European Gas Surges 79% as Market Mayhem Takes Prices to Record

(Bloomberg) -- European energy prices roared to records after the U.S. said it was considering curbs on imports of Russian oil, a move that would add to supply fears across commodity markets.

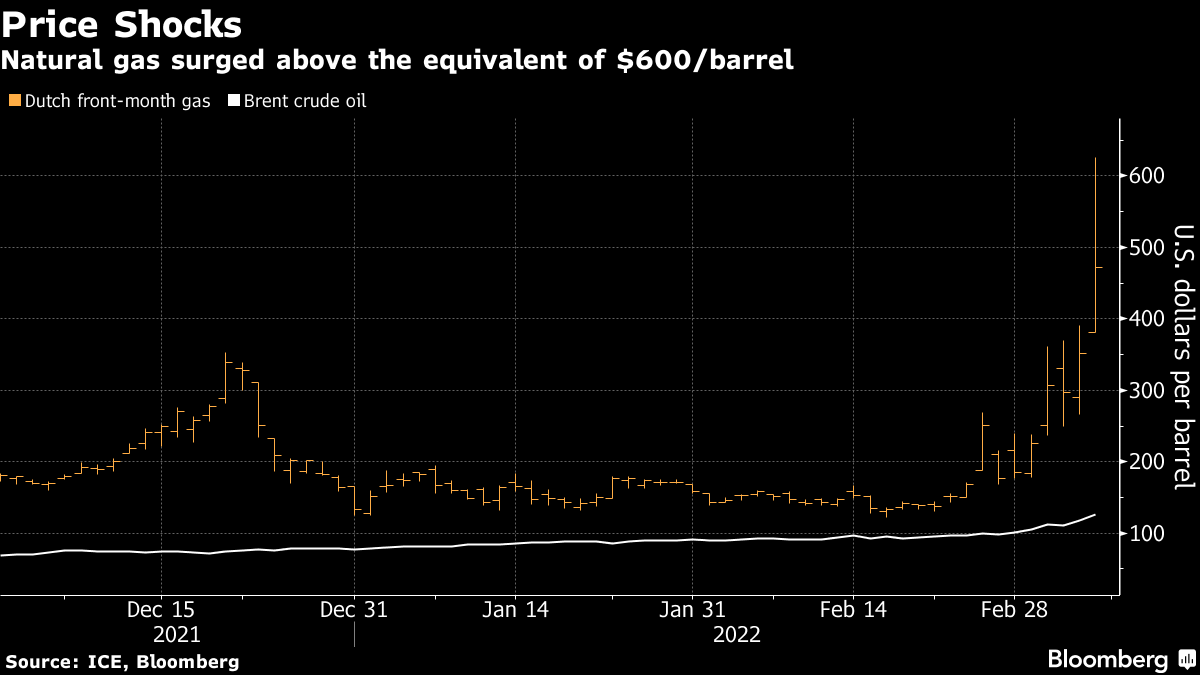

In some of the most chaotic trading the market has ever seen, benchmark gas prices leapt 79% to 345 euros a megawatt-hour. That’s the equivalent of more than $600 a barrel of oil. It extends a stunning rally following international sanctions targeting Russia that have upended commodity markets across the globe. Monday’s gas price surge is likely to lead to large margins calls, forcing companies to post more cash as collateral with exchanges to back their trades.

Gas exports from Russia, which account for about a third of Europe’s demand, are currently not covered by penalties. Shipments remain stable, with Russian exporter Gazprom PJSC reiterating on Monday that flows crossing Ukraine are at a high level and going as normal. However, traders remain on edge for any potential disruptions.

U.S. House Speaker Nancy Pelosi said in a note to lawmakers Sunday that the House is “exploring strong legislation” that would ban the import of Russian oil and energy products among other steps to isolate Russia from the global economy. The move would add to economic pressure and soaring inflation, with crude rising past $139 a barrel in London on Monday and metals from copper to gold also surging.

Ukraine Update: U.S. May Go Alone on Russia Oil Ban; Crude Soars

Any ban or cutoff of Russian gas flows to Europe could require “extreme” government measures to ration supplies for the industry and consumers, the head of France’s Engie SA told Les Echos newspaper. Europe has enough supplies to get through this winter, but problems would arise in building stockpiles over the summer for the next heating season, Catherine MacGregor said in an interview published on Monday.

‘Lost for Words’

“I’m lost for words,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S. “Margin calls and very illiquid and uncertain markets driving this move.”

Dutch front-month gas, the European benchmark, was 33% higher at 256 euros as of 10:51 a.m. in Amsterdam. The U.K. equivalent contract rose as much as 74% to an unprecedented 800 pence a therm. German month-ahead power surged 60% to 675 euros a megawatt-hour, also a record high

Any disruption to Russian gas supplies could hit Europe hard. The country met 17% of global consumption and as much as 40% of western European demand as of 2021, according to Goldman Sachs Group Inc.

If shipments through Ukraine are curtailed, Euro-area GDP could be cut by around 1%, with the impact expanding to 2.2% on an annual basis should Russian gas stop flowing completely, Goldman said in a report. Even in a baseline scenario where the fuel keeps flowing, high prices could have a 0.6% hit on the European economy, the bank said.

The European Union is already bracing for potentially severe economic consequences should supplies be affected. The European Commission, the bloc’s executive arm, is set to adopt a new strategy on March 8 that would boost energy security, cushion the impact of soaring gas prices, and accelerate the build-up of renewables and energy efficiency. It’s also planning to ensure more imports from countries including the U.S., Qatar, Norway, Egypt, Algeria and Azerbaijan.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Vestas Warns UK Wind-Auction Change Threatens Factory Investment

Valero Energy reports first-quarter loss amid challenging market conditions

Shell agrees to sell Colonial Enterprises stake to Brookfield subsidiary for $1.45 billion

Renault Confirms Full-Year Outlook on Strong EV Demand

ADNOC Distribution and noon partner to redefine quick-commerce convenience and speed

EU Weighs Targeting Spot Market for Russian Gas Phaseout

Altman to Step Down as Chairman of Nuclear Developer Oklo

Sulzer and Manweir form strategic partnership to enhance equipment repairs in Qatar

Aramco and BYD collaborate on new energy vehicle technologies