European Gas Falls as Russia Expects No Further Supply Cuts

(Bloomberg) -- European natural gas prices declined, with Russia unlikely to cut flows to additional buyers after a dispute over payment terms demanded by Moscow.

Benchmark futures dropped as much as 8.9%. All customers have either paid for gas in line with the new terms, or have been informed they won’t receive more supply, according to a person familiar with the situation. Following a halt in flows to Shell Plc and Orsted A/S on Wednesday, no additional companies are expected to get cut off.

Gas Wars Deepen as Russia Curbs Supplies to More European Buyers

Gazprom PJSC’s export arm said that it would suspend supplies to the companies after they refused to accept the Kremlin’s decree that payments ultimately be made in rubles. This followed a halt to GasTerra BV in the Netherlands on Tuesday. Poland, Bulgaria and Finland have also had their flows cut due to the payments dispute.

For months, European companies have been navigating how to secure vital gas shipments without running afoul of EU sanctions on Russia following its invasion of Ukraine. The bloc has been divided on the matter, and EU guidance has left room for interpretation. Still, some of Europe’s biggest gas buyers have found ways to keep paying for Russian supplies.

The halted supply amounts to about 23 billion cubic meters, or about 15% of the total Russian flows to the EU, and should be “manageable given the strong LNG inflows we are seeing,” ING Groep NV said in a report.

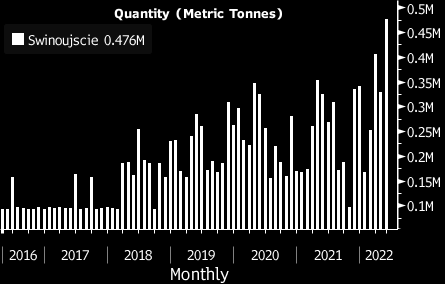

Poland’s liquefied natural gas imports surged to a record last month, as the nation also helps supply inland neighbors, such as Ukraine, and is seeking to boost its re-gasification capacity.

Demand Destruction

While LNG flows to northwest Europe have eased from April records, they are still well above seasonal norms. Consumption of gas is also low following the end of the winter months and amid higher-than-usual prices.

Industrial demand for gas in Europe has contracted about 15-20% from levels seen 4-5 years ago, according to Gyorgy Vargha, chief executive officer of MET International AG, a Switzerland-based trading company.

“Europe is paying high prices and demand destruction is forcing companies to rethink their industrial strategies,” he said. “It remains to be seen how multiple central banks, monetary policies will be reacting to economic stresses.”

Euro-zone inflation accelerated to an all-time high in May, driven by food and energy after the war in Ukraine sent commodity prices soaring.

Separately, shipments of gas to Germany via the Nord Stream pipeline, the biggest link from Russia to the EU, are expected to increase on Wednesday, based on orders. Supplies through Ukraine are likely to be stable.

The European gas front-month benchmark contract declined 5.5% to 88.81 euros per megawatt hour by 11:29 a.m. in Amsterdam. It closed on Tuesday at the highest level since May 18. UK prices fell 10%.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.