European Natural Gas Flows From Russia Ramp Up as U.S. Sanctions Skip Energy

(Bloomberg) -- European natural gas prices halted a record-breaking rally after Russia boosted flows to the continent and U.S. sanctions targeting Moscow excluded the energy sector.

Benchmark futures fell as much as 33%, after four consecutive days of gains. On Thursday, prices jumped 51%, the most since at least 2005, amid uncertainty over how Russia’s invasion of Ukraine would impact shipments.

The conflict -- the worst security crisis in Europe since the end of World War II -- has highlighted the continent’s energy-supply crunch, which has been under way for months due to low gas inventories. Russia is Europe’s biggest gas supplier, providing more than a third of the region’s needs. About a third of those shipments transit via Ukraine.

Utilities are ordering more of the fuel under long-term contracts with Gazprom PJSC. That’s because the deals are priced in such a way that Russian imports became cheaper than spot gas traded at European hubs. The development follows months of limited Russian exports.

“Gazprom’s month-forward contracts have been ‘out-of-the-money’ all year, keeping exports low,” analysts at BCS Global Markets said in a note. “That changed yesterday as prices jumped, and demand for Russian gas has risen sharply, and could well rise further in the coming days.”

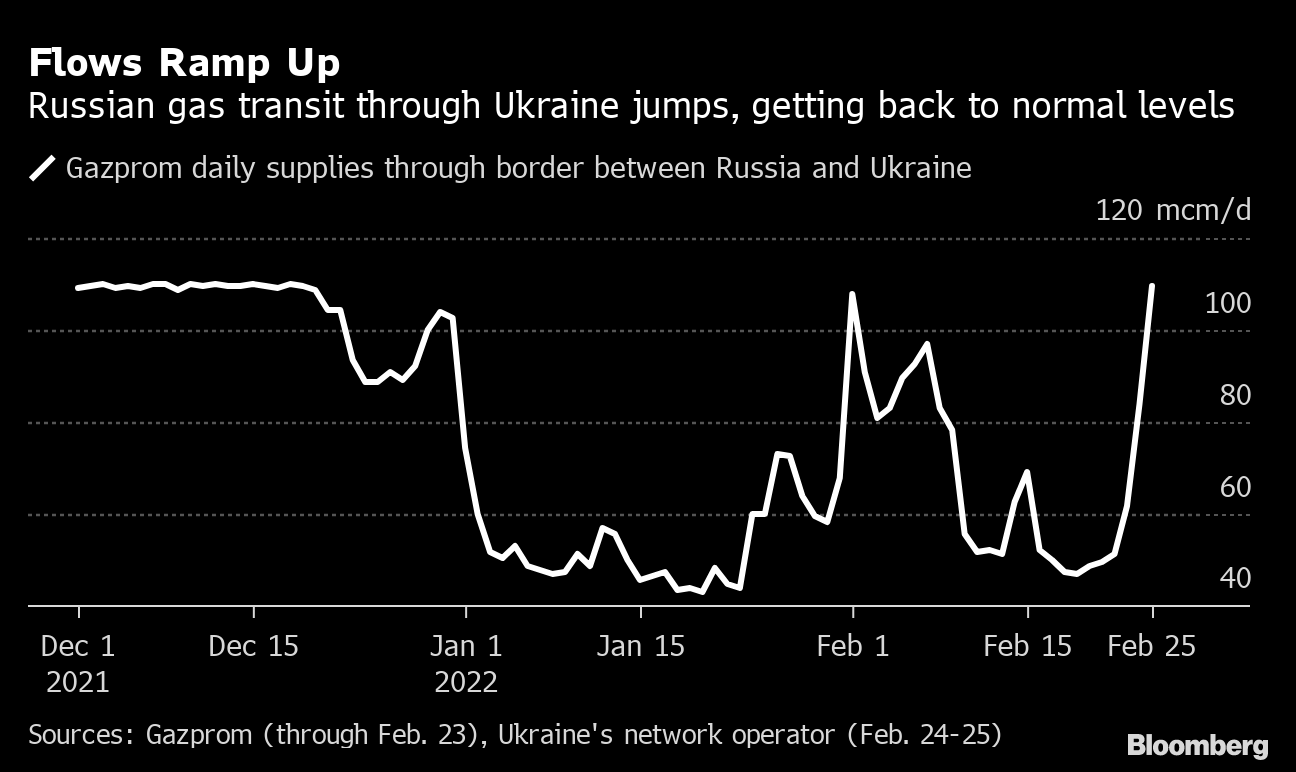

Gazprom has reiterated that gas transit via Ukraine is running as normal, and is increasing in line with client requests. Russian flows via Ukraine have rebounded to approach levels agreed in transit contracts. A key pipeline into Germany via Poland is not shipping any gas to Europe, and even if capacity bookings were made for later Friday, shipments have yet to restart after halting on Dec. 21.

Besides the economics behind higher European purchases of Russian gas, “there may also be a strategic component as buyers seek to buy now given a potential for disruption in flows or further price increases,” said Stefan Ulrich, an analyst at BloombergNEF.

Latest Sanctions

Ukraine’s foreign minister said earlier that Kyiv was hit with “horrific” rocket strikes as Russian troops pushed closer to the capital. Still, Ukraine’s president said his nation continued to resist, while Chinese President Xi Jinping spoke with Putin by phone and encouraged Russia and Ukraine to negotiate to “address problems,” China state TV said Friday.

The prospect of talks between Russia and Ukraine emerged later Friday but was quickly cast into doubt as the Kremlin said Kyiv had stopped responding after rejecting Moscow’s initial offer of a meeting in Minsk, the capital of Belarus.

The U.S. and U.K. have unveiled new penalties aimed at crippling Russia’s economy. The European Union also backed a broad sanctions package to limit Russia’s access to the region’s financial sector and restricting key technologies.

The Biden administration earlier defended its decision not to sanction Russia’s energy sector, with an official saying it was reluctant to disrupt an area “where Russia has systemic importance in the global economy.”

Russian gas exports through Ukraine jumped almost 38% on Thursday and are expected to increase further by about 30% on Friday, according to data from Ukraine’s grid operator.

“We believe that the risk of curtailment of Russian gas deliveries below its contractual commitment is limited unless there is a further material escalation of the crisis,” JPMorgan Chase & Co. analysts Vincent Ayral and Javier Garrido said in a report.

Dutch gas futures for March, the European benchmark, settled 30% lower at 94.422 euros a megawatt-hour. They still closed the week 32% higher.

German month-ahead power traded 32% lower at 203 euros a megawatt-hour. Coal prices dropped, while carbon emission allowances inched up.

Trade Finance

The conflict is showing the first signs of stifling trade in vital raw materials as the money that lubricates the flow of everything from crude oil to wheat is beginning to dry up.

Some European banks have begun to impose restrictions on commodity-trade finance linked to Russia and Ukraine, heaping pressure on traders who were already looking for additional credit and bracing for harsh western sanctions on Moscow.

“Europe is already facing a big headwind from its energy bill,” analysts from Citigroup Inc. said in an emailed note. “It is clear that the move in prices is going to quickly move to ration demand away from the marginal consumer; we suspect that we are not far off finding out who those marginal consumers are.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.