European Gas Slips With Focus on Russia’s Nord Stream Link

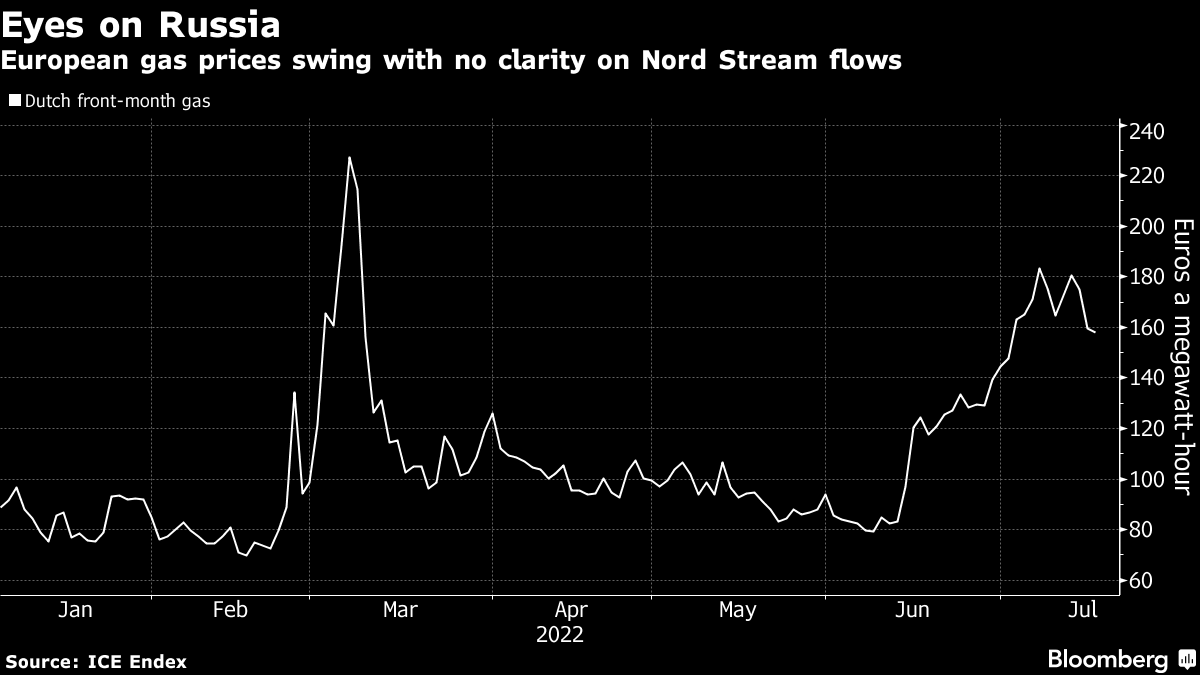

(Bloomberg) -- European natural gas prices swung between gains and losses, before settling lower, with traders weighing news on Russia’s exports and maintenance at its key pipeline to the continent.

Gazprom PJSC has declared force majeure on supplies to several European buyers, according to people familiar with the matter. The Russian gas giant, which had already been curbing shipments to Europe and has closed its main pipeline for maintenance, said in a letter dated July 14 that the force majeure notice applied to supplies over the past month.

In June, Russia slashed its exports to Europe via the major Nord Stream link, citing delays to gas-turbine maintenance because of Canadian sanctions against Moscow. One turbine was flown from Canada to Germany on Sunday and could arrive in Russia in about a week, Russia’s Kommersant newspaper reported Monday. There’s no clarity on what happens next, with some buyers and officials in Europe voicing concern that the pipeline -- halted for separate annual maintenance last week -- may not fully return once the work ends on July 21.

Read: Russian Gas Supply Halt Risks 1.5% Cut to EU’s GDP in Worst Case

“The market is reassessing the risk of Nord Stream 1 not reopening on Thursday,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S. “In addition, continued talk about the turbine being delivered from Canada has lowered the geopolitical temperature somewhat.”

Whether the part will be installed and shipments return to contractually obligated levels remains to be seen, he added.

Gazprom didn’t immediately comment on the force majeure. The clause allows a supplier to not fulfill its contractual obligations, essentially allowing it to cancel a delivery without being financially liable for a replacement.

Also: Russia Turns the Screws on Gas Market, Snubbing Transit Bookings

Curbed Demand

Dutch front-month futures settled 1.5% lower at 157.258 euros ($159.90) per megawatt-hour in Amsterdam, after gaining as much as 5.6% earlier. The UK equivalent declined 3.3%.

The market’s attention has also shifted to demand destruction, given ballooning costs and no relief in sight.

“All scenarios suggest that tight market conditions for natural gas are here to stay,” analysts at ABN Amro Bank NV said in a note. “The shortages in the market would partly be countered by demand destruction, but tight market conditions will likely remain for the coming years.”

