China’s Solar Polysilicon Giants Are Expanding as Profits Surge

(Bloomberg) -- Chinese producers of the key material for solar panels are planning major expansions as demand stays strong despite high prices, sending profits soaring.

Tongwei Co. on Monday announced first quarter net profit of 5.19 billion yuan ($792 million), about six times higher than the same period last year. That came just a few days after Daqo New Energy Inc. beat estimates with revenue of $1.28 billion in the quarter, 42% of which was net profit.

The firms are no. 1 and no. 2 in global polysilicon production, according to BloombergNEF, and now is the best time in years to produce the super-conductive material that solar panels are made of. Prices averaged about $32 a kilogram in the first quarter, up from $13 in the same period in 2021, and both companies said they expect pricing to remain strong this year, even as new capacity is expected to come online.

That’s propelling expansion within the companies. Daqo completed a project at the end of last year to bring its annual capacity to 105,000 tons, and plans to complete another 100,000-tons-a-year factory in the first half of next year. Tongwei said Monday it would raise its capacity targets, with plans to grow from 180,000 tons at the end of last year to as much as 1 million tons by 2026.

Long-term optimism over global solar demand prevails, although polysilicon prices could come under pressure starting from the second half of this year as new factories come online, Morgan Stanley analysts including Simon Lee said in a note on Monday.

Still, the firms should be able to lean on the technological advantages gained from being industry leaders. Daqo is the main Chinese supplier of so-called “n-type” polysilicon used in more advanced solar cells. It expects market share of the material to grow from less than 10% this year to as much as 50% in 2024. The new factory it opens next year will produce 100% n-type material, whereas it might take two to three years for new entrants to build up the same expertise, Jefferies analysts including Johnson Wan said in a note on Friday.

Moreover, the boost to polysilicon capacity may not fully match the surge in solar demand. The ambitious solar installation tenders recently announced by state-owned energy companies, China’s major renewable developers, has continued to lift prices for solar panels and the rest of the supply chain, according to industry media Solarbe. Market demand for solar products could continue to rise and prices for polysilicon will remain high throughout the fourth quarter if the SOEs don’t lower their installation targets this year, the report said.

Today’s Events

(All times Beijing unless shown otherwise.)

- China Offshore Wind Power Conference, Guangzhou, day 1

- EARNINGS: Xinjiang Goldwind, Ganfeng Lithium, WH Group, Chalco

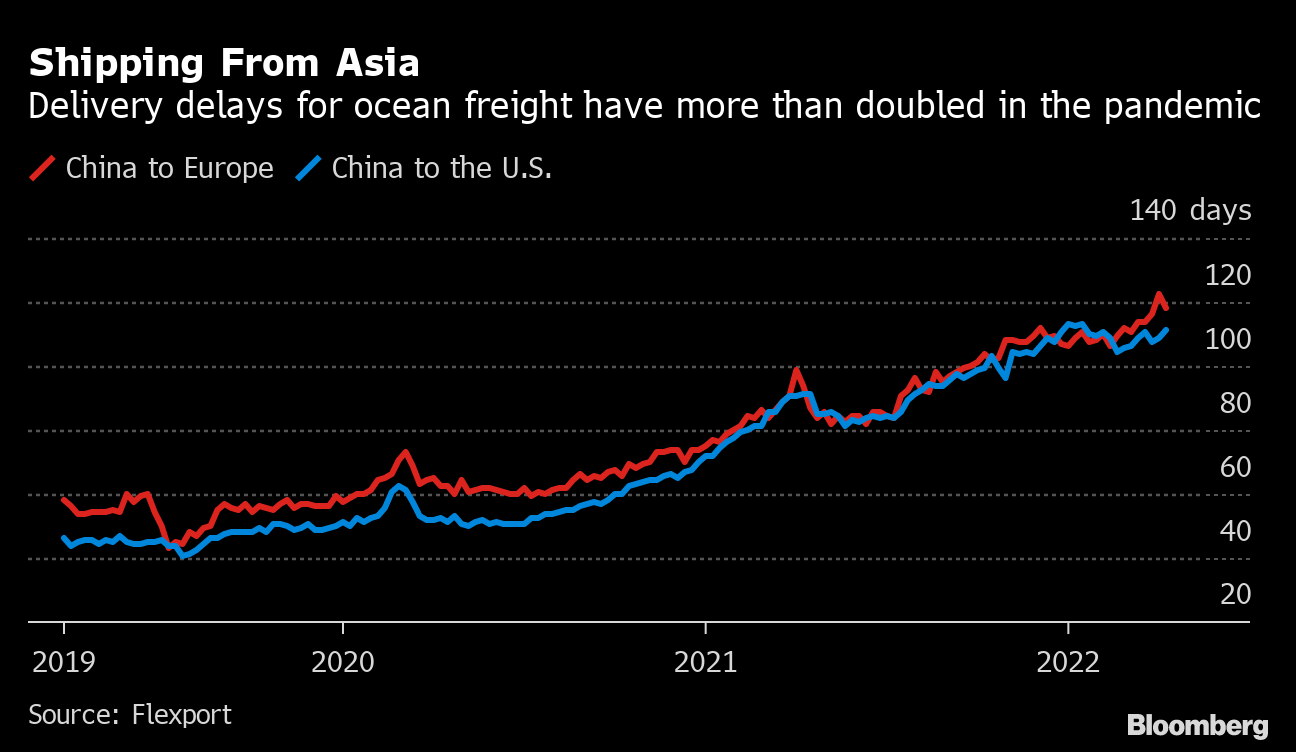

Today’s Chart

China’s stringent rules to curb Covid-19 are about to unleash another wave of summer chaos on supply chains between Asia, the U.S. and Europe.

On The Wire

China’s leaders are under mounting pressure to throw the country’s Covid-stricken economy a lifeline as they gather for a critical meeting in coming days. The economy slowed rapidly in April due to both a worsening outbreak and the nation’s stringent approach to eliminating the virus.

- PBOC Vows to Promote “Healthy and Stable” Financial Market

- Asian Miners Fall as Base Metals Slide on China Lockdowns

- China May Turn To Infrastructure Spending, Bond Issuance: Report

- CHINA INSIGHT: Yuan at 7? Macro Forces Point That Way

- China’s Exports of Aluminum Products Likely to Rise on Price Gap

- China’s Lower Crude-Steel Output to Hurt Iron-Ore Demand, Price

- IRON ORE FLOWS: Brazil Ships Av. 1M Tons/Day First 14 Days April

The Week Ahead

Wednesday, April 27

- China industrial profits for March, 09:30

- China Offshore Wind Power Conference, Guangzhou, day 2

- EARNINGS: China Coal, BYD, Huayou Cobalt, Longi Green, Sinopec, Longyuan Power, China National Nuclear Power, Trina Solar, HKEX, Hitachi Construction

Thursday, April 28

- Fortescue Metals quarterly production report

- China Coal online earnings briefing, 15:00

- China Offshore Wind Power Conference, Guangzhou, day 3

- EARNINGS: Shenhua, Gotion High-Tech, China Moly, China Oilfield Services, Jiangxi Copper, Anhui Conch, Baosteel, Cnooc, Sany Heavy, Komatsu, Caterpillar

- World Gold Council quarterly demand report

- Glencore quarterly production report

Friday, April 29

- China Caixin factory PMI for April, 09:45

- Shenhua online earnings briefing, 11:00

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- EARNINGS: Tianqi Lithium, Yangtze Power, PetroChina, Maanshan Steel, JA Solar

Saturday, April 30

- China official PMIs for April, 09:30

- EARNINGS: CATL

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.