Russian Stock Market Rout Wipes Out $250 Billion in Value

(Bloomberg) -- Russian assets nosedived as military attacks across Ukraine prompted emergency central bank action and investors braced for the toughest round of Western sanctions yet, wiping out as much as $259 billion in stock-market value.

The ruble sank to a record low, the cost of insuring Russian debt against default soared to the highest since 2009, and stocks collapsed as much as 45% -- their biggest-ever retreat. The Bank of Russia said it will intervene in the foreign exchange market for the first time in years and take measures to tame volatility in financial markets.

Putin Orders Russian Attacks Across Ukraine in ‘Dark Day’

The military attack on Ukraine cast a shadow over global markets and sparked a fresh bout of risk aversion. Russian assets took the main blow after President Vladimir Putin ordered an operation to “demilitarize” Russia’s neighbor, prompting international condemnation and a U.S. threat of further “severe sanctions” on Moscow.

“The ball is now on the West’s side, we have to see how far sanctions go -- whether Russia will be kept in the global financial system” said Viktor Szabo, an investor at Aberdeen Asset Management Plc. in London

The Russian central bank made no mention of raising interest rates, but said it will provide additional liquidity to banks by offering 1 trillion rubles ($11.5 billion) in an overnight repo auction. Policy makers have increased the benchmark rate by 525 basis points in the past 12 months to tame inflation.

Putin Sanctions Mulled; Russia Enters Via Crimea: Ukraine Update

“Significant overshooting is possible, and the dollar-ruble at 100 certainly is well in range,” said Commerzbank AG strategist Ulrich Leuchtmann. “I don’t think that interventions will be the main instrument of choice. They can only prevent extreme overshooting. Rate hikes have to follow soon.”

Stocks and the ruble pared some losses in early afternoon trading in Moscow. After slumping as much as 9.4% the ruble was down 3.6% at 84.2250 as of 12:59 p.m. The MOEX index trimmed its loss to 25%. Shares of Sberbank PJSC, Russia’s biggest lender, were down 45% at 114 rubles. Gazprom PJSC traded 39% weaker.

Russia’s sovereign bonds plummeted, taking some to distressed levels, and the nation’s credit-default swap premium soared above 750. Ukraine’s 2033 dollar debt dived, lifting the yield to 88%, while the local currency market was suspended and limits were imposed on daily cash withdrawals.

So far, the response by the central bank is more measured than eight years ago when the conflict in Ukraine first flared.

Policy makers raised rates on the first working day after Russia’s parliament approved the use of its military in Ukraine in 2014. With oil prices falling later in the same year, the Bank of Russia ended up lifting its key rate to as high as 17% to defuse a currency crisis.

Oil Soars Past $100 as Russia Attacks Targets Across Ukraine

An increase in borrowing costs may be off the table for now, though a decision to hike rates in the future hinges on how the ruble fares, according to Piotr Matys, a senior currency strategist at InTouch Capital Markets Ltd. in London.

Should the ruble “relatively quickly reach and exceed” 100 against the dollar, the possibility of a rate hike may come into play, he said. Currency options see a more than 50% probability of the ruble touching 100 per dollar in the second quarter, data compiled by Bloomberg show.

