Energy Prices Surge on Ukraine With Oil Closing In on $100

(Bloomberg) -- Energy prices surged after Russian President Vladimir Putin signed an order to send what he called “peacekeeping forces” to the two breakaway areas of Ukraine that he officially recognized on Monday.

European natural gas led gains in commodities, jumping as much as 13%. Brent oil was closing in on $100 a barrel, and German power and coal prices rose. Russia’s move is a dramatic escalation in its standoff with the West over Ukraine, with the U.S. and the U.K. saying they plan to announce new sanctions as soon as Tuesday.

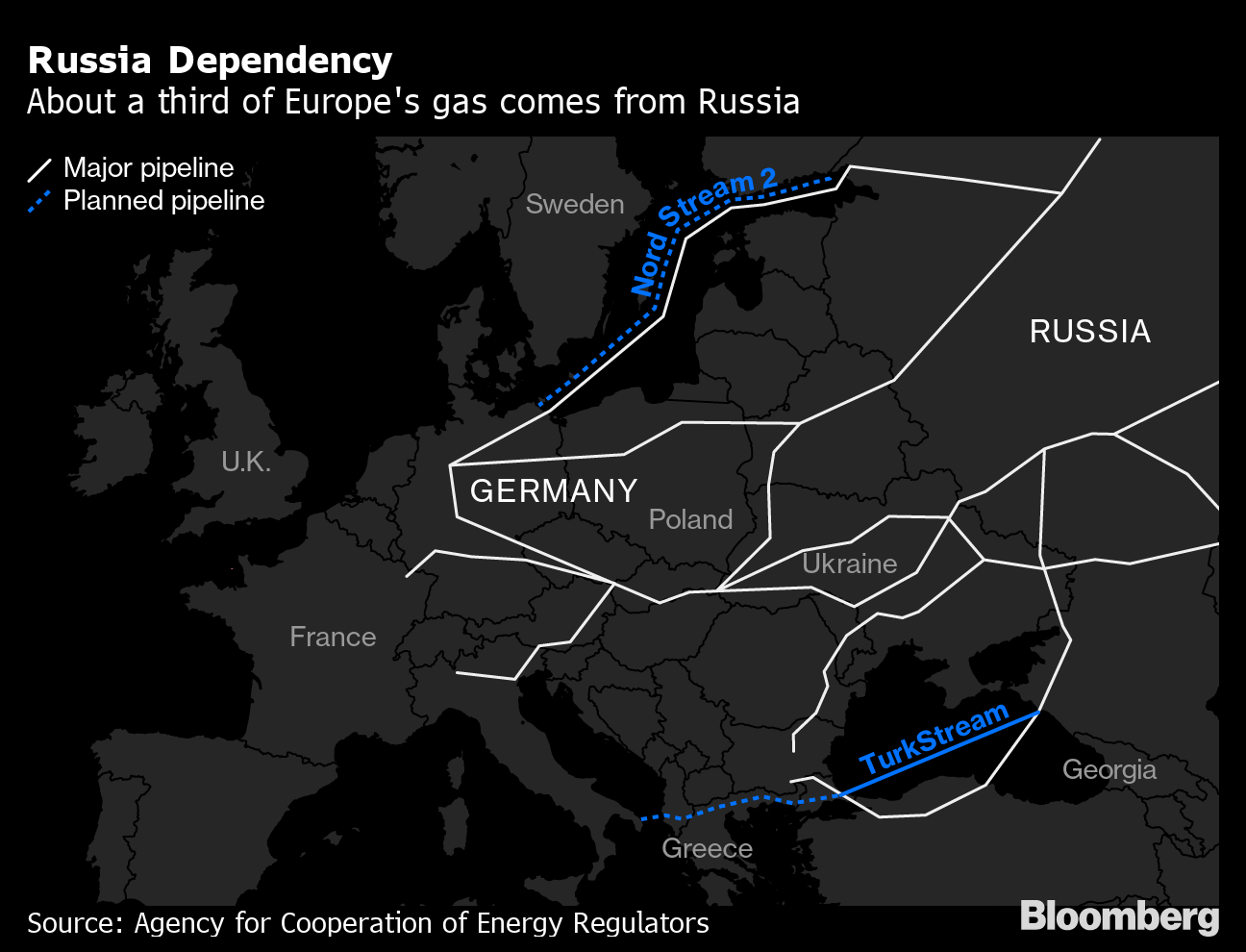

There were no details on how many troops might go in, or when, but a conflict could threaten Russian energy supplies. The country is the biggest provider of gas to Europe, about a third of which typically travel through pipelines crossing Ukraine, and a major exporter of everything from crude oil to refined products.

