Energy Trader Files for Bankruptcy as Market Turmoil Bites

(Bloomberg) -- A Danish power trading company has filed for bankruptcy as the unprecedented rally in energy prices across Europe claimed yet another victim.

Nordstrom Invest A/S filed a request on Sept. 7 to the Bankruptcy Court in Aarhus, according to the Government Gazette of Denmark. It comes just days after several energy suppliers in the U.K. ceased trading.

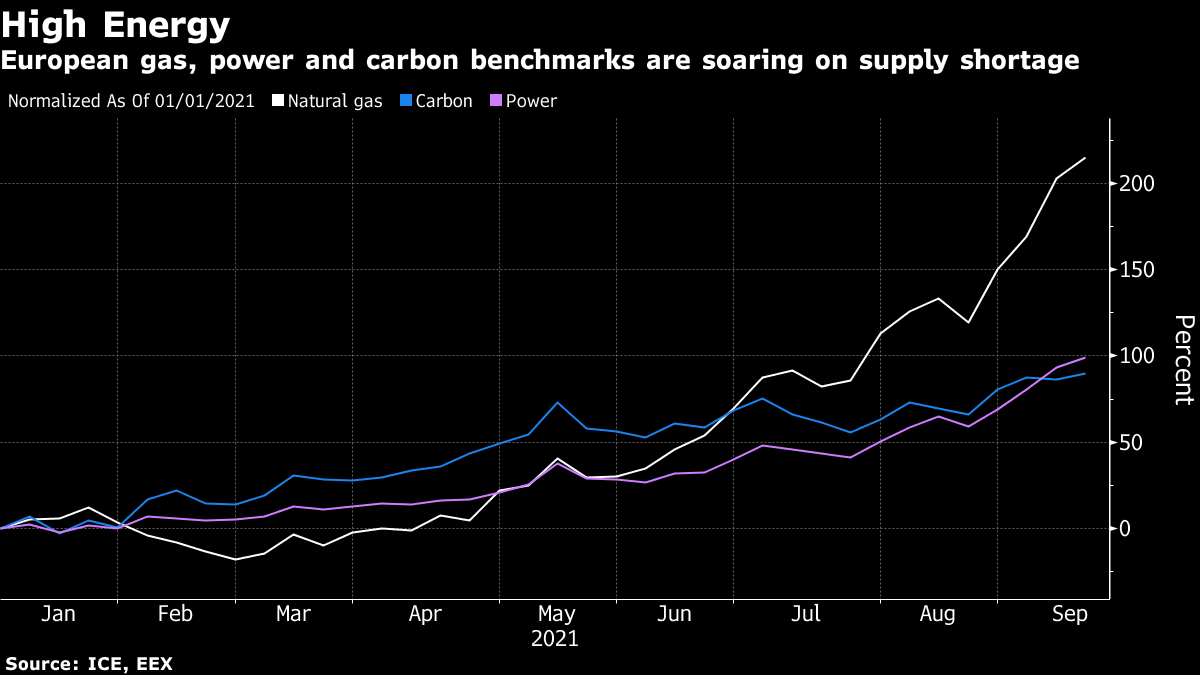

Record prices in everything from European power to natural gas and carbon futures are testing traders’ ability to navigate the markets. While some are making huge profits, others are floundering after being wrong-footed by the surge.

The company “had different positions in the electricity market that have gone against them, and then the management has decided to stop the activity,” Soren Christensen Volder, a partner at law firm Bech-Bruun who was appointed by the court to liquidate the company, said by email.

Energy markets are rallying as demand is roaring back after the pandemic. A shortage of natural gas in Europe is impacting everything from Nordic and Spanish power to coal and emission permit prices. Several new records were set on Monday.

Nordstrom Invest was founded by Stefan Barkholt Ovesen in 2016. He didn’t immediately respond to a message via Linkedin seeking comment. Before starting Nordstrom, he worked as a power trader at Neas Energy A/S, a Danish trader bought by Centrica Plc in 2016.

The company is a non-clearing member of Nasdaq Inc.’s commodity market, which means it has direct access to the market, but has to clear its trades through another company. That limited any losses for Nasdaq, which were notified of the filing on Thursday, according to a spokesman in Stockholm. He declined to name the clearing firm.

Nordstrom Invest has been banned from trading since Thursday and Nasdaq is in the process of canceling its membership, the spokesman said.

Bankruptcies among Nordic energy traders are few and far between, but the case is a reminder of the biggest blowout the market has ever seen.

Big Hit

Three years ago, Nasdaq and many of its trading members took a hit of more than 100 million euros ($118 million) when Einar Aas, the biggest and most profitable player in the Nordic power market’s history, incurred losses he couldn’t make good. The main difference with Nordstrom Invest, is that he traded directly in his own name, so the layer of protection that a clearing company offers wasn’t there.

British Energy Suppliers Go Out of Business as Prices Surge

While the extent of Nordstrom’s losses isn’t clear, the rally in prices has been too much for some energy suppliers in the U.K. Pfp Energy and Moneyplus Energy will have their 94,000 customers transferred to a new supplier, U.K. energy regulator Ofgem said last week. They follow Hub Energy, another power provider that announced last month that it was exiting the market.

Smaller utilities with limited trading capabilities are among the companies most at risk when prices rally, since they have sold energy in advance at a set price but may have to pay more to secure it in the wholesale market.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.