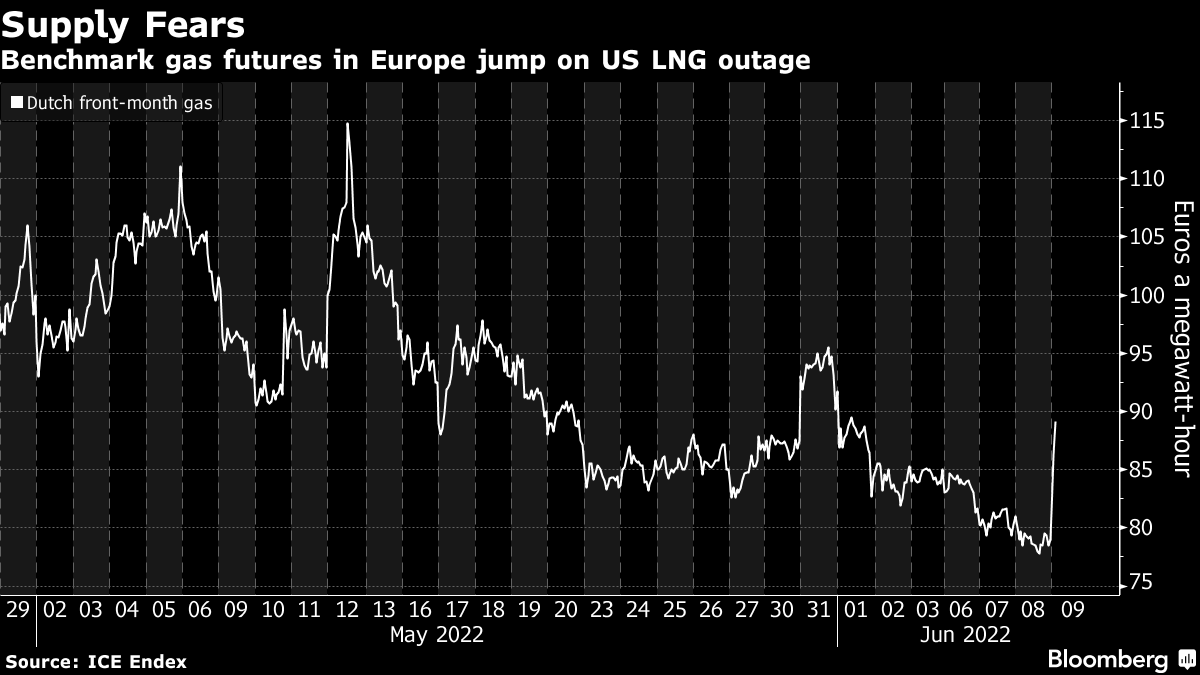

European Gas Soars as Fire in US Compounds Russia Supply Concern

(Bloomberg) -- Europe’s natural gas prices surged after a fire at a large export terminal in the US promised to wipe out deliveries to a market that’s on high alert over tight Russian supplies.

Benchmark futures traded in Amsterdam snapped a six-day falling streak, while UK prices jumped as much as 39%. The Freeport liquefied natural gas facility in Texas, which makes up about a fifth of all US exports of the fuel, will remain closed for at least three weeks. The US sent nearly 75% of all its LNG to Europe in the first four months of this year.

The closure comes as pipeline supplies from Europe’s top providers are also capped. Key facilities in Norway are undergoing annual maintenance this week, while Russia’s supplies are below capacity after several European buyers were cut off for refusing to meet Moscow’s demands to be ultimately paid in rubles for its pipeline fuel.

“The event highlights Europe’s precarious situation and it would likely signal an end for now to the calm trading seen in recent weeks,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S. “An export halt during the high-demand winter months would have triggered a much bigger reaction.”

Europe has been particularly reliant on US LNG to help offset risk of disruption to Russian pipeline imports, and ample supplies of the fuel in the past weeks had calmed the market after wild swings earlier this year.

What LNG Can and Can’t Do to Replace Russian Gas: QuickTake

“In the last three months, 68% of all Freeport cargoes were delivered into European markets,” said Tom Marzec-Manser, head of gas analytics at ICIS, citing his firm’s data. “So traders in Europe will be eagerly watching and waiting to see if this outage ends up lasting longer than initially predicted by the operator.”

The extent of the damage to the Freeport facility is not yet clear, but the fire could potentially knock out abut 16% of total US LNG export capacity “for an unknown period if the fire damage proves difficult to repair,” analysts at Evercore ISI said in a note.

Dutch front-month gas, the European benchmark, rose as much as 16% before trading 8.2% higher at 86 euros per megawatt-hour by 10:30 a.m. in Amsterdam. The contract had dropped 16% over the previous six sessions.

UK next-month futures jumped to as high as 180 pence a therm before easing to 168 pence. Send-outs from Britain’s LNG terminals, a key European destination for US cargoes, fell about 30% Thursday to the lowest since mid-March.

The continent’s electricity prices rose on the threat of tighter gas supplies to fuel power stations. German prices for next month jumped as much as 11% to 194.50 euros per megwatt-hour before easing to 186.60 euros.

Even with tepid consumption in most of Europe amid mild weather, energy companies may have to turn to gas inventories just as storage levels have improved closer to historic averages.

LNG buyers will probably start hunting for replacement shipments from the spot market, but there is a dwindling amount of supplies available, according to traders in Asia. The move is likely to boost already intense competition between Asia and Europe for the fuel.

Gas flows from Norway rebounded after a one-day halt of the giant Troll field for annual tests on Wednesday, but are still below normal as seasonal works at a number of facilities continue. Shipments of Russian gas via the Nord Stream pipeline to Germany will continue to edge down on Thursday, grid data show.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.