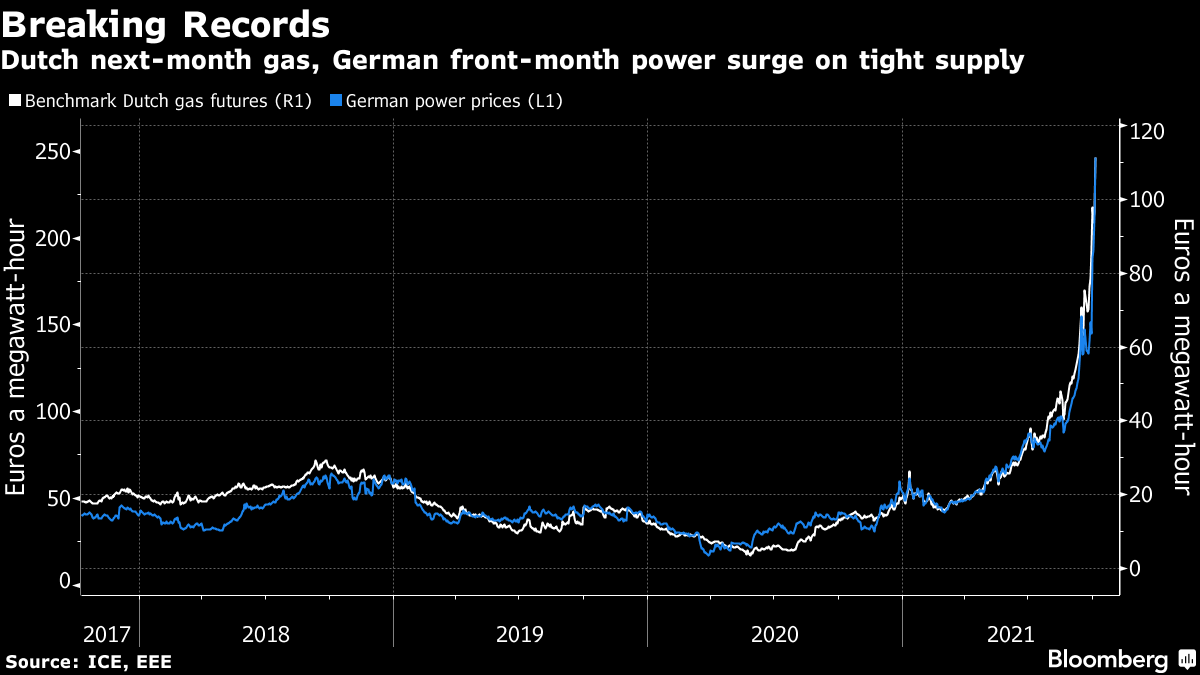

Europe’s Gas and Power Surge to Records as Energy Crunch Worsens

(Bloomberg) -- European natural gas and power prices soared to fresh records amid worsening fears over supply availability.

Global shortages of gas and coal are pushing energy prices higher, disrupting markets from the U.K. to China, as economies emerge from the pandemic. Surging costs are threatening to raise inflation and starting to weigh on industrial production, with some companies in Europe forced to cut output.

“The fiercely nervous sentiment on the market continues due to fears of reduced supply during the winter,” trader Energi Danmark wrote in a note Tuesday. “Everything looks set for another week of price climbs.”

Europe’s gas stockpiles are at their lowest seasonal level in more than a decade, while supplies from top seller Russia are limited and global competition for liquefied natural gas continue to be intense.

Read also: Asian LNG Prices Extend Record-Breaking Rally Amid Supply Crunch

“If we have a cold start to the winter and we’re withdrawing gas, we’re not going to have any gas left by the time cold winter hits,” Catherine Newman, chief executive officer of Limejump Ltd., said Tuesday at an industry conference.

Nord Stream 2

Even Monday’s news that Russia is readying its controversial new gas pipeline to Germany, a bearish factor for prices just two months ago, hasn’t eased the record rally. Nord Stream 2’s operator started filling the first part of the pipeline, preparing it for technical tests later on. Germany’s energy regulator said some operations could start soon.

The precise timing for the start of operations remains unclear given all the regulatory approvals it requires. It’s also not known how much fuel Russia’s Gazprom PJSC is able to add to its exports in the short term as the company continues to fill storages at home amid increased domestic demand.

The impact of Nord Stream 2 on gas futures for more recent delivery “is limited, given the severe supply-demand crunch seen late in 2021,” consultant Inspired Energy wrote in a note.

Front-month Dutch gas futures jumped as much as 16% Tuesday, reaching a record 111.70 euros a megawatt-hour. The U.K. equivalent benchmark rose as much as 15% to an unprecedented 282.19 pence a therm.

German power for next year rose above a record of 150 euros per megawatt-hour, with prices for next month and quarter also climbing to their highest-ever levels. Hard coal for next-year delivery in Europe headed toward the most since 2008, while the European Union’s emissions allowances gained for a third consecutive day.

Read also: Global Energy Crisis Shows Fragility of Clean-Power Era

‘Perfect Storm’

“European power prices are facing the ‘perfect storm,’” Barclays Plc analysts wrote in a note. “We believe concerns over low German gas storage levels this winter could continue to build, resulting in sustained high power prices.”

The German utility Steag GmbH has halted its Bergkamen-A coal plant until Thursday, due to lack of supplies. It’s the fifth time the company has done this since the start of September, showing how logistics and high fuel prices could hamper the country’s thermal output.

Meanwhile, the ongoing dispute between energy unions and the French utility Electricite de France SA is far from over, with nuclear and hydro being cut for 24 hours amid a strike which started at 9 p.m. Paris time on Monday.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.