EVs Add to Electricity Demand, But Not as Much as You Might Think

(Bloomberg) --

California recently asked homeowners to reduce electricity consumption to help avoid blackouts as temperatures soared and the power system struggled to keep up. The plea was effective, with consumers temporarily dialing back demand enough to keep the lights on across the state. But these sorts of close calls are the stuff of nightmares for system operators, and this specific brush with near-disaster had a new element that caught a lot of attention: a call to electric vehicle owners to avoid charging during peak demand hours.

Invariably, this was pounced on by critics as proof that California’s just-announced plan to phase out sales of new combustion vehicles by 2035 was doomed to fail. “How can the state electrify the vehicle fleet if it can barely keep the lights on?” went the refrain.

These types of discussions get emotional quickly, so it’s worth stepping back a bit to look at the data on how much electricity consumption EVs really add.

By the end this year, there will be about 27 million plug-in passenger vehicles on the road globally. Based on average driving distances, vehicle efficiencies in different countries, segment sales, the split between full electrics and plug-in hybrids and a few of other factors, BNEF estimates that global electricity demand from these EVs will be around 60 terawatt-hours this year.(1)

How should we best think about that number? One way is to compare it to global electricity demand, which will be somewhere around 28,000 TWh this year, so EVs will add around 0.2% to the total. Looking at this another way, the global passenger EV fleet consumes a similar amount of electricity as Singapore.

EV adoption in large parts of the world is still just getting started, so this comparison with global generation today isn’t totally fair. What about Norway, where EVs are already over 20% of all cars on the road and are covering more distance than their combustion counterparts?

There, EVs are adding around 1.4% to total electricity demand. That’s still small, but Norway is a special case. It has very high per capita electricity consumption because it’s cold, there’s a lot of electric heating and a lot of electrified industrial processes, so the denominator is big.