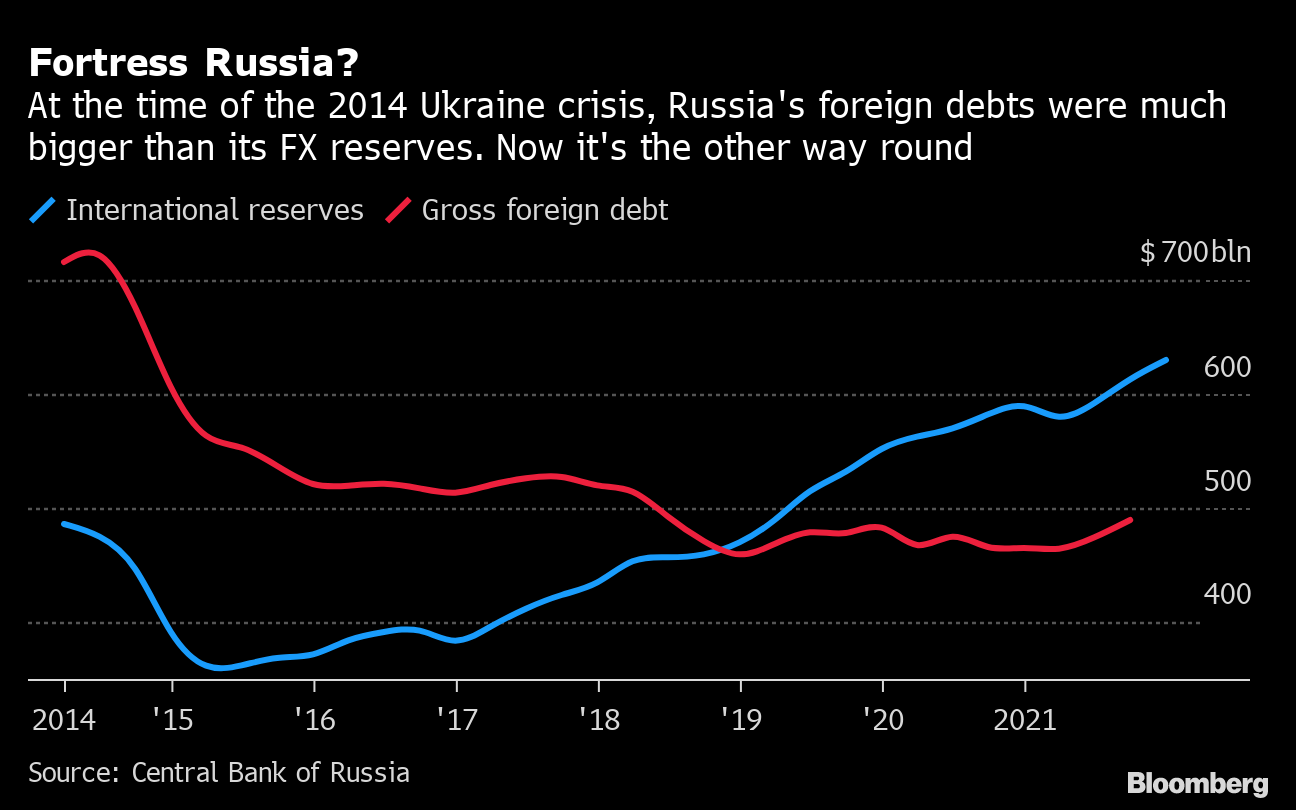

“The pace and the scale of ruble depreciation will be crucial,” he said. “Currency intervention is the first line of defense and the central bank amassed significant FX reserves to allow it to step in to slow down the pace of ruble depreciation. The second line of defense would be an emergency rate hike as witnessed at the height of the previous ruble crisis in 2014.”

Putin’s Financial Fortress Blunts Impact of Threatened Sanctions

The central bank may be asked for more support if major Russian companies and banks are targeted by the West. In a late-night statement, U.S. President Joe Biden said that he would announce “further consequences” for Russia later Thursday, in addition to sanctions unveiled earlier in the week.

Biden on Tuesday had set out a partial “first tranche” of sanctions — a modest package that underwhelmed political observers and financial markets -- then followed up with additional measures the following day, including sanctions against Nord Stream 2 AG, the company that built the $11 billion natural gas pipeline connecting Russia and Germany.

Russia’s central bank, which last conducted direct currency interventions in 2014, can resort to other measures to calm the market. Sofya Donets, economist at Renaissance Capital in Moscow, said its options include the possibility of imposing restrictions on cross-border capital flow and assets purchases, focusing especially on domestic ruble debt.

“It’s possible to assume, under the current scenario, that sanctions will be maximally tough,” bringing the central bank’s “political motivations” to the forefront, she said. “That makes them less predictable.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.