European Electricity Prices Soar as France Cuts Nuclear Forecast

(Bloomberg) --

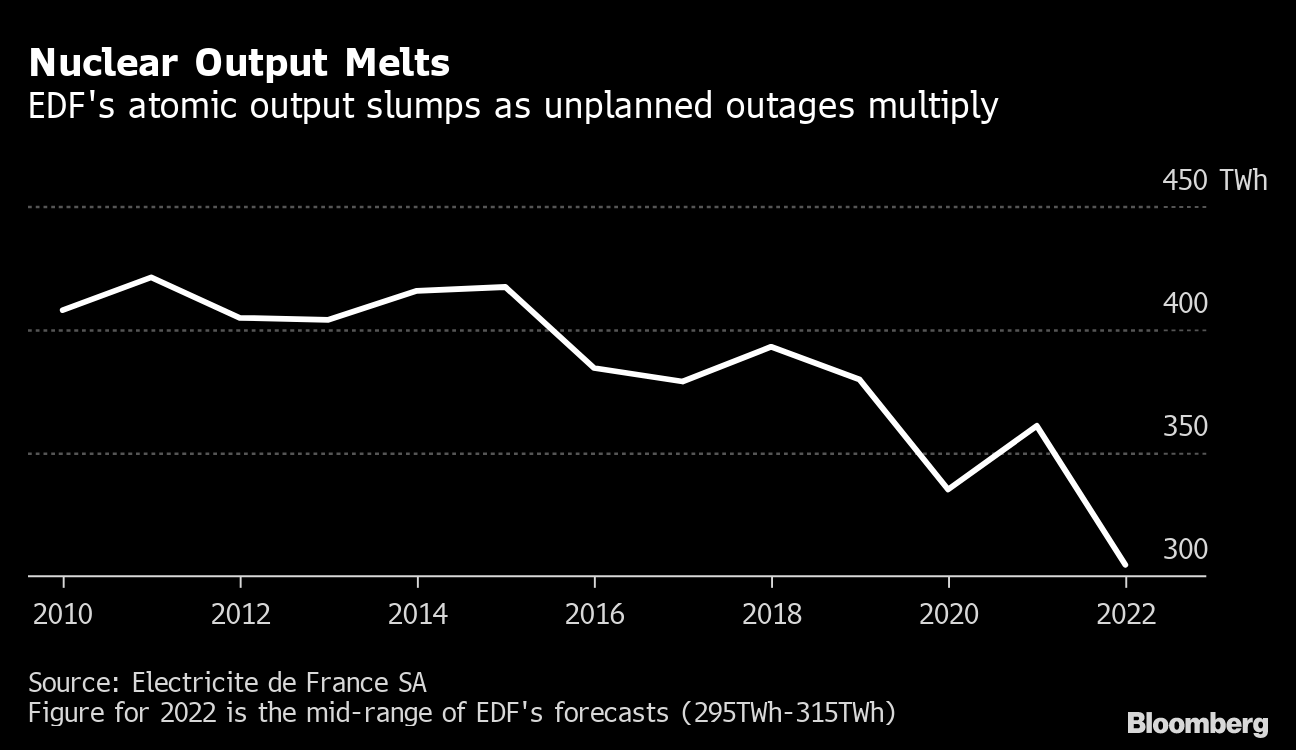

European electricity prices jumped after the regions biggest producer cut its nuclear output target for a second time in a month, the latest sign that this winter energy crisis is far from over.

Electricite de France SA said its nuclear production could fall this year to levels not seen since 1990, and Morgan Stanley says there is a meaningful likelihood of a production cut for 2023. The shortfall has forced France to import electricity at times, tightening supplies in neighboring countries used to relying on the French nuclear giant to keep the lights on.

EDF's reactors are the backbone of an increasingly integrated European power system, but the fleet is getting more unreliable because of long periods of planned and unplanned maintenance. A slew of recent outages has worsened the energy crisis in Europe just as Russia is flowing less natural gas to the continent and tensions over Ukraine are running high.

EDF said nuclear output is expected to fall to 295 and 315 terawatt-hours in 2022, down from an earlier forecast of 300 and 330 terawatt-hours. The last time the company's nuclear production fell below 300 terawatt-hours was more than three decades ago. Further cuts to next year's output could come when EDF reports results later this month, Morgan Stanley said in a report.

When the target is close to or under 300 terawatt-hours, it starts to raise concerns for next winter in terms of supply and demand, said Emeric de Vigan, chief executive officer at French energy analysis firm COR-e.

German power for next year, a European benchmark, jumped as much as 4.7% to 147 euros a megawatt-hour, while the March contract surged as much as 5.5%. The French contract for next year rose 7% to 162 euros, the highest level so far in 2022.

The French nuclear giant, once a source of national pride, has been grappling with several reactor outages that will hit earnings. Buying back 15 terawatt-hours of power at current prices will cost EDF 2.1 billion euros ($2.4 billion), or 8% of the company's market capitalization, said Ahmed Farman, an analyst at Jefferies Group said.

EDF shares fell as much as 4.5% in Paris.

“We think these announcements are detrimental for sentiment on the stock and may encourage investors to wait longer before re-engaging on the name, Morgan Stanley analysts including Arthur Sitbon said in a report.

French Nuclear Giant Fall Risks Energy Security for All Europe

France was Europe's biggest net exporter of power in the second half of last year, sending the equivalent of 10% of its demand abroad, according to industry consultant Enappsys Ltd. Less nuclear output in 2022 will probably cut exports to nations from Germany and the U.K., increasing their exposure to high gas and coal prices for its power plants.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.