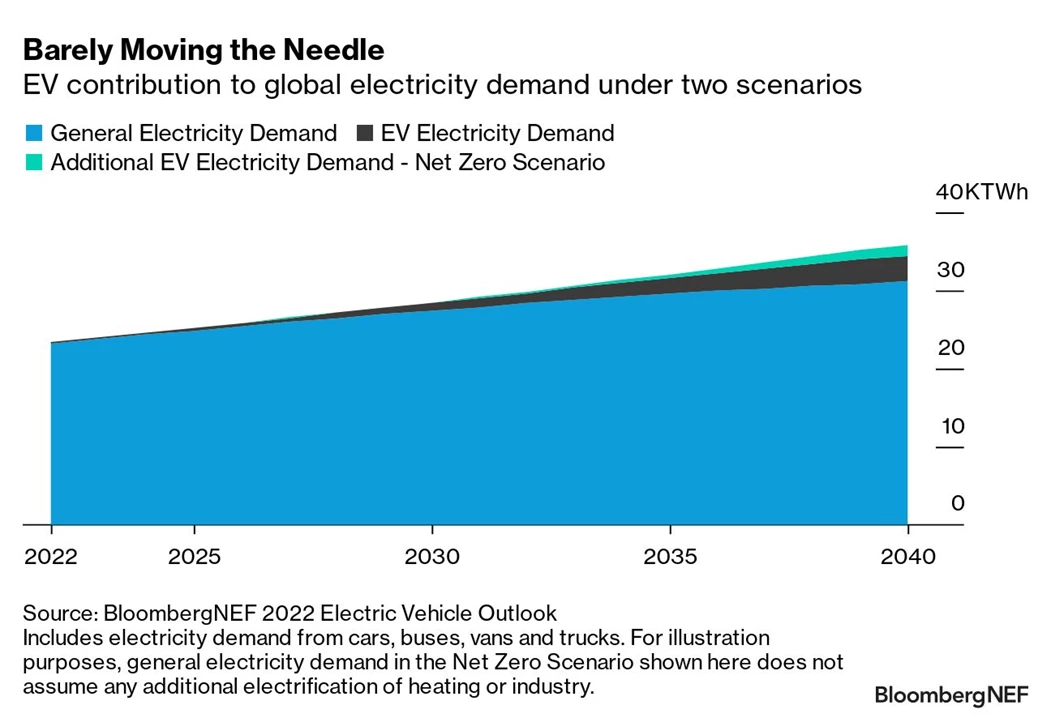

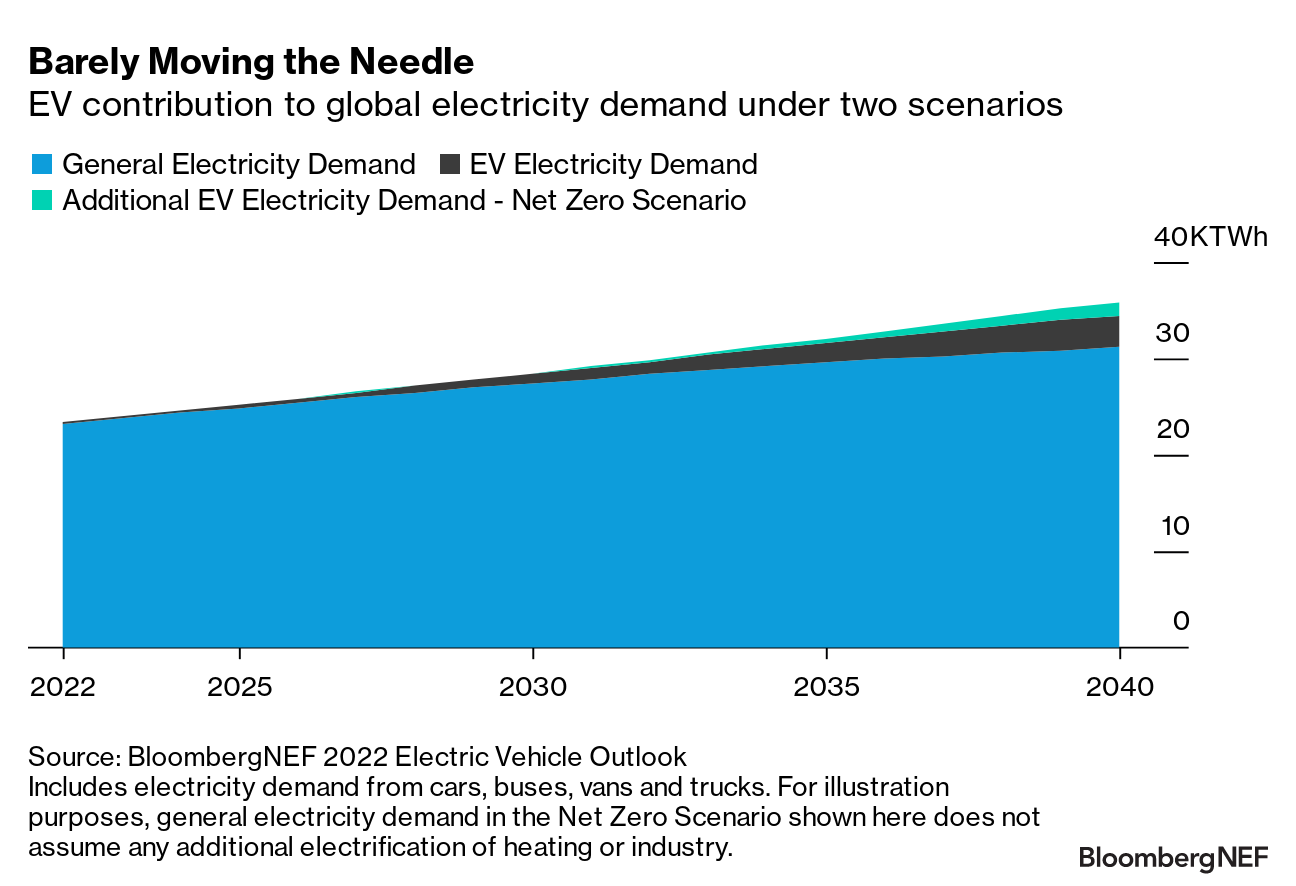

At BNEF, we’re expecting rapid EV adoption in the next two decades, so this picture will change. Our annual EV Outlook has two main scenarios: one that assumes market forces are the main driver of adoption and that no new policies get implemented, and another that assumes every country in the world gets on track for net-zero CO2 emissions by 2050.

In the first case, which we dubbed the Economic Transition Scenario, battery-electric vehicles represent three quarters of global passenger vehicle sales by 2040. In the Net Zero Scenario, they’ve almost completely taken over the market in the early 2030s.

People may quibble with the specific sales penetration rates in those scenarios, and that’s fine — there’s plenty of room for healthy debate. But if we use those two points as a reference, there will be around 730 million passenger EVs in 2040 — about half the total fleet — and increase global electricity demand by about 7% in the first scenario. In the Net Zero Scenario, there are over a billion EVs on the road then, adding around 9%.

Not all EVs are cars. Adding electric buses, trucks and other vehicles into the mix boosts the numbers a bit further, adding somewhere in the range of 11% and 15% to global electricity demand in 2040 under the two scenarios.(2)

It gets more interesting if we break this down to a country level. In China, where overall electricity demand is still growing quickly, EVs of all types add about 11% to demand in 2040 in the Economic Transition Scenario. For Europe, it’s closer to 22%, while for India they’re adding just a tiny sliver.

