German Power Prices Smash Record as Energy Panic Engulfs Europe

(Bloomberg) -- European gas and power prices surged as panic over Russian supplies gripped markets and politicians warned citizens to brace for a tough winter ahead.

Benchmark gas settled at a record high, while German power surged to above 700 euros ($696) a megawatt-hour for the first time. Russia said it will stop its key Nord Stream gas pipeline for three days of repairs on Aug. 31, again raising concerns it won’t return after the work. Europe has been on tenterhooks about shipments through the link for weeks, with flows resuming only at very low levels after it was shut for works last month.

“The catastrophe is already there,” Thierry Bros, a professor in international energy at Sciences Po in Paris, said. “I think the major question is when EU leaders are going to wake up.”

In one of the most dire warnings yet, Belgian Prime Minister Alexander De Croo said Europe could face up to 10 difficult winters. It would put sustained stress on major economies and leave thousands of households struggling to pay their bills. Concerns over the economy pushed the euro currency to a two-decade low on Monday, while inflation is at the highest in years.

Europe finds itself in a precarious situation with the official start of the winter heating season just over a month away. Nations are rushing to fill storage sites, but they are still heavily dependent on Russian gas and any further cutbacks could make rationing a reality.

French President Emmanuel Macron warned people of the potential hardships in the coming months, and asked them to “accept paying the price for our freedom and our values,” he said in a speech Friday commemorating the liberation of a town in southern France in World War II.

Germany’s circumstances are particularly urgent: the country’s dependence on Russian gas leaves it vulnerable as it desperately searches for alternative supplies. The nation is considering restarting coal-fired power plants and may extend the life of remaining nuclear power plants, while urging gas conservation. Industries in Europe’s biggest economy are already take a major hit.

Read: Germany May Resort to Nuclear Plants to Plug Russian Gas Gap

“Being the powerhouse of Europe, the combination of industrial exposure, married with energy intensive industries, means that there could be a significant hit to Germany as the crisis continues,” said Martin Devenish, a former Goldman Sachs Group Inc. managing director who now works for S-RM Intelligence & Risk Consulting Ltd. “The currency markets are already pricing in a fair amount of risk in Europe, and that’s partly energy related”.

If the energy crisis worsens, a recession is likely next winter, Bundesbank Chief Joachim Nagel said over the weekend. Further gas supply cuts could be coming, German Economy Minister Robert Habeck said, reiterated a call to conserve energy. “We have a very critical winter right in front of us,” he told public broadcaster ZDF in Montreal, during a visit to Canada with Chancellor Olaf Scholz. “We must expect Putin to further reduce gas.”

Also see: How Europe Became So Dependent on Putin for Its Gas: QuickTake

On Friday, Gazprom said works are needed in the only functioning turbine that can pump gas into Nord Stream. The pipeline has been operating at only 20% capacity for weeks and European politicians insist the curbs are politically motivated. Russia’s Gazprom PJSC said volumes would return to that level following the latest shutdown.

“The market may disregard Gazprom’s comments and start to consider whether the pipeline may not return to service, or at the very least may be delayed for any given reason,” said Biraj Borkhataria, an analyst at RBC Capital Markets.

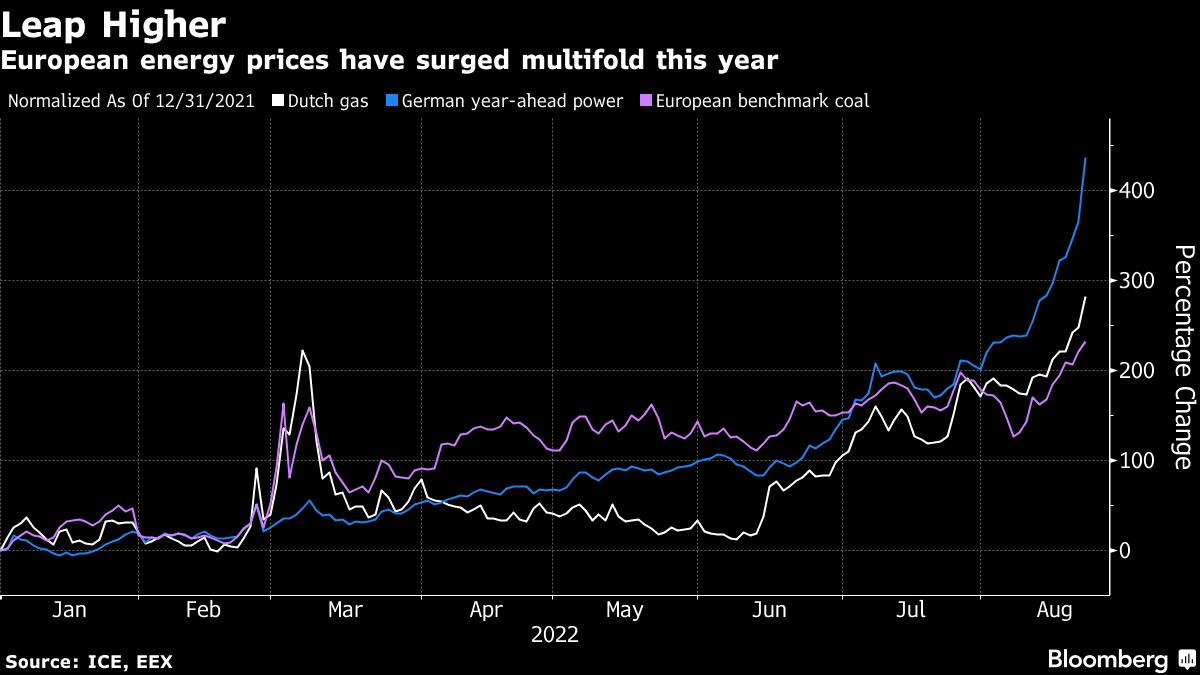

Prices Surge

The Dutch front-month contract, the European benchmark, settled 13% higher at 276.75 euros a megawatt-hour. Prices are about 15 times the average for this time of the year. The UK equivalent surged 14%.

Benchmark German year-ahead power rose 14% after earlier hitting a record 710 euros per megawatt-hour, while the French contract closed 10% higher to 801 euros. Coal futures also reached unprecedented levels. The near-term electricity market’s tightness is being compounded by nuclear reactor availability in France at near the lowest in years.

Over the weekend, German leaders said the country may struggle to replace dwindling gas supplies from Russia. The government is targeting a 20% reduction in consumption. While the country is one of the worst hit by Moscow’s cuts with the economy on the bring of a recession, the energy crisis has reverberated through the continent.

“Europe is now facing a parallel gas and power crisis,” Timera Energy said in a report. “We’ve run out of adjectives to describe the pace of this price surge.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.