European Gas Slides With Easing Fears Over Russian Supply Cuts

(Bloomberg) -- Natural gas prices in Europe declined as fears eased about supply disruptions resulting from Russia’s decision to shift payments to rubles.

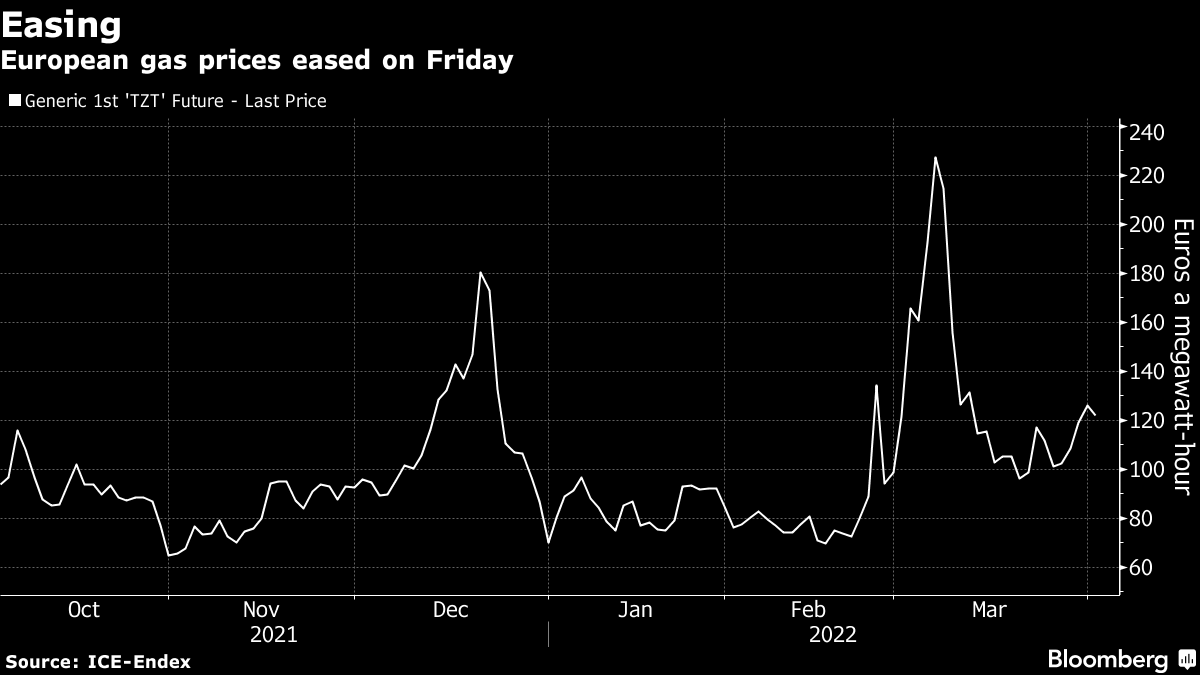

Benchmark gas futures settled 11% lower, trimming this week’s gains. The Kremlin said gas will continue to flow with payments for fuel supplied from April 1 only due by the end of the month. President Vladimir Putin’s demand to be paid in the Russian currency has been affecting the market for days, with traders on edge about how that may affect supplies.

Buyers were still looking for clarity on how the new system will work. French Ecology Minister Barbara Pompili said she didn’t see the request as a breach of contract as companies would still to be able to pay in euros. The German government was studying details, while Denmark condemned the plan. Gazprom PJSC said it has started notifying clients about the new rules, and companies were analyzing the communication.

“Energy futures will continue to receive direction from any developments surrounding the ruble payment,” consultant Inspired Energy said in a report.

Foreign buyers will need to open special ruble and foreign currency accounts with Russia’s Gazprombank JSC to handle payments, according to a Kremlin decree on Thursday. Consumers still have time to sort out the system with Kremlin spokesman Dmitry Peskov saying payments for Russian gas supplied from April 1 only due late in the month or early May.

Dutch gas for next month closed lower at 112.15 euros a megawatt-hour in Amsterdam, trimming the first weekly rise in a month to 11%. The equivalent contract in the U.K. dropped 14%.

“There is no clarity yet on how Russia’s decision will impact gas supplies, what it will mean for buyers, it is still uncertain,” said Sam Arie, an analyst at UBS Group AG. “If Europe has to replace all Russian gas imports in a short timeframe, it will be very difficult and could have a material economic impact.”

Traders will also be keeping a watch on the weather, with cold temperature over the next week likely to boost gas demand for heating. Below-normal temperatures are seen across most of Europe at the start of next week, Maxar said in a report.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.