week could decide the near-term fate of oil prices, while the global gas industry gathers in Milan to weigh the enormous pressures caused by Russia’s invasion of Ukraine and soaring fuel costs.

The extreme weather watch for agricultural and power markets shifts to the Atlantic hurricane season and to California, where soaring temperatures threaten wildfires and a buckled grid. Australia, one of the world’s top grain exporters, will update its crop forecasts on Tuesday.

In China, which is just recovering from its own historic drought, trade figures on Wednesday will provide a checkup on the health of its commodities imports. The data will be released against a baleful backdrop of power shortages, a property market in crisis, and the government’s stringent Covid Zero rulebook, which has now been thrown at the metropolis of Chengdu.

Crude Cuts

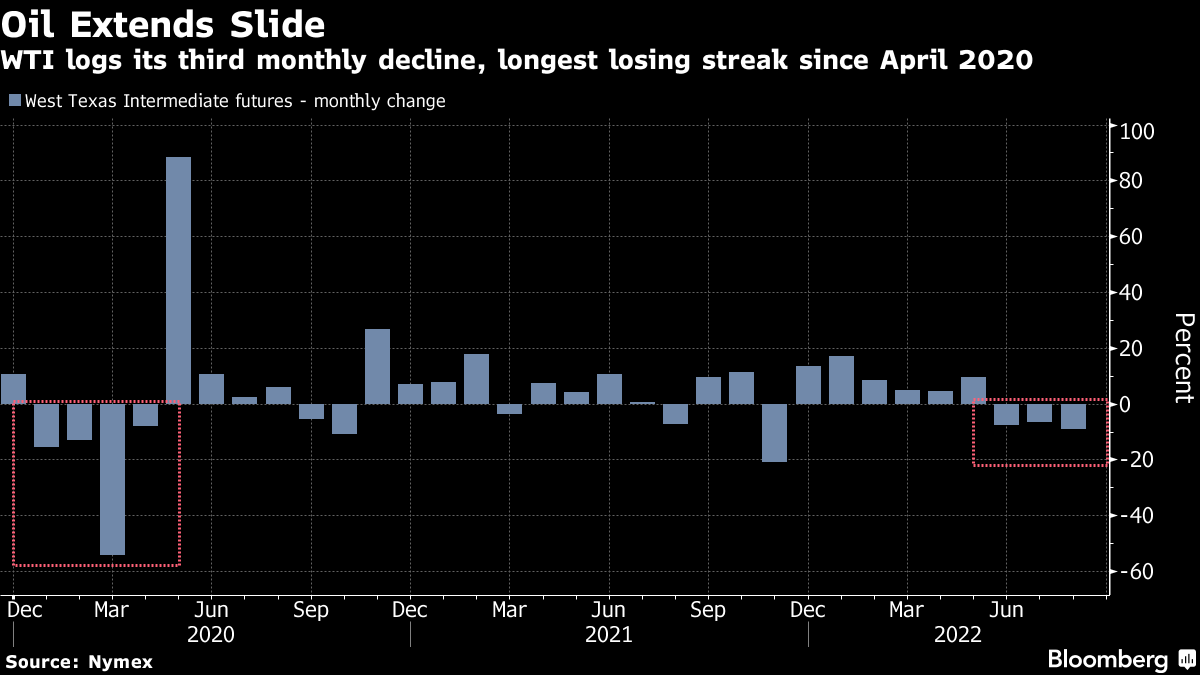

Oil rounded off three straight monthly losses this week, its longest slump in over two years, and has tumbled below $100 a barrel on fears over slower economic growth in China and tighter monetary policy in the US. The plunge prompted hedge fund star Pierre Andurand to brand the futures market for crude as “broken.” To gauge whether the selloff has further to go, traders will turn to the latest monthly meeting of the OPEC+ alliance, which convenes by videoconference on Monday.

Coalition leader Saudi Arabia has signaled it’s prepared to cut production -- which would throw into reverse the recent trend of increases -- to bring markets back into equilibrium. It has received enthusiastic backing from the rest of the Organization of Petroleum Exporting Countries. But with inflation still ravaging the world economy and EU sanctions on Russia set to inflict a winter energy crunch, Riyadh may be reluctant to risk inflaming relations with the White House and could instead opt to hold output steady.

