France to Curb Nuclear Power as Europe’s Crisis Worsens

(Bloomberg) -- Electricite de France SA said it’s likely to extend cuts to nuclear generation as scorching weather pushes up river temperatures, bringing the energy crisis in the European Union’s second-largest economy into sharp focus.

Europe’s biggest producer of atomic energy, usually a net exporter of power for most of the year, is importing now. The nuclear issues are not just a problem for France but for countries such as neighboring Germany, which may have to burn more gas to keep the lights instead of preserving the fuel in storage for winter.

The French utility said late Tuesday that power stations on the Rhone and Garonne rivers will likely produce less electricity in the coming days, but there will be a minimum level of output to keep the grid stable. A heat wave is pushing up river temperatures, restricting the utility’s ability to cool the plants.

The reductions threaten to further push up power prices, which are already near record levels in France and Germany. Europe is suffering its worst energy crunch in decades as gas cuts made by Russia in retaliation for sanctions drive a surge in prices.

Europe’s Rhine River Is on the Brink of Effectively Closing

The French rivers are part of a wider problem in Europe which has been beset by weeks of dry, hot weather.

In Germany, the Rhine is on the brink of having to close to commercial traffic at a key waypoint because it’s become too shallow for barges to pass. That’s stymieing the flow of coal that’s increasingly needed for power generation since Russia reduced flows of gas on the Nord Stream pipeline.

Navigation has also become harder on the Danube, while Italy’s longest river, the Po, is too low to water farm fields.

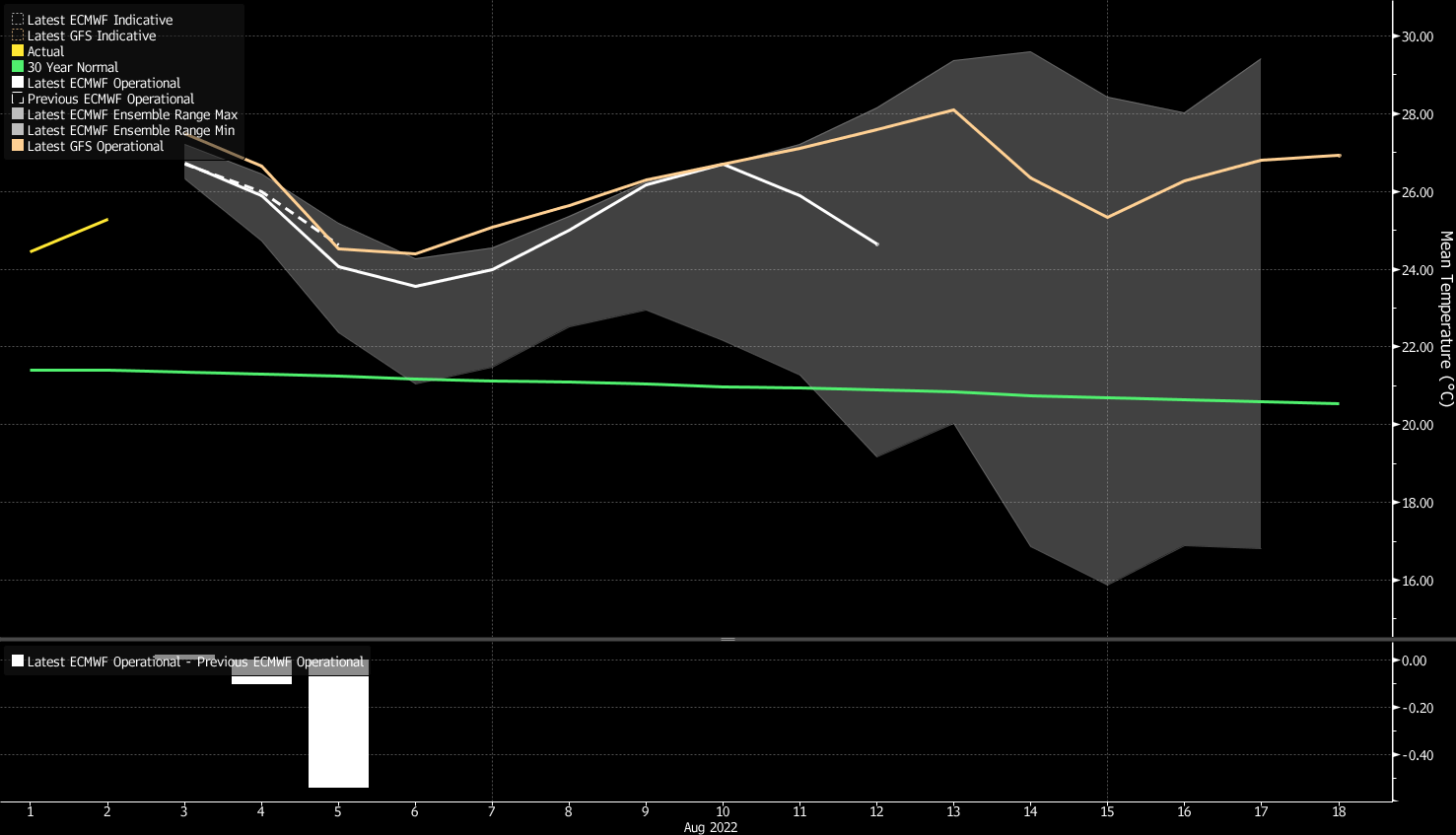

Temperatures in Paris will hit 36 degrees Celsius (97 Fahrenheit) on Wednesday, while “strong heat” will linger in France and Germany for the next five days, according to forecaster Maxar Technologies Inc. Levels will remain way above average for the next two weeks, according to Bloomberg’s Model as shown below:

Under French rules, EDF must reduce or halt nuclear output when river temperatures reach certain thresholds to ensure the water used to cool the plants won’t harm the environment when put back into waterways.

Restrictions have been in place at various times during the summer already. The latest warnings include curbs at the St. Alban plant from Saturday, according to a filing. The facility will operate at a minimum of 700 megawatts, compared with a total capacity of about 2,600 megawatts. Reductions are also likely at the Tricastin plant, where two units will maintain at least 400 megawatts.

The embattled utility has estimated that output this year will be the lowest in more than three decades as multiple plants are shut for maintenance and checks. Its troubles are forcing the nation, traditionally an exporter, to rely on imports from neighbors including the UK, which is facing its own energy crisis.

European Power Hits Record as Extreme Heat, Drought Parch Europe

The market was given some relief on Wednesday as France’s nuclear capacity rose to 49%, from 44% on Monday, as two reactors restarted, according to Bloomberg calculations using data from grid operator RTE.

German year-ahead power retreated slightly from yesterday’s record high of 405 euros ($412.84) to 398 euros per megawatt-hour on the European Energy Exchange AG. The equivalent French contract hadn’t yet traded.

(Updates details on other rivers from fifth paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.