Sanctions could also disrupt energy flows, with any curbs to Russia’s ability to trade in foreign currency having the potential to upend commodity markets from oil and gas to metals and agriculture.

“This means yet higher gas prices for longer as the market has already been very nervous for months,” said Katja Yafimava, a senior research fellow at the Oxford Institute for Energy Studies. “Some U.S., EU sanctions are likely to follow.”

Dutch gas futures, a European benchmark, were 5.9% higher at 76.85 euros a megawatt-hour by 10:43 a.m. in Amsterdam. Brent crude jumped to a high of $99.50 a barrel. German power for next year increased as much as 3.8% and European coal rose 4.4%.

Energy Crisis

Energy markets have been on edge for weeks, swinging with every twist and turn in the standoff between the West and Moscow. Europe has been grappling with a gas supply crisis that’s sent prices quadrupling in the past year. The tensions have added to oil’s blistering rally that’s also been driven by output not being able to keep up with steadily rising demand.

“The current move higher is a natural knee-jerk reaction on very high levels of uncertainty,” said Paul Horsnell, head of commodities strategy at Standard Chartered. “Base case is perhaps still a sharp spike higher and then a significant correction lower if energy sanctions prove limited” or countries release strategic oil stockpiles to curb prices.

Also see: Russian Forces in Ukraine to Be Far Away From Key Oil Pipeline

Russia has been keeping gas flows to Europe capped since the summer, having curbed sales in the spot market and failed to fill its storage sites in the European Union before the winter. Europe has avoided the worst prediction for the crisis including rolling blackouts, but the region still depends on Russia for a third of its gas needs.

Russia’s Energy Minister Nikolay Shulginov said Tuesday that the country aims to keep gas flows uninterrupted, including LNG shipments.

There are also concerns that sanctions could target the suspension of the controversial Nord Stream 2 pipeline linking Russia to Germany and bypassing Ukraine. The pipeline’s approval process has been on hold since the end of last year as the operator tries to comply with European Union rules as requested by the German energy regulator.

German Foreign Minister Annalena Baerbock said Friday that Nord Stream 2 would be part of a sanctions package if Russia invades Ukraine.

Treaties

The treaties Putin signed with the two self-declared republics allow Russia to both send troops and build military bases in the separatist zones, according to texts submitted to parliament for ratification. RussAlso see: Russian Forces in Ukraine Are Far Away From Key Oil Pipelinea plans to recognize separatists claims over the entire Luhansk and Donetsk Oblasts, Interfax reported, citing State Duma member Leonid Kalashnikov. Russia denies it plans to invade Ukraine.

Russia Parliament to Ratify Separatist Treaties: Ukraine Update

European Union ambassadors meet Tuesday to discuss a plan for sanctions in response to Putin’s decree. Commission President Ursula von der Leyen said in a Tweet that Russia’s recognition of the two separatist territories is “a blatant” violation of international law, Ukraine’s territorial integrity and the Minsk agreements.

“The EU and its partners will react with unity, firmness and with determination in solidarity with Ukraine,” she said.

The U.S. and its allies continue to warn it could soon invade its neighbor, and just what sanctions the West chooses to impose will be key for commodity markets. Over the weekend British Prime Minister Boris Johnson said that the U.K and U.S. could stop Russian companies from trading in pounds and dollars if Moscow went through with an attack.

But Europe is in a much better position to face gas supply disruptions now than at the end of last year. Mild weather and a fleet of U.S. liquefied natural gas slowed withdraw from storages, and inventories that had fallen to a record should be back within the five-year range before the end of the month.

“We believe there is a sufficient inventory buffer for TTF prices to continue to slide lower over the European summer,” JPMorgan Chase & Co. said in a report, referring to prices on the Dutch Title Transfer Facility, Europe’s biggest hub.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.