California Heating

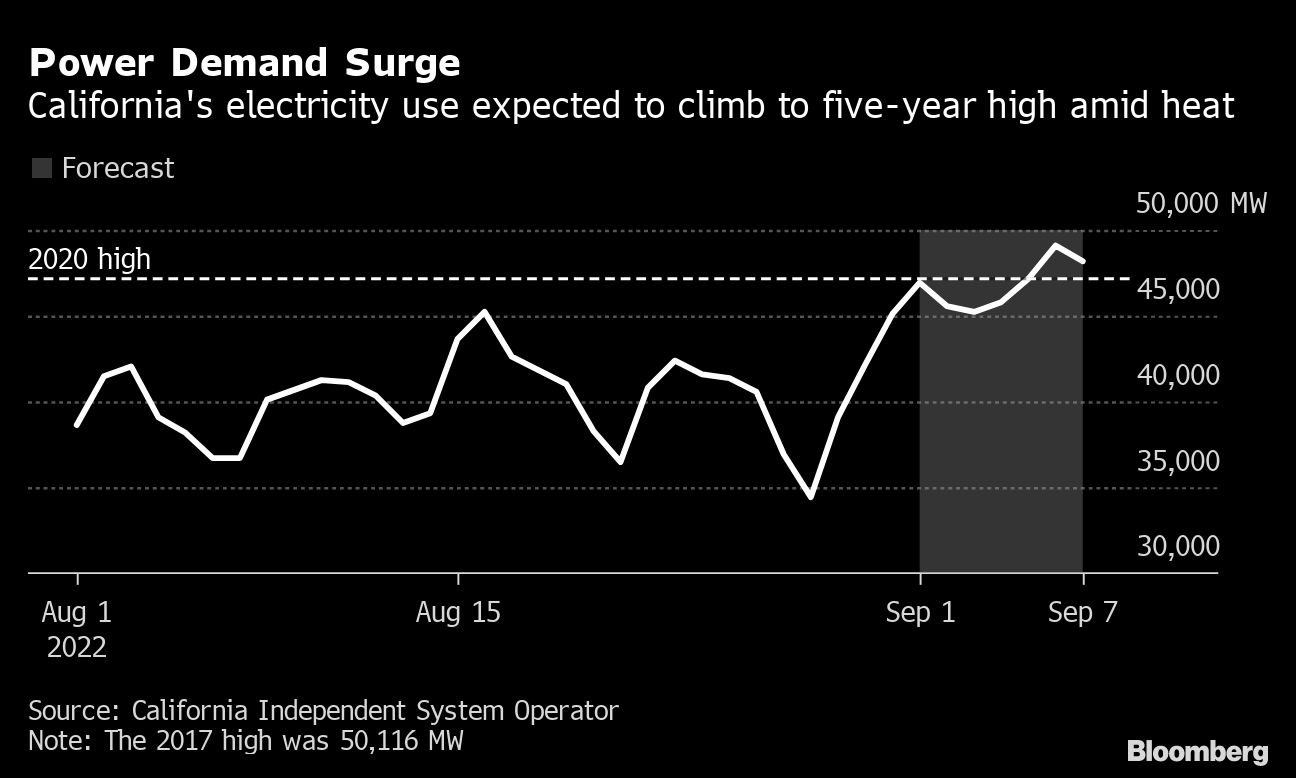

California remains in the grip of blistering heat. September started out hot across the US West and chances are it’ll linger for at least two weeks. Most of the Golden State headed into the US holiday weekend facing excessive heat warnings, and temperatures could soar as high as 110 degrees Fahrenheit (43 degrees Celsius) in some areas.

The heat wave is exacerbating drought conditions, taxing agriculture and raising the risk of wildfires, while prompting Californians to crank up air conditioning and stress the state’s power network. California’s grid operator expects electricity demand to surpass 47 gigawatts on Monday and reach 49 gigawatts Tuesday, which would be the highest since 2017. The all-time peak is almost 50.3 GW hit in 2006. A gigawatt is enough to power 750,000 Californian homes.

