European Gas Declines Amid Higher Russian Flows, Mild Weather

(Bloomberg) -- Natural gas prices in Europe declined as Russia’s shipments increased and weather forecasts pointed to milder temperatures in the region.

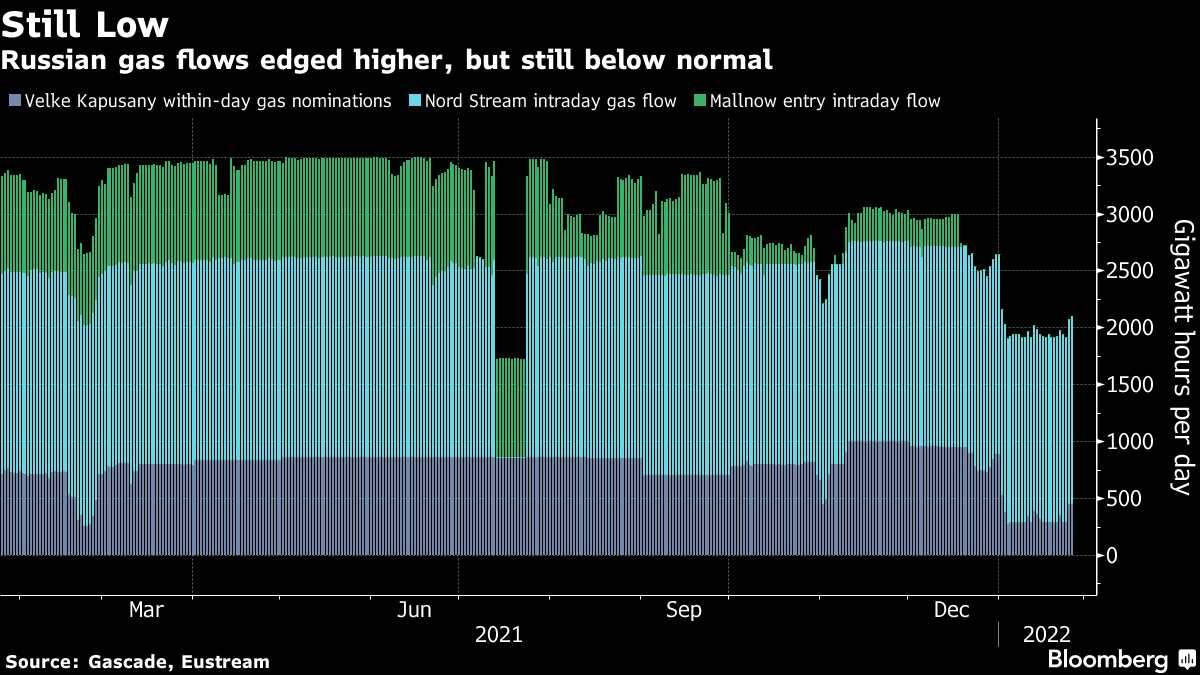

Orders to send gas through Ukraine via Velke Kapusany, a major entry point in Slovakia, rose to the highest level since Jan. 1, according to data from operator Eustream. Shipments still remain below normal. Above-average temperatures are expected across most of mainland Europe next week, Maxar said in an emailed report.

Traders are watching for any sign that Russia will bring some relief to the tight European gas market, amid concerns over escalating geopolitical tensions surrounding Ukraine. A conflict could potentially reduce gas flows into Europe at a moment when inventories on the continent run dangerously low and winter demand remains high.

Western allies are pushing ahead with diplomatic efforts to avert war as Russian troops mass on Ukraine’s borders. The U.S. is putting as many as 8,500 troops on heightened alert for deployment to bolster NATO forces in Eastern Europe if needed.

Despite higher Russian flows via Velke Kapusany, shipments are still below normal. Average flows in January last year were more than 760 gigawatt-hours a day, compared with 446 gigawatt-hours on Tuesday.

Meanwhile, gas demand for heating and power generation is expected to ease next week. Milder temperatures will coincide with high potential wind power production on the continent, according to a report from The Weather Co.

Benchmark futures traded 2% lower at 91.15 euros per megawatt-hour by 9:56 a.m. in Amsterdam, after dropping as much as 7.1% earlier. The contract closed 18% higher on Monday. The U.K. contract fell 1.7% to 221 pence a therm.

Ukraine Diplomacy

U.S. President Joe Biden held what he described as a “great” call with European leaders on Monday, and German Chancellor Olaf Scholz will discuss the Ukraine crisis with French President Emmanuel Macron in Berlin on Tuesday evening. Moscow has denied that intends to invade.

Defense Department spokesman John Kirby said that U.S. troops aren’t being deployed yet and wouldn’t be sent into Ukraine, noting that there is “there is time and space” for diplomacy.

What Would War in Ukraine Mean for Europe’s Energy Crisis?

A potential Russian invasion of Ukraine is a “clear and present threat” that’s hanging over the oil and gas market as supplies remain tight, said RBC’s Helima Croft at the Argus Crude Summit in Houston on Monday. The risk of an incursion in the next few weeks is “above 50%” and would lead to significant higher oil and gas prices, according to Croft.

Europe has recently received some relief from its energy crisis in the form of liquefied natural gas shipments. While the number of LNG tankers heading to the northwest part of the continent is still robust, shipments diverting to Asia signal flows may weaken.

At least 27 tankers are expected in Europe through the end of the month, according to ship-tracking data compiled by Bloomberg. However, diversions to Asia point to rising demand for the super-chilled fuel in that region. While European gas is still trading at a premium to Asian prices, the re-routing is a sign that the difference may soon shrink.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.