Russian Gas Link Set to Restart as Traders Weigh Further Halts

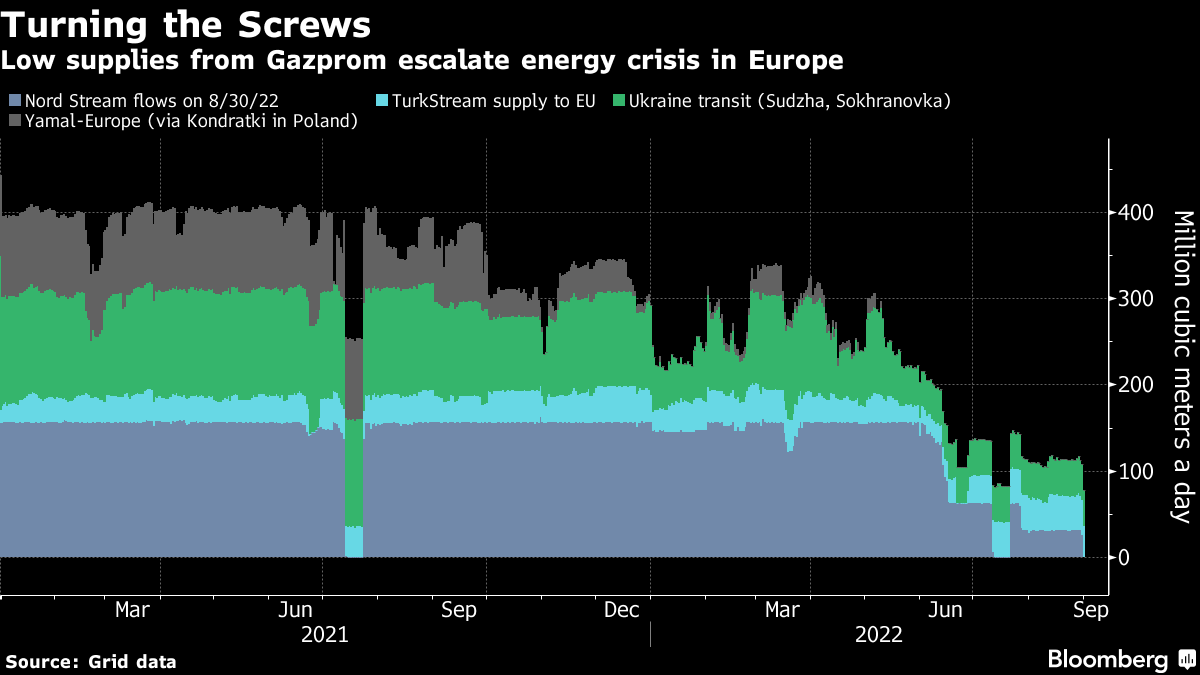

(Bloomberg) -- Russia looks set to resume gas supplies through its key pipeline to Europe, a relief for markets even as fears persist about more halts this winter. Prices fell.

It will bring some consolation to policy makers who had feared Moscow could decide against switching the gas back on after the latest bout of maintenance. But Europe is set to remain on tenterhooks through the winter, with surging prices ravaging its economies. Germany has said it can’t count on Russian gas at all during the colder months and the government is bracing for Gazprom PJSC to call another shutdown for repairs as soon as next month.

Gazprom has said the only functioning turbine at Nord Stream’s entry point must undergo technical maintenance every 1,000 hours. That’s about every 42 days, with the next checks due in mid-October.

Shipment orders, published by the pipeline’s operator, indicate that flows are expected to restart from 2 a.m. Berlin time on Saturday at 20% of normal capacity, the same level as before the work. Orders don’t guarantee actual flows, and normally it takes time for supplies to recover to planned levels. Russian Deputy Prime Minister Alexander Novak signaled on Thursday the country is sticking to schedule, according to Tass news service.

Gazprom slashed supplies through Nord Stream in July, shortly after the pipeline’s seasonal maintenance, citing technical issues. The flows were halted on Wednesday for checks at the only functioning turbine that helps to pump gas into the pipeline. Normally, it uses six major turbines and two smaller ones, but this summer most of the equipment was put out of service with Gazprom citing international sanctions that disrupted maintenance and repairs.

The European Union has been preparing for disruptions. The region’s race to store gas for the upcoming heating season has led refill rates to hit the targeted level two months ahead of schedule, easing the immediate threat.

Dutch front-month gas, the benchmark for Europe, fell as much as 10%, and was 9.3% lower at 220.35 euros a megawatt-hour as of 10:45 a.m. in Amsterdam. They are heading for the biggest weekly loss in more than five months. The UK equivalent fell 12%. German power for next year declined 3.5%, reversing an earlier increase.

Offset Risk

Lower consumption, coupled with higher gas stockpiles and supplies from alternative sources, could help offset Russia’s risks for now. But frequent Nord Stream halts would be an indicator of how far Russia is willing to go, meaning more risks this winter -- especially if it’s a cold one.

“While widespread rationing across the EU is not inevitable even in a shut-off scenario, it would be a high risk in some countries, including Germany,” Fitch Ratings said in a note Thursday. “Recession in the eurozone now appears likely as a result of the deepening gas crisis.”

It’s not yet clear when other Nord Stream turbines that are offline could be serviced. This may need to happen either on site or in Canada, where they were produced.

For the remaining unit regular maintenance is due to technical requirements provided by manufacturer Siemens, according to Gazprom. That means repeated halts if the situation with other turbines doesn’t change by October.

A spare part that could boost deliveries has been stuck in Germany after repairs in Montreal, with Moscow and Berlin arguing over which documents are needed to enable its return to Russia.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.