Softs Supply

Traders of coffee, sugar and cotton are closely tracking forecasts of weather developments across the Gulf of Mexico, as the Atlantic hurricane season enters its peak. The first hurricane of the season, which formed west of the Azores, has been named Danielle, but its meandering mid-Atlantic path poses no threat to the region.

Violent storms can threaten sugar cane in Florida and Louisiana, the top US growers, and citrus crops in Florida, the biggest domestic supplier of fruit for juice.

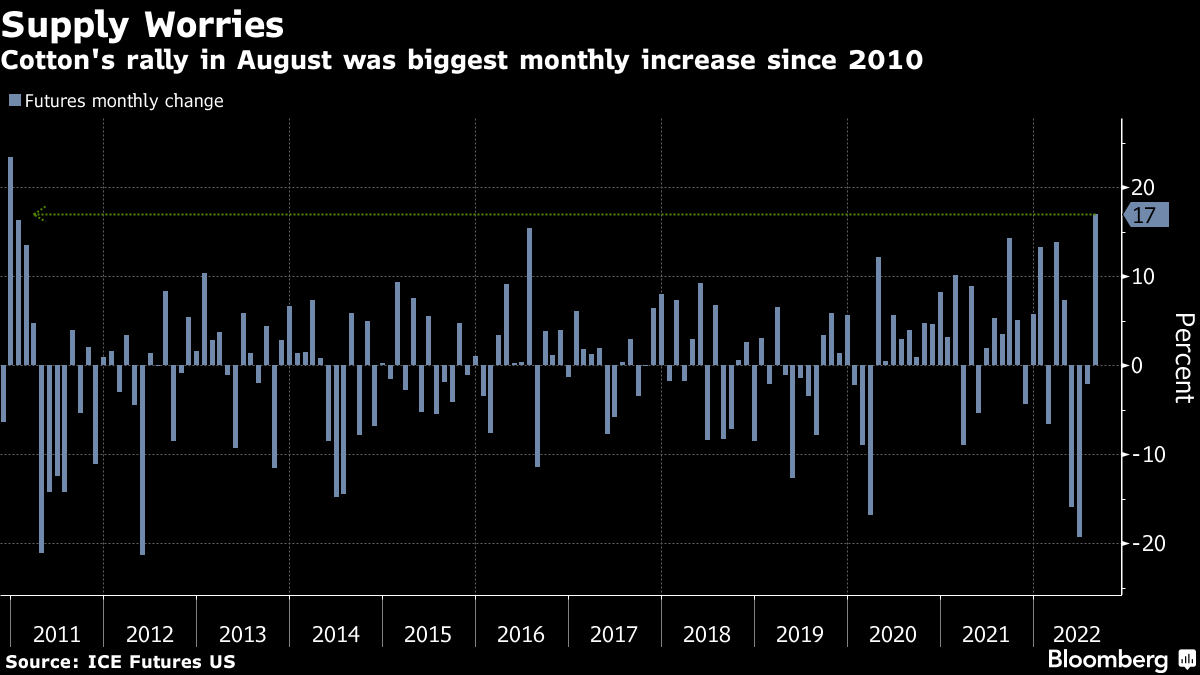

Cotton crops across the southern states are also vulnerable to extremes. Drought has already hurt top US grower Texas, crimping global supplies and contributing to the 17% surge of cotton futures in August, the biggest monthly jump since late 2010. American cotton supplies are even more important now after catastrophic flooding ruined a big portion of the crop in Pakistan, the fifth-largest producer, in the past week.

Severe storms can also cause damage to coffee crops and infrastructure in Central America, where some areas are still recovering from hurricane damage of two years ago.

