U.K. says nuclear renaissance will be different

(Bloomberg) --

Britain is poised to usher in another nuclear renaissance, except this time the government says it will actually happen.

A lot has changed since previous promises -- the push to zero out emissions, the high political stakes to ensure energy security and a different financing model mean now is the time to build nuclear power stations, energy minister Greg Hands said.

“We want the U.K. nuclear industry in a fantastic renaissance, to be able to avail itself of a variety of developers and financiers,” Hands said in an interview Tuesday in his office in Westminster. “The Russian invasion of Ukraine has put a premium on energy security, and one of the huge advantages of nuclear is that it is, very largely, homegrown.”

It’s not the first time the U.K. has tried to revive its nuclear industry: efforts have been underway since the 1908s under different governments. But just one plant is being built -- Hinkley Point C.

Conservative Prime Minister Boris Johnson committed to building as many as eight nuclear plants by 2050 in the government’s energy-security strategy released last month. He tweeted Monday after visiting the plant in Hartlepool that “instead of a new one every decade, we’re going to build one every year.”

Achieving that will require a significant acceleration in the pace of development, and only Electricite de France SA has firm plans for a large-scale facility at Sizewell.

“The U.K. government has a lot of work to do to deliver on this target,” BloombergNEF said in an April report.

Hands said the government is talking with Westinghouse Electric Co., Toshiba Corp., state-owned Korea Electric Power Corp. and EDF, among others, about building new plants. The intention is to get them approved this decade to meet the 2050 target.

The biggest hurdle is financing: nuclear plants cost about 20 billion pounds ($25 billion) and compete for investor capital with renewables, which provide returns much quicker.

An overhaul of the financing mechanism for atomic plants was meant to attract more investors. The regulated asset base, or RAB, model is supposed to encourage private-sector investment and dilute the construction risk shouldered by the developer and taxpayers.

“Traditionally, the problem with nuclear has always been that you put a lot of money in, and you don’t get any return for at least 10 years,” Hands said. “In the RAB model, you allow the investor to get a return from really the point at which construction starts rather than the point at which electricity is connected.”

Hands and the department of business, energy and industrial strategy is working with investment minister Gerry Grimstone and the department for international trade to attract investors. The financing model has been “well-received,” Hands said.

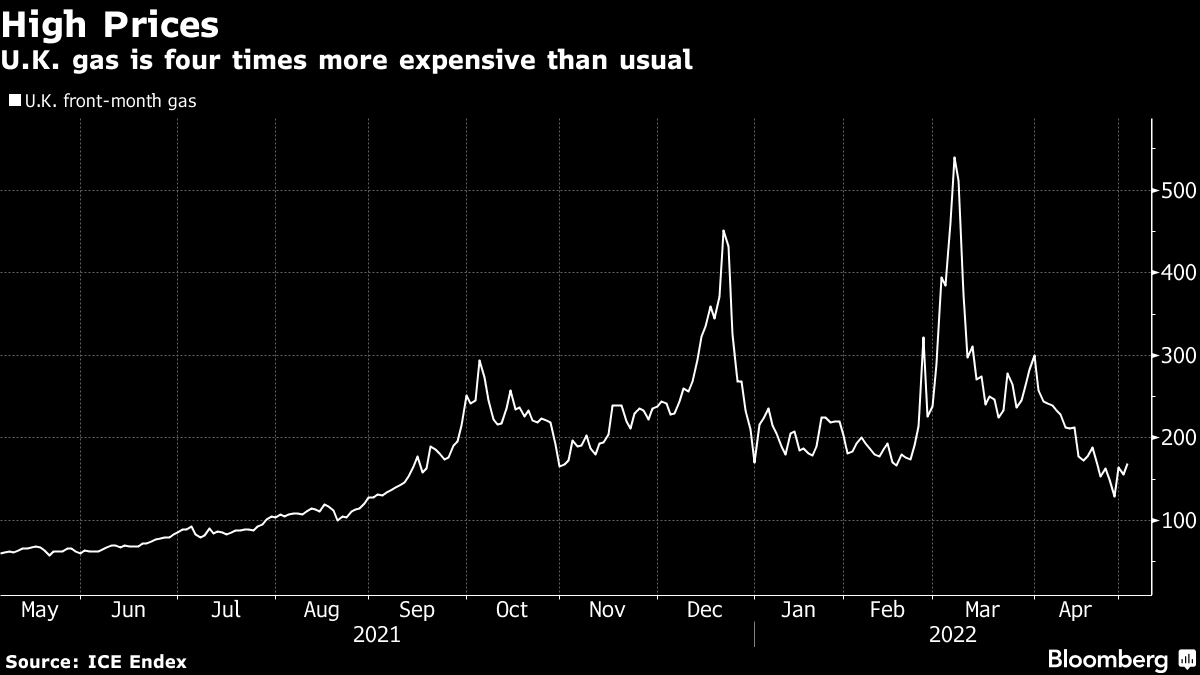

While building up a large pipeline of nuclear projects may help the U.K.’s long-term security of supply, it does nothing to alleviate the upward pressure on energy prices currently affecting ordinary Britons.

Chancellor of the Exchequer Rishi Sunak unveiled a 9 billion-pound plan in February to help soften the blow of a 54% jump in the regulator’s price cap on domestic gas and power bills. But consumer groups and opposition parties say Sunak’s plan isn’t enough.

The cap is due to be revised again in August -- a change that will take effect in October. Hands said wholesale prices during the past three months were higher than in the preceding six months, suggesting another increase is in the cards. He also hinted no fresh aid for consumers will be forthcoming before the fall.

“We haven’t ruled anything out from October onwards in terms of support for bill payers,” Hands said. “The first thing we wanted to look at are the support schemes that you’ve got in place already,” he said, pointing to cold-weather payments and the warm-homes discount.

It’s not just large-scale nuclear projects being targeted. The government wants small modular reactors and advanced modular reactors, or “mini-nukes,” to be part of the electricity mix, too.

“We don’t want to be dependent on either one developer, a small set of developers, a small set of financiers, state finance,” Hands said. “It’s in our interest -- in our national interest and in our commercial interest -- to have as competitive an environment as possible.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.