European Gas Drops as Buyers Eye Options to Keep Russian Supply

(Bloomberg) -- Natural gas prices in Europe declined as buyers considered options to keep receiving supply from Russia without violating sanctions.

The most-widely traded June contract closed 7.2% lower, following gains in the previous two days. In the strongest sign yet of workarounds to meet Moscow’s demand for ruble payments, Hungary confirmed that it is sending euros to Gazprombank JSC, which it is then allowing to be converted into the local currency. Italy’s Eni SpA is preparing to open ruble accounts with the Russian bank.

The payments issue, which has been hanging over the market for weeks, escalated dramatically on Wednesday after Moscow cut off supplies to Poland and Bulgaria for failing to comply with its new mechanism. The Kremlin has said that flows to other buyers who don’t pay in rubles could also stop.

European Union officials on Thursday warned companies that opening ruble accounts would breach the bloc’s sanctions on Russia. But it may be possible to keep buying gas if they only pay into an euro account and declare the transaction complete, the officials said. Moscow’s decree, however, stipulates that a payment is considered to be done only after the funds have been converted into rubles.

“The market seems to be adopting the view that gas will continue to flow from Russia and that a compromise can be found,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S. “Russia needs the money and Europe, especially Germany, most certainly needs the gas. So despite the war, some solution seems likely.”

Benchmark futures for June closed lower at 99.84 euros per megawatt-hour in Amsterdam. The equivalent contract in the U.K. declined 22%.

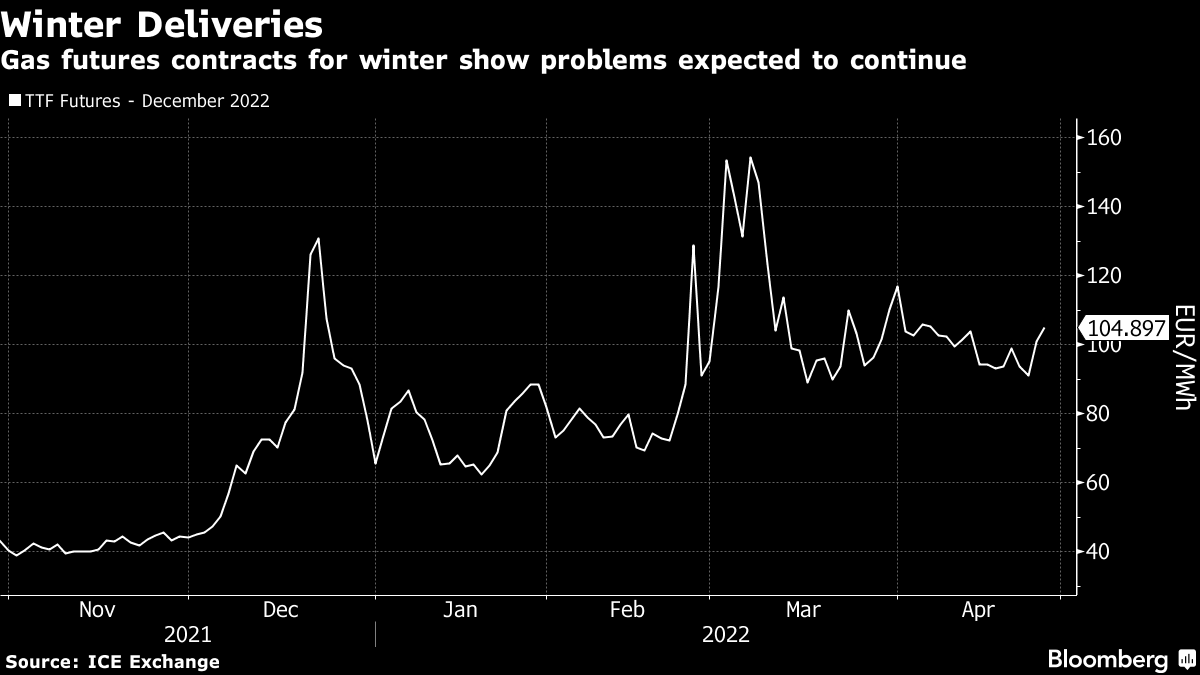

Winter Prices

Prices have been kept in check by high levels of liquefied natural gas imports into Europe easing supply concerns should Russian flows be disrupted further. The flows are making U.K. gas prices for May and June cheaper than later contracts, consultant Inspired Energy Plc said. At the same time, demand is ebbing with the end of the peak winter heating period.

Orders for Russian gas via Ukraine were steady for Thursday, but remain far below capacity. Orders for supply from Germany to Poland via the Yamal-Europe pipeline have risen as the eastern European country seeks supplies after Russia halted flows. Germany’s reliance on Russian gas means Poland’s energy security is still indirectly tied to Moscow.

The war in Ukraine and efforts to isolate Moscow have made European nations rush to find alternative to Russian energy. But that supply still accounts for about 40% of the European Unions’ gas requirements, and replacing it would be an immense task. Disruptions would make it much harder for the region to refill its storage sites over the summer in preparation for next winter.

That risk is showing in persistently high prices for gas to be delivered in the coming winter, Hansen said. It is “a clear sign that the market will remain challenged in its efforts to boost storage during the coming months” while trying to avoid Russian supplies, he said.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.