Wheat Optimism

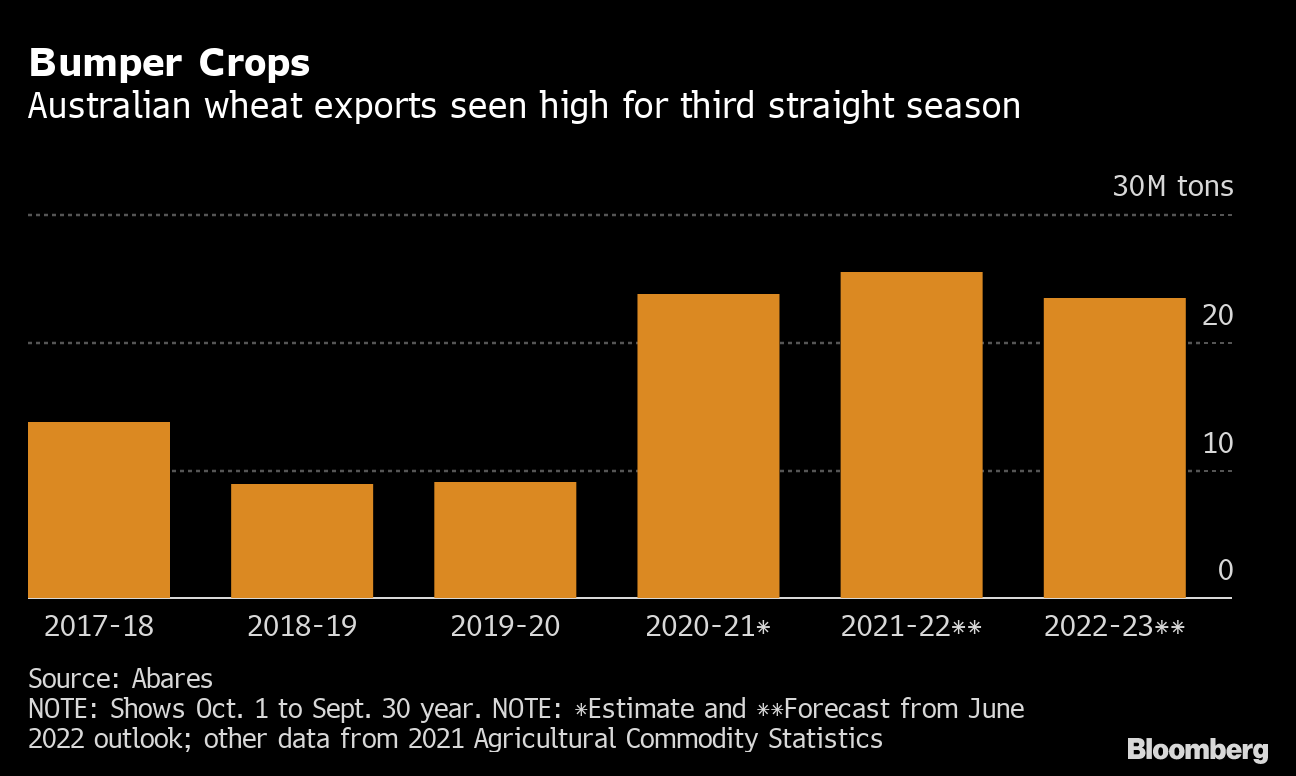

Better news may be due from Australia, where the government is set to release a quarterly update detailing what it thinks the size of the upcoming wheat crop might look like. Wet conditions across the nation this year have given many growers reason for optimism. After ramping up plantings, farmers are expected to pull off another bumper crop, and the report is likely to see an upward revision to an already fairly buoyant production forecast.

The prospect of more supplies should offer some relief to a world facing uncertain grain reserves. Extreme weather has trimmed output in parts of Europe, and there are concerns for the crop in Argentina -- the southern hemisphere’s other big wheat producer. As La Nina saps soil moisture there, farmers have pulled back on sowing due to dryness. Drought is also shrinking crops from the US Farm Belt to China. And even as shipments start flowing from Ukraine again, there are fears over the next harvest as a chunk of farmland was lost in the war.

Chinese Metals

China’s import data for August should help form views on the direction of metals prices. While the government’s intention to spend more on infrastructure will help revive consumption of materials used in construction, there are doubts over whether it’ll be enough to fully offset the impact of virus-related curbs on economic activity and a teetering property sector.

