Europe gas prices ease as market sees continued flows to Germany

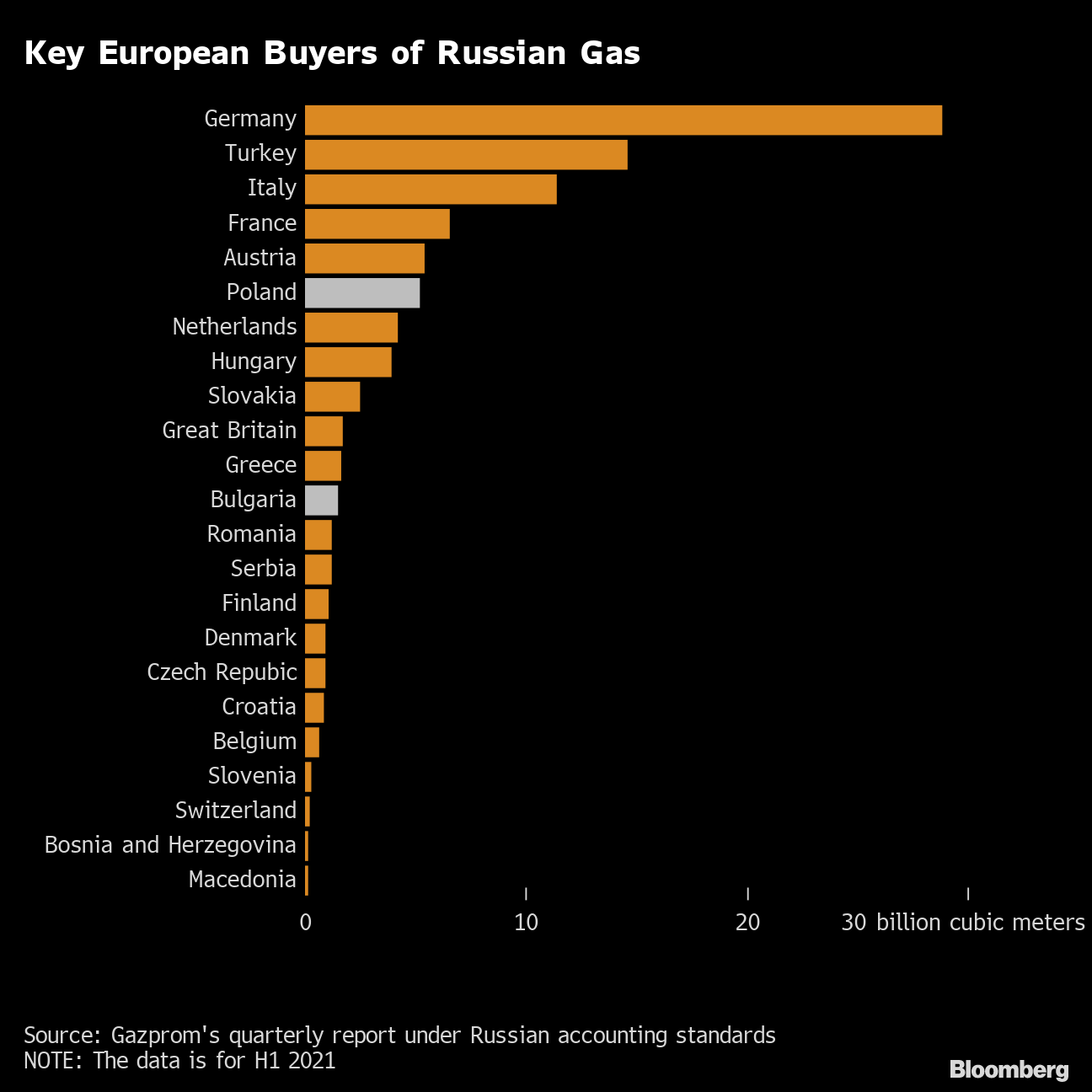

(Bloomberg) -- European gas pared gains, as traders bet that top-buyer Germany will continue to receive shipments from Russia, following a halt in flows to Poland and Bulgaria amid a dispute over fuel payments.

German utility Uniper SE reiterated that it’s possible to pay for Russian gas in euros while remaining in compliance with Moscow’s demand for rubles. The company said it’s in close contact with the German government on the issue.

The comments come after Russia’s Gazprom PJSC suspended flows to Bulgargaz and Poland’s PGNiG. It will keep those shipments turned off until the two countries agree to pay in the Russian currency, the producer said in a statement.

Read: Germany Says It’s Meeting Now With EU Partners on Gas Supplies

The developments illustrate the high-stakes brinkmanship underway over Europe’s energy supplies following Russia’s invasion of Ukraine and a raft of sanctions aimed at isolating Moscow. Russia is the European Union’s largest gas provider, and the bloc is now racing to find alternative supplies.

Benchmark Dutch futures traded 5.6% higher at 109 euros per-megawatt hour by 12:44 p.m. in Amsterdam, after initially jumping 24%. The U.K. equivalent rose 1.5%.

“The market is still working out where it stands,” said BloombergNEF analyst Stefan Ulrich, adding that it was “already pricing in significant disruption to Russian gas supplies.”

President Vladimir Putin last month demanded that “unfriendly” buyers pay in rubles or risk a cut-off in gas shipments. The EU has suggested that companies could keep paying in euros, or risk violating sanctions. Buyers are now trying to figure out how to respond, with payments due in late April or May.

Four European buyers have already paid for supplies in rubles and ten companies have opened accounts at Gazprombank to meet Putin’s payment demands, according to a person close to the Russian producer.

Modest Impact

The halt in Russian flows to Poland and Bulgaria should have “only modest physical impact” on northwest European gas balances, according to Goldman Sachs Group Inc. analysts led by Samantha Dart.

Read: Germany Won’t Manage Without Russian Gas Supply, Uniper Says

Orders for gas flowing from Germany to Poland via the Yamal-Europe pipeline surged Wednesday, data from network operator Gascade show. Shipments via the Nord Stream pipeline to Germany were little changed from a day earlier, flowing at about the link’s capacity, according to data from the operator.

Gas transit to Hungary is going according to plan, and the country has devised a way to pay Gazprom for it, Foreign Minister Peter Szijjarto said in a video message on social media. Austrian oil and gas company OMV AG said imports haven’t been disrupted by the halt to Poland and Bulgaria.

Orders for Russian gas via Ukraine were again muted, though Gazprom said flows are in line with client requests.

Read: Europe Needs to Speed Up Energy Independence Path, Galan Says

Poland’s government said Tuesday that it has enough fuel in storage to withstand the supply disruption. Bulgaria has secured gas for at least a month, according to its energy minister.

Poland will miss out on 7 billion cubic meters of gas for the remainder of the year and Bulgaria 2-3 billion, according to German utility Uniper SE. It should be possible to replace these flows with LNG and other supplies without too much of an impact, Chief Commercial Officer Niek den Hollander said.

Other Supplies

Elsewhere, capacity at Norway’s giant Troll gas field is set to be lower in early May than previously planned according to network operator Gassco AS. Flows via the Interconnector pipeline between the U.K. and Belgium have been curbed since Sunday due to works.

The end of the heating season in Europe this month has also reduced the need for immediate supplies, though buyers are now starting to fill storage sites for next winter.

German power for next month delivery also curbed its advance after jumping as much as 30% to the highest level since the start of April.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.