In some wealthy countries, EVs are what’s keeping electricity demand from falling, while in emerging economies they make a modest addition to steady expected increases in overall electricity demand. Playing it out even further, electrifying almost all of road transport by 2050 in the Net Zero Scenario would add around 27% to global electricity demand.

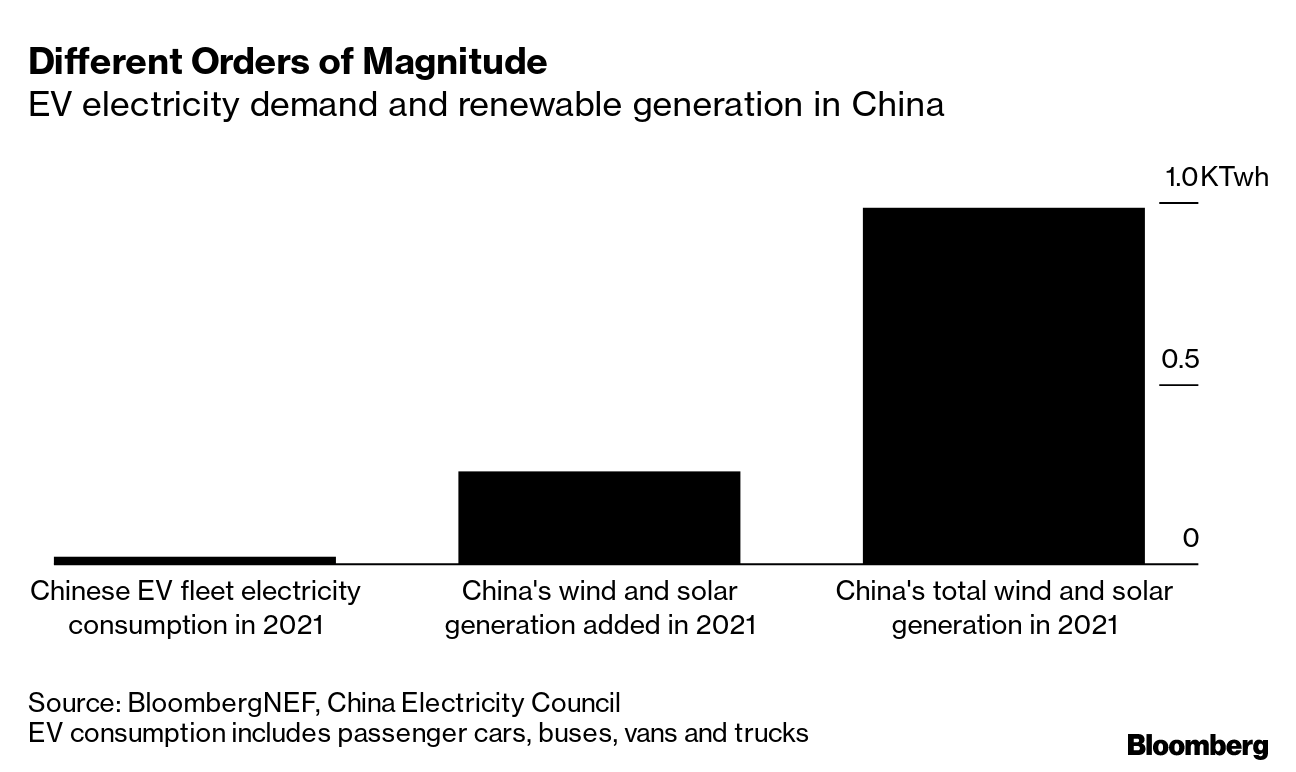

One final way to think about this: In 2021, China generated 983 TWh of electricity from wind and solar, 25 times more than the global passenger EV fleet used. China added around 255 TWh of new wind and solar generation to its energy mix in 2021, meaning its newly installed renewable generation produced more than six times what the entire global passenger EV fleet — built up over many years — consumed.

Integrating EVs into the power system will still require careful planning, incentives for off-peak charging to reduce peak demand, and localized grid reinforcement in many places. As a share of global electricity demand, though, the contribution will still be very modest for quite a few years.

(1) This is probably an overestimate, because China’s urban EVs are covering less distance than expected and doing so more efficiently. Estimates will be updated with the latest China Electricity Council data early next year.

(2) For illustration purposes, this Net Zero Scenario assumes no addition electrification of cooking, heating or industrial processes.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.