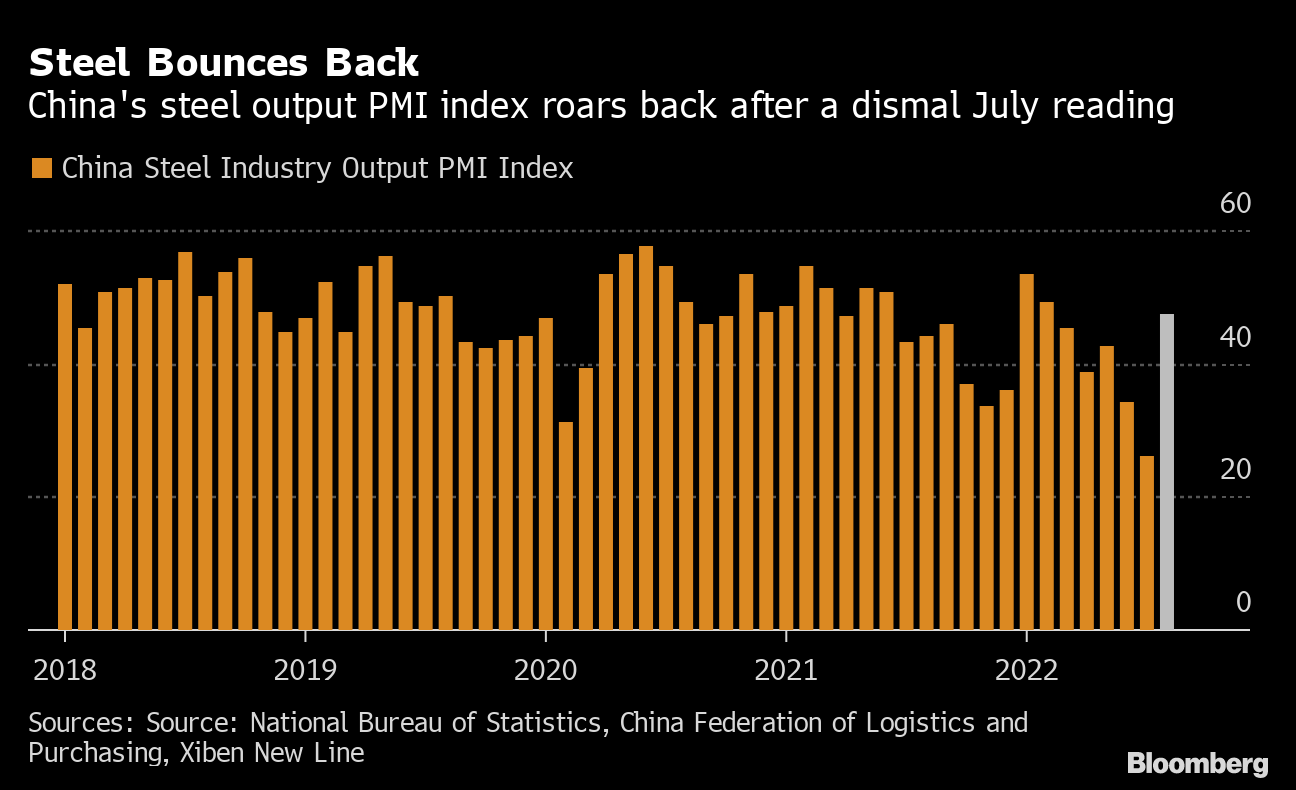

This week’s purchasing managers’ indexes suggest some grounds for optimism that conditions have at least bottomed. The steel reading in August showed that the industry was still shrinking, but the pace of the decline narrowed sharply and, lockdowns permitting, China is now heading into one of its peak periods for construction activity. Traders will look to the trade data to see if that has translated into more overseas demand for items like iron ore and copper.

For The Diary

- Click here for oil markets

- Click here for gas markets

- Click here for metals markets

- Click here for agricultural markets

- Click here for China

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.