European gas demand is already down 11% so far this year, despite use in power increasing by 10%, Rosaline Hulse, a senior gas analyst at Wood Mackenzie Ltd., said last week.

Read: Europe Must Slash Gas Demand Now Before ‘Hard’ Winter, IEA Warns

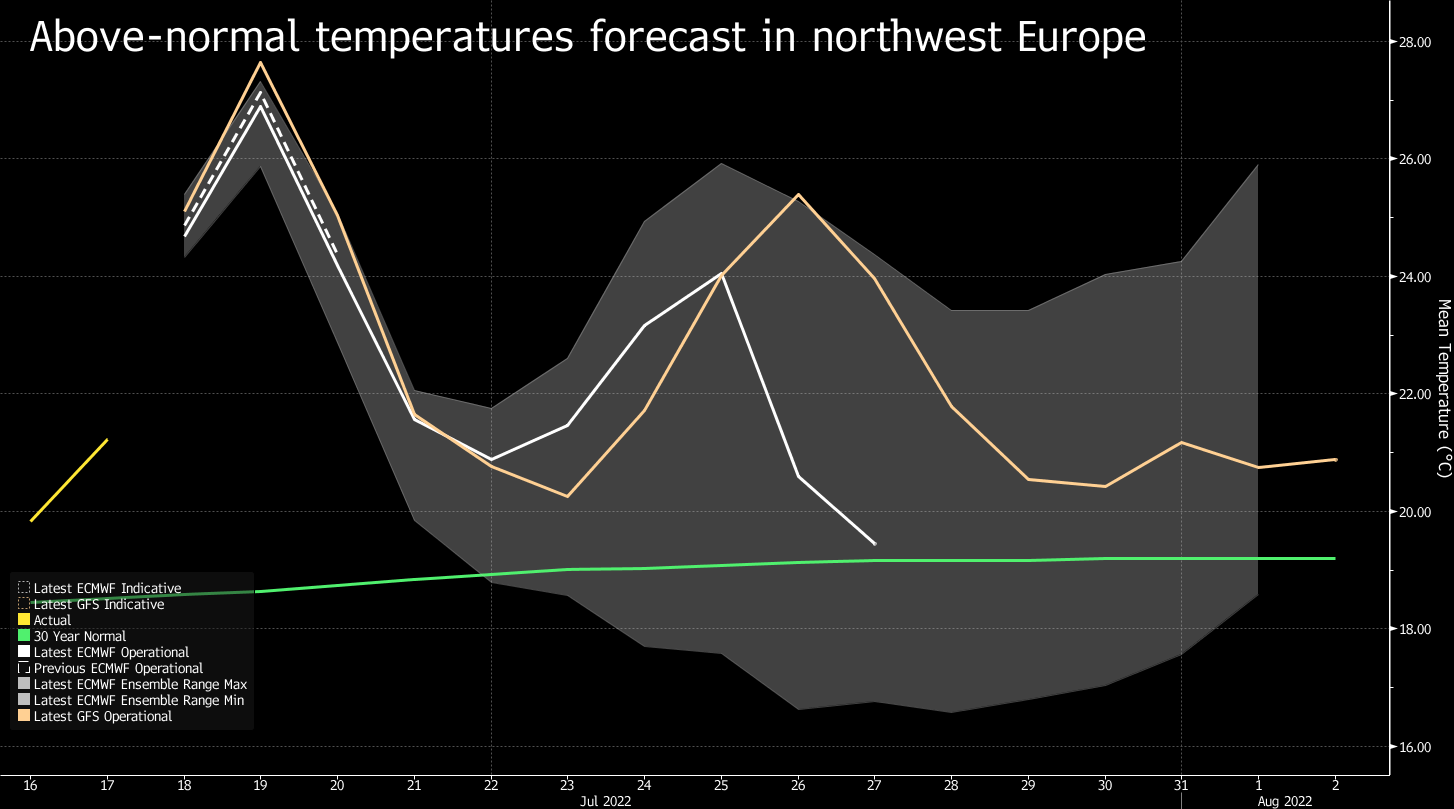

Meanwhile, temperatures in parts of the UK and France could rise to record levels Monday and Tuesday, according to forecaster Maxar. While this has raised solar power production -- Germany produced a record amount on Sunday and is set to exceed that level Tuesday -- it also cranks up demand for cooling. The heat wave is also boosting global liquefied natural gas prices.

Rising temperatures will hinder Europe’s ability to rebuild its gas inventories ahead of winter, Rystad Energy said in a note. European storage levels have improved since March but remain below normal for this time of year.

“Our updated scenarios show that Europe will probably be heading into the storm much earlier than previously thought -- and that the region will be under-prepared for the chaos it will bring,” it said.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.