China Stocks Extend Post-Congress Rout on Lockdowns, Weak Data

(Bloomberg) -- Chinese shares extended losses following last week’s selloff as a ramp-up of Covid restrictions and poor economic data worsened the outlook for the market.

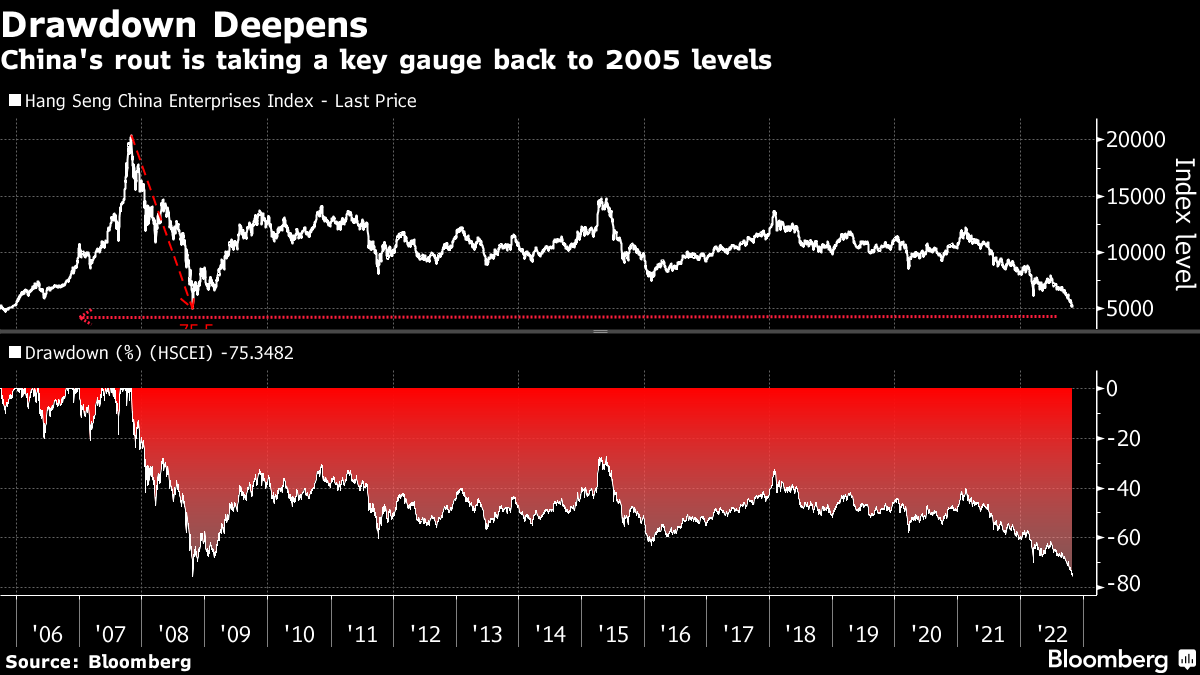

The Hang Seng China Enterprises Index ended Monday’s volatile session with a 1.8% loss, closing at its lowest since November 2005. Property shares plunged, while tech shares bucked the downtrend following BYD Co.’s record earnings. The CSI 300 Index, a benchmark of onshore shares, fell 0.9% to its lowest close since February 2019.

Chinese stocks have faced relentless selling pressure through most of the year, hammered by Covid curbs and tensions with the US. Sentiment suffered a fresh blow after President Xi Jinping’s power grab and his recommitment to the Covid Zero strategy at the Community Party congress, which spurred the worst ever five-day rout for the Hang Seng China gauge following any leadership meet since its 1994 inception.

Down 40% this year, the Hang Seng China Enterprises Index is the worst performer among more than 90 global equity measures tracked by Bloomberg.

“Investors appear to be increasingly concerned about three issues in particular,” namely that China’s reopening might take longer than expected, China’s social priorities may take precedence over the economy and Beijing’s emphasis on security means a higher risk premium, strategists at Nomura Holdings Inc. including Chetan Seth wrote in a note.

China’s factory and services activity contracted in October, data showed on Monday. That signaled Covid curbs and an ongoing slump in the property market are continuing to pressure the world’s second-largest economy. The official manufacturing purchasing managers index fell to 49.2, below an estimate of 49.8 in a Bloomberg survey.

Foreign investors net sold a combined 57.3 billion yuan ($7.9 billion) of Chinese A-shares in October, the most since March 2020, when the pandemic triggered a global market rout, Bloomberg data shows.

Read: China Factory, Services Activity Slump as Covid Hits Recovery

Policymakers last week imposed fresh lockdowns from Wuhan to the nation’s industrial belt on the east coast, following a pickup in cases. Meantime, Macau mandated residents to undergo three days of rapid Covid tests and locked down a casino resort over the weekend. China reported 2,675 new local Covid cases for Sunday, marking the biggest nationwide surge in infections since Aug. 10.

The worst performer on the HSCEI was Longfor Group Holdings Ltd., which plummeted most on record following the resignation of its chairman.

Read: Longfor Billionaire Wu Quits as Chair, Shocking Investors

--With assistance from .

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.